- The three strongest currencies in the world are held by Iraq’s neighboring nations – Kuwait, Bahrain and Oman. How does Iraq compare economically and politically against these powerhouse currencies, and can the Iraqi Dinar RV support such valuations?

This is Section 3 of: The Ultimate Guide to Every Economic and Political Reason for an Iraqi Dinar Revaluation (RV)

This section represents the culmination of the 3-section article series which set out to analyze and explain the important factors surrounding a potential revaluation (RV) of the Iraqi Dinar (IQD)Section 1, Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Eventsprovided a detailed, historical context surrounding the Iraqi Dinar, This included its evolution, the impact of wars, the role of economic sanctions, and the popular reasons for speculations regarding an Iraqi Dinar revaluation.Section 2, A Sky High Iraqi Dinar RV Boils Down to This identified and explained every key economic and political stability indicator that directly influences and supports a strong and stable currency exchange rate.

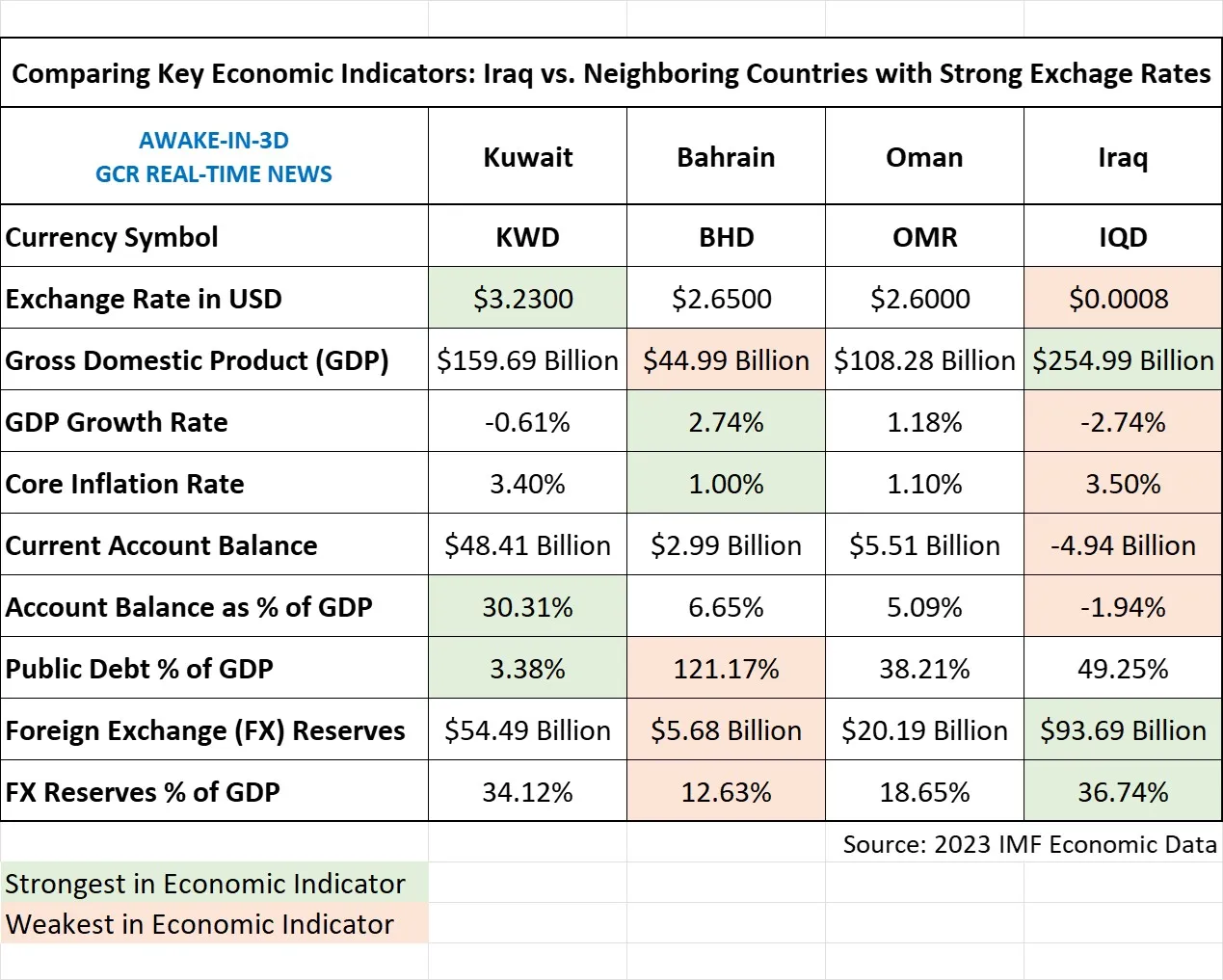

Building upon the knowledge acquired regarding key economic indicators in Section 2, we now direct our focus toward a comparison of Iraq’s neighboring countries, distinguished by their robust and stable currencies.

This analysis centers on the examination of the key economic indicators and political stability indices that underpin countries with very strong (high) exchange rate in U.S. Dollar terms. Specifically, the nations of Kuwait, Bahrain, and Oman.

By comparing these nations with Iraq, we will gain valuable insights into the practical determinants that may influence the potential revaluation of the Iraqi Dinar.

3.1 Iraq’s Regional Neighbors with Strong Currency Exchange Rates

Let’s start by establishing a baseline of currency exchange rates within the region.

- Kuwait (KWD): 1 KWD = $3.23

- Bahrain (BHD): 1 BHD = $2.65

- Iraq (IQD): 1 IQD = $0.00076 (1310 IQD per 1 USD)

3.2 Key Regional Economic Indicators to Support an Iraqi Dinar RV

The relevance of this comparative analysis lies in the examination of fundamental economic indicators which serve as the bedrock of currency dynamics.

These indicators allow us to assess the currency dynamics and economic environments within Iraq and its regional counterparts.

Here are the key economic indicators we shall scrutinize and compare for each country:

- National Gross Domestic Product (GDP)

- Economic Growth (GDP Growth Rate)

- Core Inflation Rate

- Current Account Balance

- Public Debt (as a Percentage of GDP)

- Foreign Exchange Reserves

The following chart summarizes a direct comparison of these key economic indicators between Iraq, Kuwait, Bahrain and Oman based on the latest 2023 economic data.

Source Data: 2023 IMF Economic Research

3.2.1 What this Economic Comparison Indicates Relative to an Iraqi Dinar RV

National Gross Domestic Product (GDP):

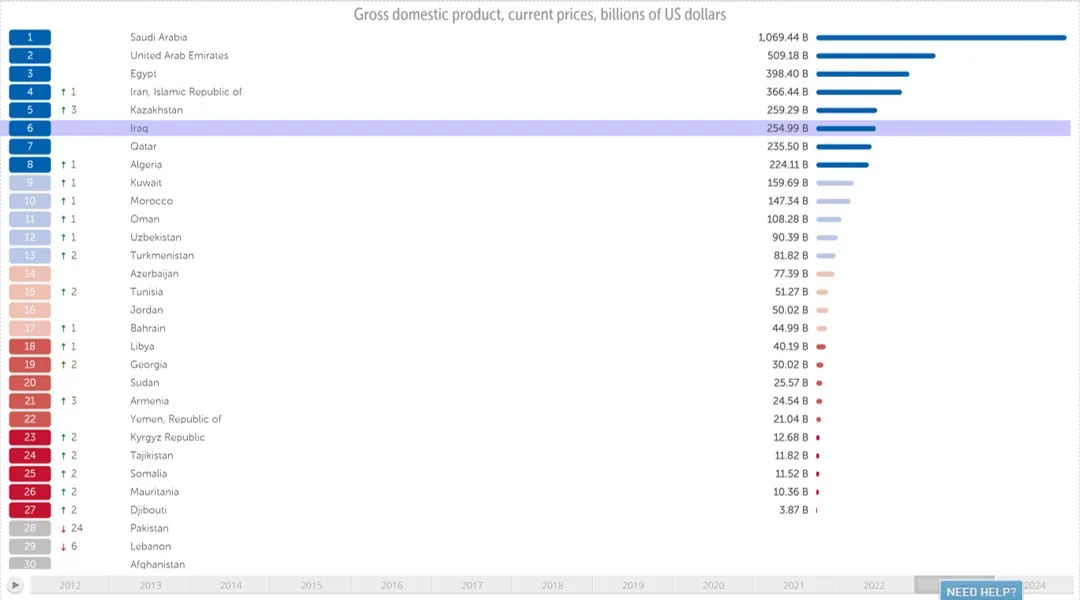

- Iraq has the highest GDP among the mentioned countries at $254.99 billion, indicating the largest economic size in the region.

- While Iraq’s GDP is relatively large, its economy is heavily dependent on its competitive strength in oil exports and processing efficiency (production cost per barrel of oil). Given Iraq’s ongoing need for infrastructure efficiency and capacity upgrades, its competitive position is weaker than that of neighboring nations .

- Moreover, Iraq’s economy suffers from a broader set of structural issues, including elevated levels of financial and political corruption, which prevents the confidence necessary for significant foreign capital investment.

GDP OF MIDDLE EASTERN REGION. Source: IMF

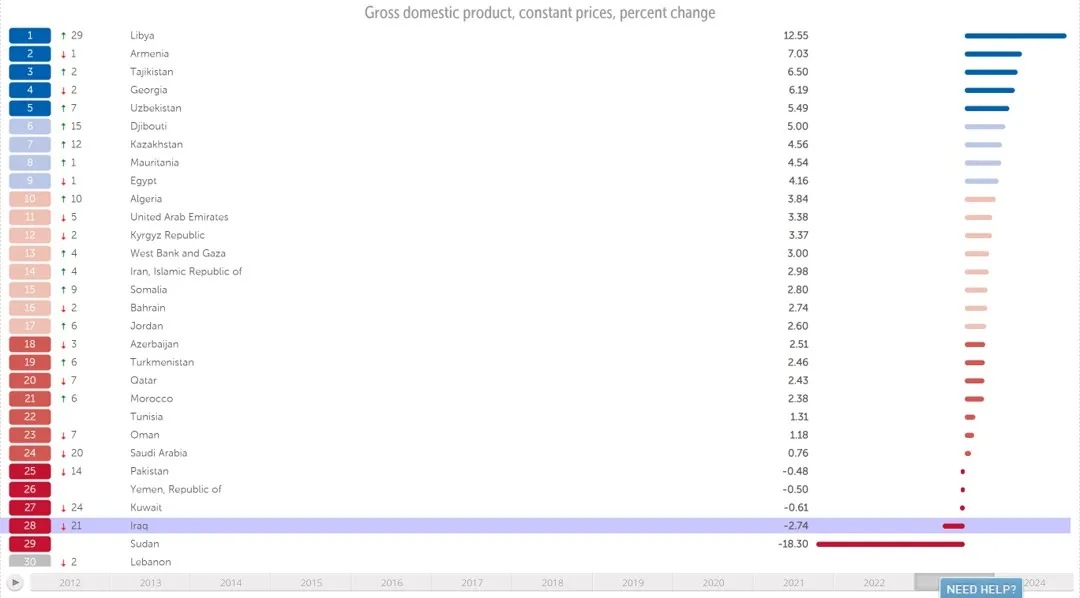

Economic Growth (GDP Growth Rate):

- Bahrain leads in economic growth with a GDP growth rate of 2.74%. This positive growth rate signifies a thriving economy.

- Oman’s growth rate is 1.18%, indicating a moderately growing economy.

- Kuwait has a negative growth rate of -0.61%, suggesting a contraction in its economy.

- Iraq’s GDP growth rate is -2.74%, showing a significant economic output decline, which can likely be attributed to ongoing security issues and political instability.

GDP GROWTH RATE OF MIDDLE EASTERN REGION. Source: IMF

Inflation Rates:

- Bahrain has a relatively low inflation rate of 1.0%, indicating price stability.

- Oman’s inflation rate is also low at 1.1%, contributing to stable purchasing power.

- Kuwait’s inflation rate is 3.4%, relatively high compared to its neighbors, which may affect consumer affordability.

- Iraq, with an inflation rate of 3.5%, experiences even higher price increases, impacting the living standards of its citizens, which is reflected by Iraq’s contracting GDP above.

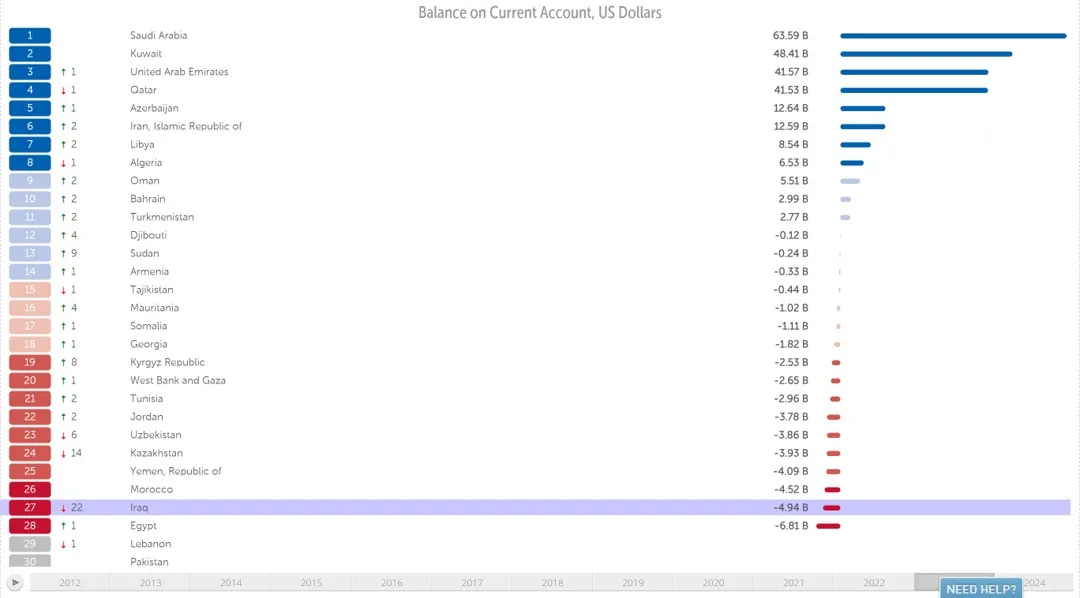

Current Account Balance:

- Kuwait maintains a significant surplus with a current account balance of $48.41 billion, reflecting strong international trade.

- Oman has a surplus of $5.51 billion, indicating a healthy trade balance.

- Bahrain’s surplus is $2.99 billion, showcasing its economic stability.

- Iraq, however, has a deficit of -$4.94 billion, implying that it imports more than it exports, which can strain its foreign exchange reserves.

CURRENT TRADE ACCOUNT BALANCE OF MIDDLE EASTERN REGION. Source: IMF

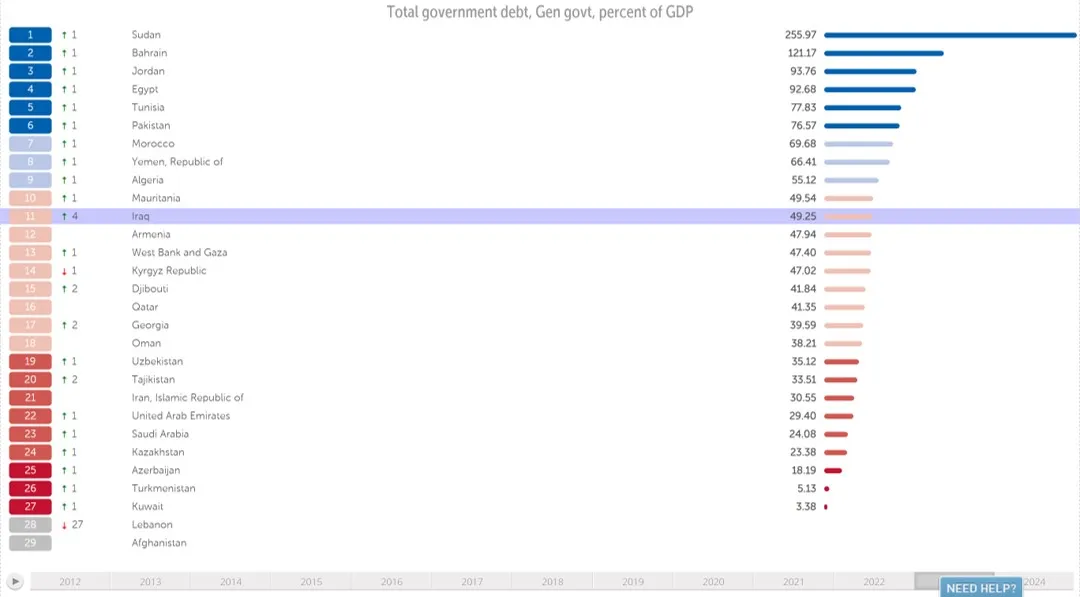

Public Debt (as a Percentage of GDP):

- Kuwait’s public debt is relatively low at 3.38% of its GDP, reflecting fiscal responsibility.

- Oman’s public debt is 38.21% of its GDP, suggesting a higher debt burden.

- Bahrain’s public debt is notably high at 121.17% of GDP, indicating significant fiscal challenges.

- Iraq’s public debt is 49.25% of its GDP, which is relatively high and indicates a substantial debt burden.

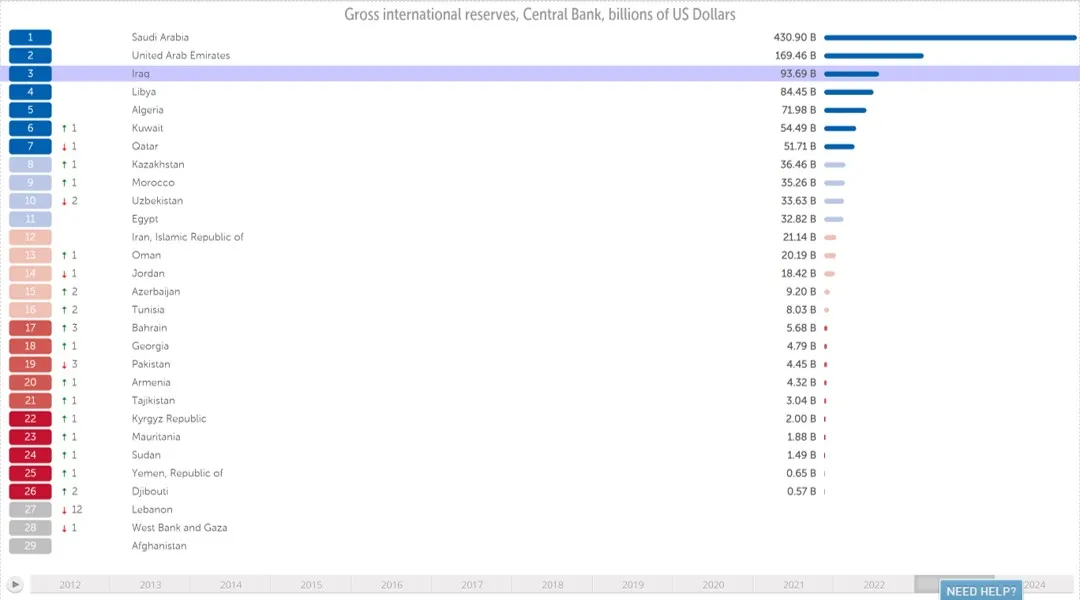

- Kuwait holds foreign exchange reserves of $54.49 billion, which is substantial and provides stability to its currency.

- Oman’s reserves are $20.19 billion, providing a buffer against external economic shocks.

- Bahrain’s reserves are $5.68 billion, which, while lower than its neighbors, still contributes to currency stability.

- Iraq’s foreign exchange reserves are $93.69 billion at approximately 37% relative to GDP – stronger than any of its neighbors. This would serve well in maintaining a strong currency peg to the U.S. dollar (or a basket of currencies including the USD).

PUBLIC DEBT OF MIDDLE EASTERN REGION. Source: IMF

Foreign Exchange Reserves:

FOREIGN EXCHANGE (FX) OF MIDDLE EASTERN REGION. Source: IMF

The Bottom Line

Iraq faces substantial economic challenges compared to its neighbors with stronger currencies being the weakest in 5 out of 8 key indicators.

These challenges include a negative GDP, economic contraction, higher inflation rates, a trade deficit, and a relatively high public debt burden. Consequently, Iraq’s ability to support an equally high exchange rate as its neighbors is limited by these economic constraints.

However, the weakness around Iraq’s key economic indicators is not so severe as to prevent a significant currency RV in the $2.00-$2.75 range.

Iraq appears to have the basic economic strength to support a currency peg similar to Kuwait, Bahrain and Oman.

So what’s holding Iraq back from Revaluing the IQD with a new currency peg? Perhaps the political stability index can provide an answer.

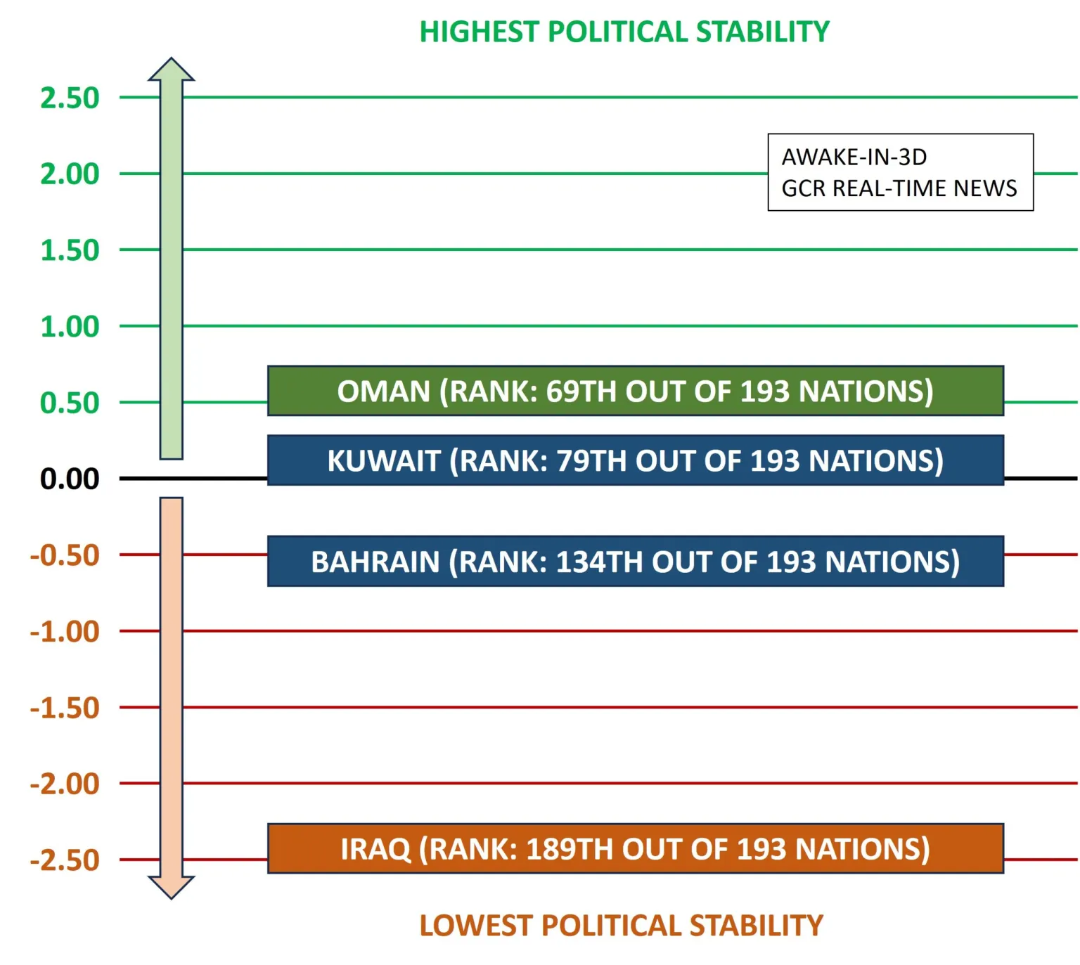

3.3 Political Stability: The Most Significant Challenge Facing an Iraqi Dinar RV

Political stability is a pivotal element in the realm of global economics and currency valuation. Understanding the political stability index is integral to our comparative analysis.

This index measures the perceived likelihood of a country’s government being destabilized or overthrown through unconstitutional or violent means, including politically motivated violence and terrorism.

An index value of 2.5 points indicates a strong and secure political environment, while a value of -2.5 points reflects a weak and insecure setting. The global average index value for 2021, derived from 193 countries, stands at -0.07 points.

Here is how the different countries rank in terms of overall political stability:

- Oman: With a commendable index of 0.51, Oman holds the 69th place in the global political stability rankings, signifying a robust and stable political environment.

- Kuwait: Kuwait secures the 79th position in global political stability standings with an index of 0.30, indicating a relatively stable political climate.

- Bahrain: Bahrain ranks 134th in global political stability standings, albeit with a modestly negative index of -0.51, reflecting specific political challenges.

- Iraq: Within this regional context, Iraq stands at the 189th position in political stability rankings out of a total of 193 countries. Iraq’s political stability index stands at -2.4, signifying a significantly weaker and insecure political environment.

Source Data: 2021 TheGlobalEconomy.com

Conclusion

In unison, these comparisons have underscored the interplay of economic indicators and political stability that define the currency dynamics within Iraq and its regional counterparts.

Clearly Iraq has a long way to go in reducing the political and financial corruption that dominates how the international business and foreign exchange markets view Iraq in terms of overall risk vs. reward.

Until the endemic corruption that plagues Iraq is addressed and mitigated, any serious attempts to float or peg a revalued IQD substantially higher will likely fail to achieve the desired results such an RV would yield.

Sources:

- IMF Economic Data: https://data.imf.org/?sk=2ab615ea-9fb9-45b2-8d65-a031a6204fea

- Political Stability Index: https://www.theglobaleconomy.com/rankings/wb_political_stability/

Section 1, Staging an Iraqi Dinar Revaluation (RV): A Unique Background of Eventsprovided a detailed, historical context surrounding the Iraqi Dinar, This included its evolution, the impact of wars, the role of economic sanctions, and the popular reasons for speculations regarding an Iraqi Dinar revaluation.

Section 2, A Sky High Iraqi Dinar RV Boils Down to This identified and explained every key economic and political stability indicator that directly influences and supports a strong and stable currency exchange rate.