Monday, August 14, 2023

"13F Season: Avoid These 3 Pitfalls", 14 AUGUST

What is 13F Season?

13F season refers to the quarterly period in which institutional investment managers with over $100 million in assets under management (aum) must disclose their holdings of publicly traded securities to the US Securities and Exchange Commission (SEC). The 13F filing provides transparency and insight into the strategies and composition of large institutional investors, hedge funds, mutual funds, and pension funds. However, though 13F statements can be valuable learning tools for everyday investors, they are often misunderstood. Below are 3 pitfalls that investors fall into when following the 13F season:

Conflating Notional Value & Real Value

Earlier this morning, I read a ton of social media hysteria about Michael Burry’s 13F. Burry is a legendary short seller portrayed by Christian Bale in the hit movie “The Big Short.” At face value, Burry’s updated portfolio showed roughly 51% of his portfolio in S&P 500 ETF ((SPY - Free Report) ) put options and another 43% in Nasdaq 100 ETF ((QQQ - Free Report) ) puts.

Before investors get crazy bearish and follow Burry, it is essential to remember that 13Fs report the entire value of the underlying stock and NOT the market value of the option.Notional value refers to the nominal or theoretical value of the option without considering factors like market conditions or external influences. Conversely, real value or actual value considers a more accurate representation of the asset’s current value.

Discounting Time Frame

Without context, 13Fs have little value for investors looking to piggyback on ideas. For example, Michael Burry and Stanley Druckenmiller can be in and out of positions quickly. Conversely, Warren Buffett tends to invest in companies, not stocks, and has a theoretical time frame of “forever”.

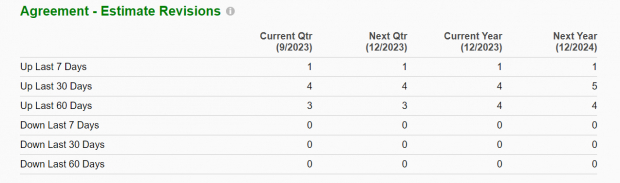

In other words, there is more value in following an investor like Buffett. Speaking of which, Buffett’s 13F just hit the news wires, and he opened new positions in homebuilders such as DR Horton ((DHI - Free Report) ), Lennar ((LEN - Free Report) ),and NVR ((NVR - Free Report) ). NVR and Lennar earn the best possible Zacks Rank #1 (Strong Buy) as several analysts have raised their EPS estimates recently.

Image Source: Zacks Investment Research

Buffett also added to oil stock Occidental Petroleum ((OXY - Free Report) ), which is breaking out.

Complete Picture is Not Clear

Because short positions are not displayed in 13F filings, investors never fully know one’s portfolio exposure (hedges? directional shorts). As always, investors should do their own due diligence when looking at 13Fs.

"Is commercial policy or banks bear the instability of the exchange rate?", 14 AUGUST

Is commercial policy or banks bear the instability of the exchange rate?

the most important of which is the growth of Iraqi per capita consumption, which was accompanied with external openness, which caused an increase in the volume of imports. Any controls and are not subject to taxes and fees as a result of rampant corruption in government departments and other factors.

All these factors produced an unregulated commercial system, for example, a merchant who deals in millions of dollars is not officially registered and ships goods in the names of customs clearance companies and does not have a commercial record, for fear of the tax system in Iraq, and therefore the system destroyed the banking system, through unregulated trade And financial transfer according to messages via social media applications, which transfer money in moments, which has become more flexible for the commercial sector , but it had adverse and negative results on the banking sector, which exposed it to risks and obtained a low rating in compliance with the rules of money laundering and terrorist financing.

The commercial sector received a shock from the US Federal Bank, which changed the rules of financial transfer from old rules established by the banking system based on the requirements of the commercial sector to solid rules through the remittance platform (despite our reservations about some technical failures in this platform), but the question is whether the commercial sector is able to adapt himself according to these banking requirements in order to be able to continue, by implementing the procedures represented in establishing an official company first and opening bank accounts for it, and obtaining a tax record despite the harshness and brutality of the Iraqi tax system, and shipping in the names of the importers themselves and transfer by the banking system and according to international norms and the required compliance rules..

A warning was issued against the attempts of some people to drag the banking sector to adapt its situation to a distorted commercial policy, and he opposite must be to support the commercial sector by adapting its legal status , creating tax and customs reforms to serve this sector, which has been exposed and is subject to many calamities and calamities, and maintaining a strong, discreet banking sector with the ability To keep abreast of developments and is able to meet the requirements of correct trade, and here is the role of the Central Bank of Iraq and its ability to exercise its supervisory role on banks and motivate them in order to develop their practical tools, and the results will be positive if the vision is completed between the commercial sector and the reforms that the government must consider, which contributes to reducing the price of dollar exchange.

https://economy-news.net/content.php?id=35633

------

Al-Nusairi: The Battle For The Stability Of The Exchange Rate With Speculators In The Black Market Will End With The Recovery Of The Dinar

Money and business Economy News _ Baghdad Samir Al-Nusairi, an adviser to the Association of Iraqi Private Banks, confirmed today, Monday, that the battle led by the government and the central bank with speculators to control the stability of the dinar exchange rate against the dollar on the black market will end with the gradual recovery of the dinar and that the rise in the exchange rate is temporary, and will inevitably decrease back to the target rate of The central bank in Iraq, because the dollar that is traded in, if it does not come from the central bank, then its source is illegitimate and is held accountable by Iraqi law for its negative effects on the national economy .

Al-Nusairi said in an interview with "Al-Iqtisad News", that "one of the most prominent reasons for the dollar's rise is the news of depriving 14 banks of dealing in US dollars and what the big speculators did in withdrawing cash dollars and the manipulation of unauthorized exchanges with exchange rates." In addition, some small retailers did not enter the electronic platform for external transfer.

And he added, “Some media outlets and analysts exacerbated the confusion of the market by amplifying unreal and incomplete data and information, as well as websites and microbes that announce daily the exchange rate on the black market despite the warnings of the Central Bank and its clarification by its statements issued successively that the offer of foreign currency is available for all requests submitted to the electronic platform by companies.”

And merchants and businessmen, and that the platform is the only approved system for external transfers, which achieves the real guarantee for the safety of external financial transactions in accordance with international standards, which guarantee the arrival of transfers to the final beneficiary.

Al-Nusairi pointed out, "The Central Bank follows up and monitors the markets in cooperation with the concerned government agencies, and takes urgent measures to address the situation and stop all countermeasures that harm the national economy." In particular, limiting illegal trade through unofficial outlets.

And he continued, “The Central Bank is working to diagnose and study the causes and obstacles to entering the electronic platform, delaying some transfers, and setting up procedures that facilitate merchants’ conduct of their business smoothly and easily, and taking possible flexibility to accelerate external transfers in banks, the Central Bank, and in the relevant international banking agencies.”

Al-Nusairi noted that “the measures will inevitably result in a decrease in the exchange rate on the black market for the illegal dollar, and that the Central Bank is currently working on adopting new mechanisms and work contexts to control monetary stability, and their results will appear soon.” We urge all government agencies, wholesalers, and businessmen to support the Iraqi dinar and deal with it in all local monetary activities and transactions, as it is strong and covered by foreign monetary reserves that exceed $113 billion, and that its purchasing power is gradually recovering. In addition to being an essential pillar of national sovereignty. 08/14/2023 https://economy-news.net/content.php?id=35658

Evening News with MarkZ 08/14/2023

"Index Options vs Stock Options Explained For Beginners", 14 AUGUST

Many novice options traders are initially confused by the difference between the options on cash indices like SPX and the options traded on stocks and ETFs like AAPL or SPY.

After all, you can’t trade indices like SPX on the stock market. It’s just an index!

So let’s settle a few differences. Firstly, why are there even options on a cash index like SPX when you can simply trade options on the S&P 500 ETF, SPY?

An index like SPX or NDX are simply math calculations. They take each component’s weightings in the index and automatically calculate the index price based on the price changes in the underlying components.

You can’t trade shares of these, but you can trade options on them. And the way the options trade is slightly different from the traditional stock options you’re probably used to.

On the other hand, an ETF like SPY is an actual company which holds shares that reflect index components in a trust. So when you trade SPY, you’re trading a portion of the actual trust.

Trading shares or options on SPY are structurally no different than trading shares or options of AAPL or IBM.

Before we get into the individual differences between index and stock options, let’s first settle on what an option actually is.

What is an Option?

An option is a contract between a buyer and a seller of an asset. Options contracts could be created for just about anything. They’re popular in the real estate market, for example.

An option contract grants the contract buyer the right, but not the obligation, to purchase an asset at a specified price, and on or before a specified date.

For example, you and I might agree to an option contract on your house. I pay you $1,000 for the right to buy your house at the current market price of $200,000 for the next six months.

You get to keep the $1,000 (known as the “premium” in the options market), no matter what happens, but you can’t sell the house to anyone else until our agreement expires.

Options are pretty much that simple. Perhaps I don’t have the money to buy your house today, but I want to lock in today’s price, so I’d pay you an option premium to have the right to buy it for the next six months.

In the stock market, you can buy or sell (‘write’) options on any stock/ETF/future, regardless of whether you own it.

Now let’s move onto the differences between index and stock options.

List of Index Options

Here’s a list of the most popular index options available on US exchanges:

- $NDX – NASDAQ 100 Index

- $SPX – S&P 500 Index

- $RUT – Russell 2000 Index

- $DJX – Dow Jones Industrial Average 1/100 Index

- $OEX – S&P 100 index

- $VIX – S&P 500 Volatility Index

- $XEO – S&P 100 (European) Index

Keep in mind that many brokers and charting platforms require you to prefix the ticker with the dollar sign ($), because these are ‘cash’ indices, while others just require the ticker.

Other cash-settled index options trade on US exchanges, but most of the others are thinly traded. The CBOE has a list of other index options they offer here.

Index Options Require More Capital

An index option like the SPX requires much more capital per contract than it’s ETF counterpart, SPY, because of SPX’s higher price, which is approximately ten times higher than the SPY.

For example, today’s SPY price is around $347, while today’s SPX price is around $3471.

Contracts for both tickers are denominated for 100-share lots, so you can expect SPX options to cost roughly ten times that of an equivalent SPY option.

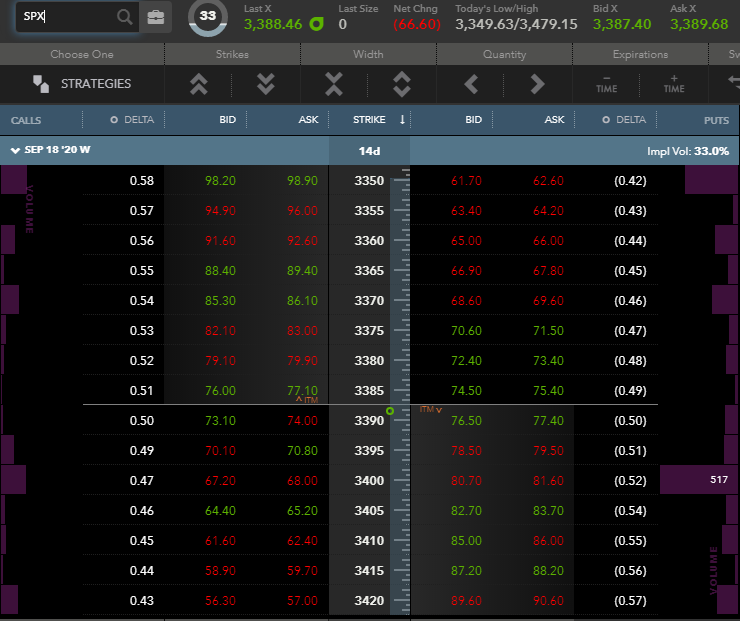

Here’s an example of an SPX option chain:

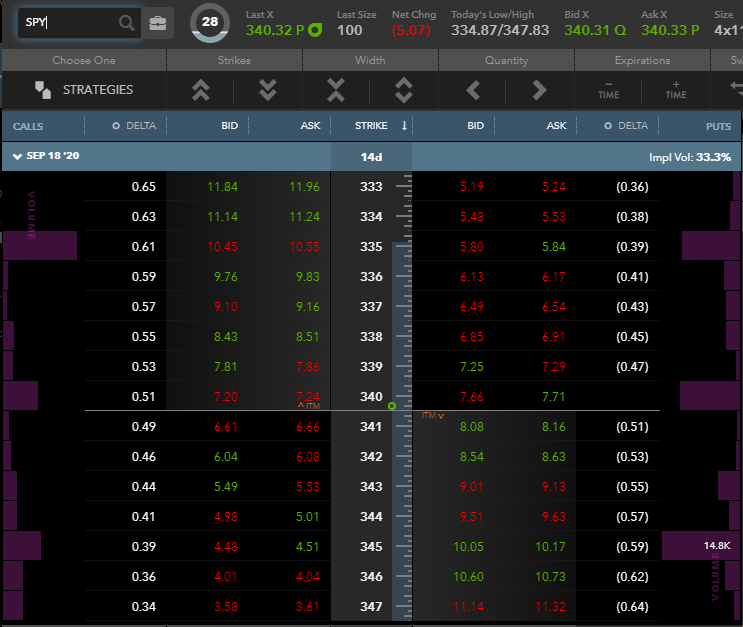

And here’s an example of a SPY option chain:

As you can see, for each equivalent strike, SPX options cost roughly 10x more than SPY options.

Index Options Are Cash Settled

Index options are European-style options, which are mostly the same as the standard American-style options we’re used to trading on individual stocks like Apple or Amazon.

Still, they do have a few key differences. One of those is the settlement.

If I were to buy one call option on an individual stock like Apple and it expired in-the-money, the option would settle in shares. So at the close of expiration Friday, 100 shares of Apple would be credited to my account at my strike price.

Index options, on the other hand, are cash-settled. This means that instead of crediting shares to your account at settlement, your account would simply be credit for the option’s intrinsic value.

Suppose we bought a $330 SPY call option for $3.00, and the price of SPY was $340 at option expiration.

At settlement, our broker would automatically purchase 100 shares of SPY at $330, leaving us a profit of $10 per share. Our net profit after factoring in the cost of the option would be $7.00.

If we bought the equivalent SPX call option, at $3300.00, paid $30.00, and the price of SPX was $3400.00 at expiration. At settlement, our broker would credit us the intrinsic value of the option in cash.

Index Options Are Taxed Like Futures

The main reason that index options typically receive more volume than their ETF counterparts is due to their tax treatments. Under the IRS code, index options are designated as “1256 contracts,” which get special tax treatment. These unique tax treatments are as follows:

- 60/40 Tax Treatment

- 60% of your P&L is treated as long-term capital gains

- 40% of your P&L is treated as short-term capital gains

- This treatment applies regardless of holding period, making futures and index options more tax-advantageous than their ETF counterparts.

- Not subject to wash-sales (a big deal for day traders)

- Your P&L is marked to market at the end of the year, regardless of whether you closed your position.

Let’s create an example to illustrate the benefit of the 60/40 rule for index options. You trade an Apple option and make $100 in gross profits with a one week holding period.

Then you trade an index option and make $100 in gross profits with a one week holding period.

For the stock option, the entire $100 is subject to the short-term capital gains tax. Of course, these tax rates vary dramatically based on your annual income. Let’s assume you’re in the top tax bracket and subject to the highest taxes to keep things simple.

Stock Option:

- $100 profit

- Subject to highest short-term capital gains tax: 37%

- Total taxes owed: $37

Index Option:

- $100 profit

- Subject to highest long-term capital gains tax for 60% of profits: 20%

- Long-term taxes owed: (100 * .6) * .2 = $12

- Subject to highest short-term capital gains tax for 40% of profits: 37%

- Short-term taxes owed: (100 * .4) * .37 = 14.80

- Total taxes owed: $12.00 + $14.80 = $26.80

Add some zeroes to the end of those numbers and see how significant the savings are at scale.

Index Options Have Different Settlement Rules

Index options and stock options have significantly different settlement rules. Not knowing these differences can land you in a world of trouble.

Talking about the nuances of settlement is boring, but these are the types of things that you really only need to learn once and can potentially save you from a big headache if you’re an active options trader.

Index options settle differently from product to product and based on whether they’re regular or weekly options. Weekly index options can settle similarly to a normal stock, while regular index options have some differences.

The first difference is the day of expiration. If you’re used to trading stock options, Friday is typically expiration day, but index options typically settle on Thursday’s close.

The time of expiration is also different. Index options settle based on the first trade made on Friday morning.

So they technically settle on Friday morning, but for all practical purposes, they settle on Thursday, because you would never be able to trade them on Friday morning.

Stock options, on the other hand, expire on Fridays.

So, as a general rule: index options expire on Thursday’s close, stock options expire on Friday’s close.

Pros and Cons of Index Options

Pros:

- Preferable tax treatment

- More liquid markets

- The small number of indices may be a benefit in that you have fewer things to focus on. The thousands of choices in the stock market can be intimidating and distracting.

- Cash settlement makes things more simple.

Cons:

- Fewer choices; there are thousands of optionable stocks, compared to a handful of optionable indices.

- Generally require more capital to trade.

- Less potential to find inefficiently priced options

Final Thoughts

Index options offer traders and investors the opportunity to easily speculate or hedge their positions in a liquid market with preferential tax treatment.

They’re not for everyone, however, as their vast buying power requirements lockout smaller traders.

To summarize:

- Index options have different expiration dates.

- Index options are cash-settled, rather than physically settled.

- Index options are generally more liquid.

- Index options receive preferential tax treatment.

- V]https://www.warriortrading.com/index-options-vs-stock-options/

"3 Sector ETFs That Beat The Market Last Week", 14 AUGUST

Wall Street wrapped up the last week with mixed performances. The Dow Jones industrial Average inched up 0.3% while the other two benchmarks fell. The S&P 500 Index slid 0.3% — its second consecutive week of decline — while the Nasdaq Composite Index dropped 0.7%.

The decline came on the back of a series of negative news on the U.S. credit rating downgrade and multiple bank downgrades. The inflation data also added to the woes.

Fitch Ratings downgraded the U.S. credit rating to AA+ from AAA, citing “expected fiscal deterioration over the next three years,” an erosion of governance and a growing general debt burden. This led to a strong sell-off in the stocks and a surge in yields. Meanwhile, ratings agency Moody's downgraded the credit ratings of several small to mid-sized U.S. banks and warned that it may downgrade some of the nation's biggest lenders too, citing a looming mild recession, higher interest rates and increased funding costs.

Inflation in the United States rose for the first time in July after 12 straight months of decline. The Consumer Price Index rose 3.2% year over year, up from an annual increase of 3% in June, which was the lowest rate in over two years (read: Inflation Moderates in July: ETFs to Gain).

The underperformance in the tech-heavy Nasdaq Index was due to concerns that interest rates could rise further. As the tech sector relies on easy borrowing for superior growth and its value depends heavily on future earnings, a rise in rates lowers the present value of companies’ future earnings, sparking fears of overvaluation.

While most of the sector lost last week, few eked out gains. In particular, the pharma and energy sectors were the biggest winners last week. Pharma stocks were driven by Eli Lilly’s (LLY) significant surge in stock prices in over two decades following the release of an impressive second-quarter 2023 earnings report and an optimistic outlook. Meanwhile, the energy sector rose on an oil price surge. A tightening oil market fueled by surging crude demand and supply reductions by major OPEC+ players — Saudi Arabia and Russia — are driving oil price higher (read: Oil Price at 2023 High: Make Profits With Leveraged ETFs).

We have highlighted one ETF from different sectors that were in green last week. These include Sprott Junior Uranium Miners ETF (URNJ - Free Report) , iShares U.S. Pharmaceuticals ETF (IHE - Free Report) and Invesco Dynamic Energy Exploration & Production ETF (PXE - Free Report) .

ETFs That Gained

We have profiled the above-mentioned ETFs in detail below:Sprott Junior Uranium Miners ETF (URNJ - Free Report) – Up 6.3%

Sprott Junior Uranium Miners ETF is the only pure-play ETF focused on small uranium miners, selected for their potential for significant revenue and asset growth. It tracks the Nasdaq Sprott Junior Uranium Miners Index, which is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining related businesses. Sprott Junior Uranium Miners ETF holds 29 stocks in its basket and charges 80 bps in annual fees.

Sprott Junior Uranium Miners ETF has accumulated $39.9 million in its asset base and trades in average daily volume of 59,000 shares.

iShares U.S. Pharmaceuticals ETF (IHE - Free Report) – Up 5.6%

iShares U.S. Pharmaceuticals ETF provides exposure to 39 U.S. companies that manufacture prescription or over-the-counter drugs or vaccines by tracking the Dow Jones U.S. Select Pharmaceuticals Index (read: Eli Lilly Soars on Blockbuster Q2 Earnings: ETFs to Tap).

iShares U.S. Pharmaceuticals ETF has $388.9 million in AUM and charges 40 bps in fees and expense. Volume is light as it exchanges about 6,000 shares a day. The fund carries a Zacks ETF Rank #3 (Hold) with a High risk outlook.

Invesco Dynamic Energy Exploration & Production ETF (PXE - Free Report) – Up 3.8%

Invesco Dynamic Energy Exploration & Production ETF follows the Dynamic Energy Exploration & Production Intellidex Index, which thoroughly evaluates companies involved in the exploration and production of natural resources used to produce energy based on a variety of investment merit criteria, including price momentum, earnings momentum, quality, management action and value.

Holding 31 stocks in its basket, Invesco Dynamic Energy Exploration & Production ETF has amassed $167.8 million in its asset base and charges 63 bps in annual fees. It trades in a volume of 51,000 shares and has a Zacks ETF Rank #3.

WALKINGSTICK: this will be all done by the end of the 2nd quarter!! #iraqidinar #iqd

Read also: Gifted ZIM Holders, 800 Numbers, and Redemption Timeline Explained by Bruce

-

A groundbreaking and irreversible shift is occurring in the global financial system as it rapidly transitions to a gold-backed structure. T...

-

Confirmed on Live TV – Announced Exchange Rate: $6.02! – Take Advantage!🔊 Highlights Summary Here are reports on the officially confirmed...

-

Global Currency Reset: Mon. 19 May 2025 NESARA & QFS REDEMPTION EXPOSED: THE FINAL PHASE HAS BEGUN · The RV Redemption is LIVE. The fin...