Tuesday, August 8, 2023

"THE IRAQI G0VERNMENT IS SERIOUS ABOUT CONTROLLING THE PRICE OF THE DOLLAR", 8 AUGUST

Baghdad Trade praises a procedure for the Iraqi Trade Bank: curbing the rise in the price of the dollar

Shafaq News/ The Baghdad Chamber of Commerce confirmed, on Monday, that the move of the Trade Bank of Iraq (TBI) prevented the rise in the price of the dollar, while it indicated that 90% of consumer goods are imported.

The head of the Chamber, Firas Al-Hamdani, said, in an interview with Shafaq News agency,

"The Iraqi markets are completely affected by the dollar, because 90% of consumer goods are imported, and therefore the high price of the dollar results in price inflation." He pointed out that

"the Iraqi government is serious about controlling the price of the dollar and has taken a positive step by authorizing the Central Bank of Iraq to the Trade Bank of Iraq (TBI) to sell the dollar at a price of 1320 Iraqi dinars to small merchants for import purposes

without the requirement to submit the fundamental documents that belong to companies except for its affiliation with the Chamber of Commerce." or has a commercial record. He stressed that

"this step limited the rise in the price of the dollar against the dinar and created relative stability in the prices of goods in the local markets, because this matter is linked to the transfer of currency abroad, and

therefore we need the central bank and Iraqi banks to be supportive of the merchant." Al-Hamdani pointed out that

"the Iraqi Trade Bank, on July 30, began transferring dollar purchase requests to small merchants (shop owners), amounting to 100 thousand dollars per merchant at a price of 1320 per dollar, through banks directly without the need to participate in the electronic platform of the Central Bank."

https://www.shafaq.com/ar/اقتصـاد/تجارة-بغداد-تشيد-ب-جرا-للمصرف-العراقي-للتجارة-كبح-ارتفاع-سعر-الدولار

Meeting in the Ministry of Finance on the "Unified Treasury Account"

Today, Monday, Finance Minister Taif Sami Muhammad chaired a meeting to discuss the requirements for designing and implementing the unified treasury system.

A statement from the ministry, received by Alsumaria News, stated that

the minister "chaired a meeting today, in the presence of the Director General of Accounting, the head and members of the committee supporting the application of the unified treasury account, representatives of government banks, representatives of the Office of Financial Supervision, the Central Bank of Iraq and the Iraqi Trade Bank, to discuss the requirements for designing and implementing the unified treasury system." The meeting discussed

"plans to reform the public finance sector through the application of the unified treasury account, which represents a qualitative leap in the management of public funds, as

the project will allow the possibility of monitoring the movement of funds and their safety." Sami stressed,

"The need to continue the ministry's efforts through the committees formed for the purpose of implementing the system to complete the steps of the project, which represents one of the pillars of developing the ministry's policy towards reforming the financial sector and the optimal implementation of the stages of the unified treasury account project."

https://www.alsumaria.tv/news/economy/463948/اجتماع-في-وزارة-المالية-حول-حساب-خزينة-الموحد

"THE HISTORY OF THE IRAQI DINAR", 8 AUGUST

TNT

AL: I post the for the benefit of anyone that may be new to this venture.

As you will see, the Dinar has always been higher in value than the US Dollar. Iraq today has more opportunity to reach its full potential that it has in the past 50 years. Iraq currently has the 3rd largest oil reserve in the world and with further exploration possible the largest. It has the largest natural gas reserve in the middle east. They have water and potential for agriculture which many of the middle east countries do not have. They also posses a great deal of gold and other natural resources. Suffice it to say they could be the wealthiest country in the world.

Because of the war their currency has been artificially devalued and now that the sanctions have been lifted they are ready to explode as an economic power. They have the support of every country in the world the IMF, World trade organization etc. ……need I say more.

History of Iraqi Dinar 1932 – 2011

1932

Currency unit consisting of 1,000 fils or 20 dirhams. When officially introduced at the end of the British mandate (1932), the dinar was equal to, and was linked to, the British pound sterling, which at that time was equal to US$4.86.

1932–1949

Iraqi dinar (ID) equaled US$4.86 between 1932 and 1949 and after devaluation in 1949, equaled US$2.80 between 1949–1971.

1959–1967

Iraq officially uncoupled the dinar from the pound sterling as a gesture of independence in 1959, but the dinar remained at parity with the pound until the British unit of currency was again devalued in 1967.

1971

One Iraqi dinar remained equal to US$2.80 until December 1971, when major realignments of world currencies began.

1973

Upon the devaluation of the United States dollar in 1973, the Iraqi dinar appreciated to US$3.39.

1980

It remained at this level until the outbreak of the Iran-Iraq War in 1980.

1982

In 1982 Iraq devalued the dinar by 5 percent, to a value equal to US$3.22, and sustained this official exchange rate without additional devaluation despite mounting debt.

1988

In early 1988, the official dinar-dollar exchange rate was still ID1 to US$3.22; however, with estimates of the nation’s inflation rate ranging from 25 percent to 50 percent per year in 1985 and 1986, the dinar’s real transaction value, or black market exchange rate, was far lower-only about half the 1986 official rate.

1986–2003 1986–2003 between .33 cents to 1.32 to a dollar.

2001

Oil-production: 2.452 million bbl/day (2001 est.); note — production was disrupted as a result of the March –

April 2003 war (2001est.)

2002

GDP: purchasing power parity — $58 billion (2002 est.)

2002

Exports–partners:US 40.9%, Canada 8.2%, France 8.2%, Jordan 7.5%, Netherlands 6.4%, Italy 5.4%,

Morocco 4.7%, Spain 4.4% (2002)

2003

In october 2003, the official dinar-dollar exchange rate was ID1 to US$0.00027.

2004–2011

August 2004 till 2005, the official dinar-dollar exchange rate is ID1 to US$0.00068. Population: 25,374,691 (July 2004 est.) *See graph at top of this page to chart the dinar from 2004 – 2011

Positive Changes in Iraq

Upon Saddam Hussein’s deposition in 2003, Iraq has undergone political and economic changes. Many believe that the re-building of Iraq’s infrastructure will stabilize Iraq socially, politically, and economically. With the new government establishing a new monetary system that encourages foreign investment, and the central bank of Iraq awarding foreign licences, many also believe that the value of the new Iraqi dinar banknote is poised to escalate.

More Treasury Bills on the Way

The government of Iraq will issue more Treasury bills to the secondary market. For the first time in years, the central bank auctioned Treasury bills in July. Thus far, local banks have bought 900 billion Iraqi dinars ($628 million) worth of three-month bills with coupons ranging between 2.5 percent and 6.8 percent. To improve Iraq’s local currency, the dinar against the dollar, Iraq’s central bank also plans to build up its foreign-currency reserves.

Creating viable domestic capital markets will start the process of trimming the massive pre-war debt. Iraq’s path to debt reduction along with the generosity of the Paris Club by forgiving 80% of Iraq’s debt is good news for the Iraqi economy. Iraq’s growth-oriented policy, along with Iraq’s prospects of economic stability makes investing in the dinar potentially lucrative.

The Central Bank of Iraq

For the first time in decades, the central bank of Iraq awarded foreign bank licences to the following banks: HSBC, Standard Chartered, National Bank of Kuwait, Iranian National Bank, Commercial Housing bank, and Bahraini Arab Banking Institute. The Bahraini Arab Banking Institute is listed on the Bahrain, Kuwait, and Paris stock exchanges, and its major shareholders include the Kuwait Investment Authority, the central bank of Libya, and the Abu Dhabi Investment Authority. Granting foreign licences and liberalizing interest rates will create a vibrant free-market economy. Iraq’s re-invigorated banking policies will positively effect the value of the dinar in the near future.

The Potential of the Dinar

Prior to United Nations sanctions, the Iraqi dinar traded at 3.35 per U.S. dollar, and prior to the war in Iraq, the Iraqi dinar traded at .33 U.S. Dollars. During major combat operations, the Iraqi dinar declined to an all time low. However, after major combat operations, the value of the dinar increased 25%. Countries such as Germany (post WWII) and Kuwait (post Iraqi invasion) experienced a similar devaluation of their currency, but both countries recovered. Today, the dinar has increased from 3,500 against the dollar during the U.S. led invasion last year to 1,400 against the U.S. dollar. Imagine the growth potential of the Iraqi dinar once Iraq recovers and begins to enjoy the potential revenue of a country rich in oil and other natural resources.

The New Iraqi Dinar Banknote

Today, De La Rue, the world’s largest commercial security printer and papermaker based in Great Britian, prints the new Iraqi dinar banknote. The new Iraqi dinar banknote has various security features making the dinar very difficult to counterfiet, and the dinar banknote is now available in 50, 250, 500,1000, 5000, 10000, and 25000 bills. With the re-building of Iraq’s infrastructure and with the prospect of stability at hand, the Iraqi dinar is quickly becoming a very attractive investment opportunity.

This article reflects on until 2011 and we are much further down the road since then. In fact we are at the point where they can revalue . IMO

DINARLAND UPDATE FROM DINARCHRONICLES, 8 AUGUST

MarkZ

[via PDK]We have a great bank story…out of North Carolina from a Regional Bank. A person goes in their local branch…There is a new office in there. …In it is a currency exchange room with pictures of mostly European currencies on them. The person asked what this was about?… It was explained to them that they would be handling a lot of currencies. The person said “I have a lot of …“Vietnamese dong, “ The branch manager said “That’s great” The person asked “What do you think the rate is going to be? The bank manager said “Around $3 is what we are hearing…”

“Iraq shut down Telegram yesterday for National Security ” This was yesterday about noon their time. From a number of news agencies. They said it’s for “national security” that they suspended the popular messaging system. We were also told they wanted control of information across borders in and out of Iraq close to the revaluation. So things could not leak…It could be. We were told they would start controlling currency movement at the borders …and control the press releases…at that time… I think its interesting…let’s see if it pans out.

Nader From The Mid East

Let me explain…why the parallel market is so hard to get out of it…If you live in Iraq and you have say, $1000. If you go to the bank or you go in an exchange office they will change your dollar for 1320-1310 plus some fees. You lose a lot of money. If you go to the parallel market…can be in a street changing money, without license, without anything… You come see me [Street vendor] with $1,000 and I’ll give you 1500 dinar for a dollar .Where would you go? Would you come to me? Of course you would come to me because you’ll make more money on your dollars…That’s why it’s so hard…That’s why the parallel market will always exist. It will never go off no matter how many they’re gonna arrest. But they can control it. Instead now it’s 70% parallel market will become like 20%, 10% maybe. The dinar is going to be a lot stronger if the parallel market goes down to 10%-20%.

They already have 132 tons of gold. Now they’re coming in with another 50 tons per year. They’re planning on making this the strongest currency in the world. There’s no question in my mind. They already have the strongest currency in the world because they’ve got 110 billion in cash in reserves…they’re over 100% coverage of their full money supply. No other country has that strong of a currency… they’re not messing around. They want to have the strongest currency in the world.

Article Quote:

“Regarding the increase in the monetary mass, Khalaf stressed that the process of increasing the monetary mass is directly linked to the process of increasing the foreign reserves owned by the Central Bank, so any financing for the public treasury is through the exchange of dollars obtained from oil sales with dinars, and therefore any increase in the dinar mass comes mainly from foreign currency…There is no fear of any increase in the monetary mass.”

There we have it. The Central Bank is not going to increase the monetary mass. There should be no fear of any increase in it from here on out. The CBI is giving reassurances to the citizens on that matter.

If they issue new notes, 1s, 5s, 10s, 20s, 50s etc alongside the bigger notes they’re going to be able to be in country side by side for a period of up to 10 years…

Monday, August 7, 2023

"3 Top-Rated Stocks to Buy as Earnings Approach" BY ZACKS, 7 AUGUST

In a week where investors will be primarily focused on July’s CPI numbers, several top-rated stocks are worthy of attention.

Here are three top-rated stocks worthy of investors’ consideration ahead of their quarterly reports on Wednesday, August 9.

The Trade Desk (TTD - Free Report) )

Coveting a Zacks Rank #1 (Strong Buy) The Trade Desk’s stock is certainly one to pay attention to ahead of its second-quarter earnings report. Those on the prowl for tech stocks that could have more upside may have the opportunity with Trade Desk.

Trade Desk’s Internet-Services Industry is currently in the top 31% of over 250 Zacks industries and the company looks poised to benefit with its platform providing digital advertising services.

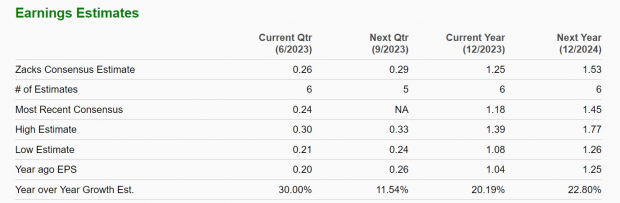

Slowly but surely ad spending has increased with inflation beginning to ease and Trade Desk’s Q2 earnings are expected to climb 30% at $0.26 per share. This compares to EPS of $0.20 in the prior-year quarter with Q2 sales forecasted to jump 21% to $455.21 million compared to $376.96 million a year ago.

Image Source: Zacks Investment Research

Shares of TTD have soared 89% YTD to easily top the Nasdaq’s +33% and this strong performance could continue if Q2 results help reconfirm Trade Desk’s intriguing growth trajectory.

As shown above, annual earnings are now expected to climb 20% in fiscal 2023 and soar another 23% in FY24 at $1.53 per share. Earnings estimates have remained higher over the last quarter with sales now forecasted to jump 22% this year and soar another 25% in FY24 to $2.42 billion.

Image Source: Zacks Investment Research

Honda Motor Co. (HMC - Free Report) )

Several automakers have stood out this earnings season and Honda Motors joins the club with its stock sporting a Zacks Rank #2 (Buy). Notably, Honda’s Automotive-Foreign Industry is in Zacks top 18%.

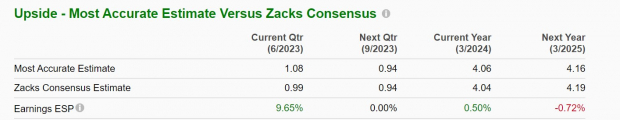

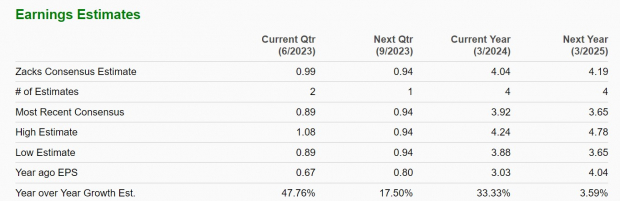

Set to report its fiscal first-quarter results on Wednesday, Honda’s earnings are projected to soar 48% at $0.99 a share versus EPS of $0.67 a year ago. First-quarter sales are anticipated to rise 13% to $33.57 billion. It’s also noteworthy that the Zacks Expected Surprise Prediction (ESP) indicates Honda could surpass earnings expectations with the Most Accurate Estimate having Q1 EPS at $1.08.

Image Source: Zacks Investment Research

More impressive, annual earnings are expected to climb 33% in Honda’s current fiscal 2024 to $4.04 per share compared to EPS of $3.03 in FY23. Fiscal 2025 earnings are expected to rise another 3%.

On the top line, FY24 sales are expected to jump 13% and then dip -4% in FY25 to $134.84 billion. Still, earnings estimates have trended higher with Honda stock up +36% this year to outperform the broader indexes.

Image Source: Zacks Investment Research

Jack In The Box (JACK - Free Report) )

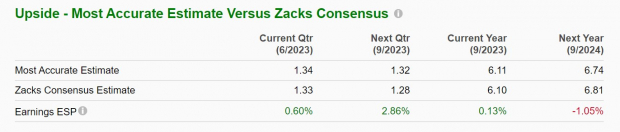

Lastly, the Retail-Restaurants Industry is also in Zacks top 18% and Jack In The Box stock sports a Zacks Rank #2 (Buy). Set to report its fiscal third-quarter results on Wednesday, the trend of earnings estimate revisions is compelling for Jack In the Box ahead of its report.

This is despite Q3 earnings expected to dip -3% at $1.33 per share following a tough to compete-against quarter. First quarter sales are forecasted to dip -1% to 393.53 million. However, earnings estimates are up and the Zacks ESP now indicates Jack In The Box could beat expectations with the Most Accurate Estimate having Q3 EPS at $1.34.

Image Source: Zacks Investment Research

Furthermore, annual earnings are now projected to rise 4% in FY23 and jump another 11% in FY24 at $6.81 per share. Total sales are forecasted to climb 16% this year and then dip -3% in FY24 to $1.65 billion. With that being said, annual earnings estimates are still noticeably higher and Jack In The Box stock is up +40% YTD to also top the broader indexes.

Image Source: Zacks Investment Research

Bottom Line

These companies are benefitting from strong business environments at the moment. Rising earnings estimates are a great sign they may be able to reach or exceed their quarterly expectations and offer positive guidance. More importantly, this could extend the strong performances of Trade Desk, Honda, and Jack In The Box stock this year.

https://www.zacks.com/commentary/2133289/3-top-rated-stocks-to-buy-as-earnings-approach

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...