The major U.S. indices have remained under pressure in recent weeks, as distribution and consolidation continue to dominate the tape. Any rally attempts that we’ve seen in August have been short-lived and on relatively low volume. Volatility has also picked up as this pullback has coincided with a seasonally weak period.

While there are countless headwinds for equities including rising bond yields, high interest rates, and slowing Chinese growth, there are reasons to be optimistic about a longer-term bull market.

Sector rotation began in mid-July, as market participants started taking profits in tech stocks. New pockets of the market such as energy and industrials are now showing relative strength. This is completely normal price action and is a healthy sign that this new bull market can be sustained as market breadth broadens out.

While the more aggressive areas of the market like technology take a breather, how do we go about locating winning stocks in the present?

Zacks Industry Rank: Improve Your Stock-Picking Success

We want to look for stocks that are holding up well through the increased volatility and are still experiencing some levels of buying pressure, as these companies will likely be the ones to surge to new highs once the market regains its footing.

Zacks Investment Research employs several proprietary methodologies to make it easier for investors to detect top stocks at any given point in time. One such method is the Zacks Industry Rank, which is a great starting point to begin building out your portfolio. Using this investment tactic, we’ll start with a leading industry group in the current market environment.

This system harnesses the power of the Zacks Rank, meaning that the top-ranked industries contain more stocks that are receiving upward earnings estimate revisions. Simply put, your most profitable stocks will be those with upward earnings estimate revisions in the industries enjoying the same.

Our industry ranking system sorts companies into more than 250 industry groups. The Zacks Industry Rank is calculated by averaging the Zacks Rank for all individual stocks within a specific industry. A recent 10-year backtest has shown that stocks within the top 50% of all Zacks Ranked Industries outperformed the bottom half by a factor of more than 2 to 1.

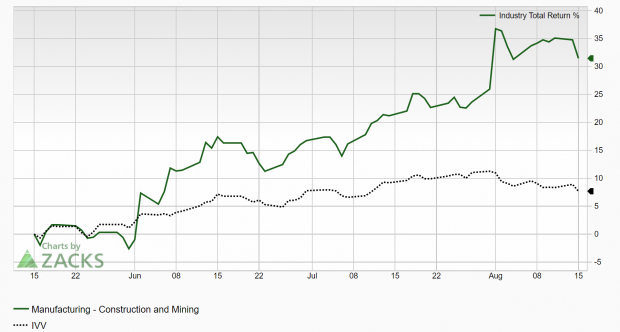

Let’s take a look at an example. The Zacks Manufacturing – Construction and Mining industry currently ranks in the top 1% out of more than 250 Zacks Ranked Industries. We’ll start with this industry group that has been significantly outperforming the market over the last 3 months:

Image Source: Zacks Investment Research

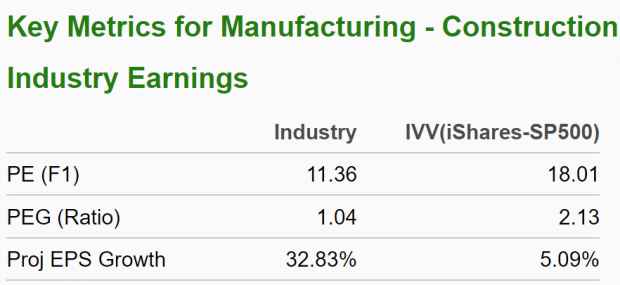

Also note the favorable characteristics for this industry below:

Image Source: Zacks Investment Research

Quantitative research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. Focusing on stocks within the top-performing industries provides a constant tailwind to our investing results. Including this step in our selection process also allows us to filter our investment list and select stocks with the best profit potential.

Narrow Down the Investment Universe with the Zacks Rank

Once the top industry groups are identified, we can peel back the curtain to find stocks with the highest Zacks Rank. Stocks with rising earnings estimate revisions have significantly outperformed the S&P 500 year after year. This ranking system uses five different ranks: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell), and #5 (Strong Sell).

Our top-down process narrows the investable universe, starting with the Zacks Manufacturing – Construction and Mining industry (top 1%). Let’s take a look at a leading Zacks Rank #1 (Strong Buy stock) contained within this top industry.

Caterpillar (CAT - Free Report) is one of the largest global construction and mining equipment manufacturers. The company serves a variety of sectors such as infrastructure, construction, oil and gas, mining, and transportation. Caterpillar is considered a bellwether of the global economy, and as such, its stock price can be viewed as a gauge of the market cycle.

What did Caterpillar stock do most recently? CAT shares broke out to an all-time high:

Image Source: StockCharts

A big reason for the move is the company’s earnings outlook. CAT has surpassed earnings estimates in three of the past four quarters, with an average earnings surprise of 18.54%. The industrial heavyweight most recently reported second-quarter earnings earlier in August of $5.55/share, beating the Zacks Consensus Estimate of $4.51 by 23.06%.

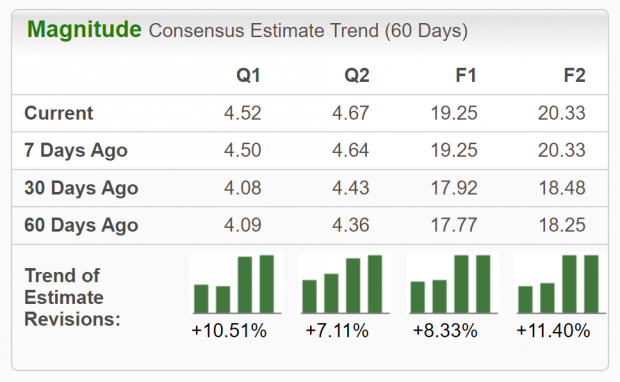

Cost-saving actions and strong end-market demand are positives for the stock, in addition to a strong liquidity position. CAT, a Zacks Rank #1 (Strong Buy), has witnessed improving earnings estimate revisions. Looking into the current year, analysts have raised their 2023 EPS estimates by 8.33% in the past 60 days. The Zacks Consensus Estimate now stands at $19.25/share, reflecting potential growth of 39.09% versus last year. Revenues are projected to climb 12% to $66.55 billion.

Image Source: Zacks Investment Research

Final Thoughts

Employing a top-down approach utilizing the various Zacks Ranking systems can help investors find leading stocks like CAT more easily. The world’s leading manufacturer of construction and mining equipment, Caterpillar appears well-positioned to extend its recent gains.

As we move further into 2023, be sure to take advantage of all that Zacks has to offer.