BRUCE

Wednesday, August 16, 2023

"ONLY INTEL" BY BRUCE ( SPANISH & ENGLISH), 16 AUGUST

THE BATTLE FOR THE STABILITY OF THE EXCHANGE RATE WITH SPECULATORS IN THE BLACK MARKET WILL END WITH THE RECOVERY OF THE DINAR, 16 AUGUST

AL-NUSAIRI: THE BATTLE FOR THE STABILITY OF THE EXCHANGE RATE WITH SPECULATORS IN THE BLACK MARKET WILL END WITH THE RECOVERY OF THE DINAR

"STATUS OF THE RV" BY IQD IRAQ & VND VIETNAM, 16 AUGUST

STATUS OF THE RV

How to Identify Winning Stocks During Market Pullbacks, 16 AUGUST

The major U.S. indices have remained under pressure in recent weeks, as distribution and consolidation continue to dominate the tape. Any rally attempts that we’ve seen in August have been short-lived and on relatively low volume. Volatility has also picked up as this pullback has coincided with a seasonally weak period.

While there are countless headwinds for equities including rising bond yields, high interest rates, and slowing Chinese growth, there are reasons to be optimistic about a longer-term bull market.

Sector rotation began in mid-July, as market participants started taking profits in tech stocks. New pockets of the market such as energy and industrials are now showing relative strength. This is completely normal price action and is a healthy sign that this new bull market can be sustained as market breadth broadens out.

While the more aggressive areas of the market like technology take a breather, how do we go about locating winning stocks in the present?

Zacks Industry Rank: Improve Your Stock-Picking Success

We want to look for stocks that are holding up well through the increased volatility and are still experiencing some levels of buying pressure, as these companies will likely be the ones to surge to new highs once the market regains its footing.

Zacks Investment Research employs several proprietary methodologies to make it easier for investors to detect top stocks at any given point in time. One such method is the Zacks Industry Rank, which is a great starting point to begin building out your portfolio. Using this investment tactic, we’ll start with a leading industry group in the current market environment.

This system harnesses the power of the Zacks Rank, meaning that the top-ranked industries contain more stocks that are receiving upward earnings estimate revisions. Simply put, your most profitable stocks will be those with upward earnings estimate revisions in the industries enjoying the same.

Our industry ranking system sorts companies into more than 250 industry groups. The Zacks Industry Rank is calculated by averaging the Zacks Rank for all individual stocks within a specific industry. A recent 10-year backtest has shown that stocks within the top 50% of all Zacks Ranked Industries outperformed the bottom half by a factor of more than 2 to 1.

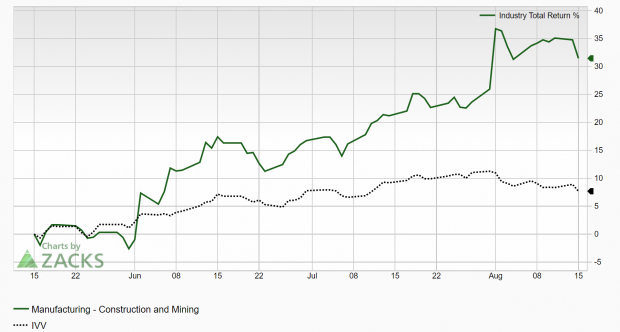

Let’s take a look at an example. The Zacks Manufacturing – Construction and Mining industry currently ranks in the top 1% out of more than 250 Zacks Ranked Industries. We’ll start with this industry group that has been significantly outperforming the market over the last 3 months:

Image Source: Zacks Investment Research

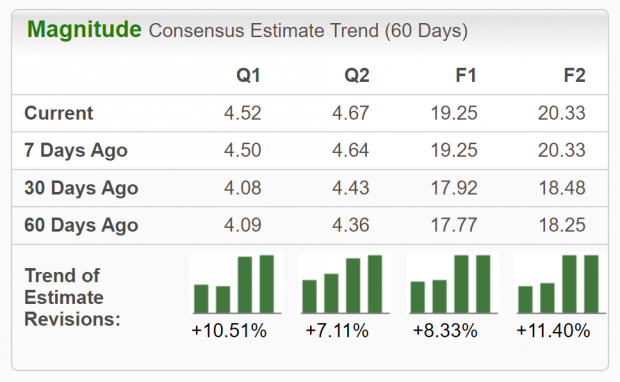

Also note the favorable characteristics for this industry below:

Image Source: Zacks Investment Research

Quantitative research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. Focusing on stocks within the top-performing industries provides a constant tailwind to our investing results. Including this step in our selection process also allows us to filter our investment list and select stocks with the best profit potential.

Narrow Down the Investment Universe with the Zacks Rank

Once the top industry groups are identified, we can peel back the curtain to find stocks with the highest Zacks Rank. Stocks with rising earnings estimate revisions have significantly outperformed the S&P 500 year after year. This ranking system uses five different ranks: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell), and #5 (Strong Sell).

Our top-down process narrows the investable universe, starting with the Zacks Manufacturing – Construction and Mining industry (top 1%). Let’s take a look at a leading Zacks Rank #1 (Strong Buy stock) contained within this top industry.

Caterpillar (CAT - Free Report) is one of the largest global construction and mining equipment manufacturers. The company serves a variety of sectors such as infrastructure, construction, oil and gas, mining, and transportation. Caterpillar is considered a bellwether of the global economy, and as such, its stock price can be viewed as a gauge of the market cycle.

What did Caterpillar stock do most recently? CAT shares broke out to an all-time high:

Image Source: StockCharts

A big reason for the move is the company’s earnings outlook. CAT has surpassed earnings estimates in three of the past four quarters, with an average earnings surprise of 18.54%. The industrial heavyweight most recently reported second-quarter earnings earlier in August of $5.55/share, beating the Zacks Consensus Estimate of $4.51 by 23.06%.

Cost-saving actions and strong end-market demand are positives for the stock, in addition to a strong liquidity position. CAT, a Zacks Rank #1 (Strong Buy), has witnessed improving earnings estimate revisions. Looking into the current year, analysts have raised their 2023 EPS estimates by 8.33% in the past 60 days. The Zacks Consensus Estimate now stands at $19.25/share, reflecting potential growth of 39.09% versus last year. Revenues are projected to climb 12% to $66.55 billion.

Image Source: Zacks Investment Research

Final Thoughts

Employing a top-down approach utilizing the various Zacks Ranking systems can help investors find leading stocks like CAT more easily. The world’s leading manufacturer of construction and mining equipment, Caterpillar appears well-positioned to extend its recent gains.

As we move further into 2023, be sure to take advantage of all that Zacks has to offer.

3 Stocks to Increase Your Dividend Yield,16 AUGUST

Dividends have been out of fashion for a while. For many years, low and still falling interest rates devalued income producing assets as great returns were to be had on growth stocks. Even this year, with rates moving back to historical norms, growth has been king, but if you are investing for the long term, it is important to understand that that is a trend, part of the cyclicality of markets, but that tried and tested strategies are still your friend. The importance of dividends is one of them.

A study a while back by Hartford Funds revealed something that will probably surprise most investors, and especially those new to the game. From 1960 to 2021 just over 40% of the total gains in stocks were attributable to dividends. That is a huge potential percentage gain that you as an investor would be giving up if the dividend yield of your portfolio isn’t at least around the average for a broad index like the S&P 500. Given the popularity of growth stocks that often don’t pay a dividend at all, I would hazard a guess that this is the case for most investors right now.

With some uncertainty around what the rest of this year will bring for the stock market, now is a good time to redress that imbalance by adding some solid dividend paying stocks to your portfolio. The fact that they have been out of favor for a while means that there is some value to be had in a conventional sense too, so you are not necessarily sacrificing capital growth when you add dividend payers to your holdings. Here are three stocks to consider if you are thinking of doing that:

1. 3M Company (MMM): 3M, best known as the maker of household first aid and adhesive products, has been around since 1902, which is remarkable longevity for a manufacturing company. The stock has dropped more than thirty percent over the last year, though, and not just because of the trend towards growth. They were very hard hit by the post-pandemic supply chain issues which revealed some weaknesses in that area.

That has called into question whether or not the company can continue its 64 year tradition of increasing dividends, but history shows that they have maintained that through much tougher times than this, so probably will this time, too. At current levels the forward dividend yield is right around 6% and a forward P/E below 12 indicates the possibility of capital appreciation to boot.

2. Pioneer Natural Resources (PXD): Energy is a traditional sector in which to look for dividend yield, but the inexorable move away from fossil fuels makes stocks in the industry less attractive from a long-term perspective. However, Pioneer’s balance of oil and natural gas gives them some degree of future proofing, and a forward dividend yield of around 7% is extremely attractive. In this case, too, there is also a good chance of some capital appreciation. PXD is currently trading at a forward P/E of just over 11, with a PEG ratio of around 0.75 when projected growth is factored in.

3. United Parcel Services (UPS): UPS is another company with a history of growing dividends, although their stretch of doing so only dates back around fourteen years. The yield here is not as high, at around 3.7% on a forward basis, but the long-term prospects of the company in a world that is still making the transition to e-commerce adds some very long term prospects of appreciation makes that quite attractive.

These three stocks offer some diversification and long-term growth prospects, so adding the yield doesn’t necessarily mean that you won’t see capital growth over time. However, combining these three stocks with equal weight will give you a small portfolio of dividend payers, with a combined yield of just over 5%, more than enough for you, with reinvested dividends, to take advantage of that 40% of portfolio growth that comes from dividend payers.

https://www.nasdaq.com/articles/3-stocks-to-increase-your-dividend-yield

EXCHANGE RATES WILL RISE FURTHER.. WARNING OF AN IMMINENT ECONOMIC CRISIS DUE TO THE “COLDNESS” OF THE CENTRAL BANK WITH COMMENTS OF MNT GOAT, 23 NOV

EXCHANGE RATES WILL RISE FURTHER.. WARNING OF AN IMMINENT ECONOMIC CRISIS DUE TO THE “COLDNESS” OF THE CENTRAL BANK Economic researcher Zi...

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...