Tuesday, August 15, 2023

"THE DOLLAR IS BETWEEN HIGH & LOW", 15 AUGUST

American attempts and Iraqi solutions… The dollar is between high and low, and government measures8-13-2023American attempts and Iraqi solutions... The dollar is between high and low and government measuresInformation / Baghdad…It became clear to everyone the impact of US banking policies towards Iraq, especially the banking sector, in an attempt to cause confusion in the movement of the commercial market and push the government into direct confrontation with the people, after the rise in most prices, although the government was able to take a decision to reduce the exchange rate after it crossed the barrier of 175 thousand dinars for every 100 dollars.In turn, the Sudanese government drew up a new financial policy, setting the official exchange rate at 130,000 dinars for every $100.

Despite this, however, the US measures were behind the continued rise in the exchange rate in terms of restricting Iraqi banks’ access to hard currency under the pretext of smuggling, speculation and the black market.The representative of the Sadiqoun bloc, Muhammad al-Baldawi, told Al-Maalouma that “America is taking retaliatory measures against Iraq after its move towards resolving the electricity crisis, bartering oil with Iranian gas, and getting out of the dollar’s impasse.”He added, “Washington seeks to impose its opinion and be dominant over decisions in Iraq, as it took retaliatory measures that caused a rise in the exchange rate of the dollar in the local markets, thus increasing the prices of goods, commodities, foodstuffs, and causing harm to the citizen.”Al-Baldawi pointed out that “the American side seeks, through its measures, to be in control of Iraq and take whatever decisions it wants, and unlike it, it resorts to using some pressure tricks to achieve its interests and harm Iraq and its people.”On the other hand, a member of the Al-Fateh Alliance, Ali Al-Zubaidi told Al-Maalouma, that “Washington lacks a lot of credibility in the treaties and covenants that are agreed upon, as there is no fairness in continuing to deposit the country’s money in the US Federal Bank.”

He explained, “Iraq will end the dollar crisis if it gets rid of the hegemony imposed by the United States of America on the money for selling oil, especially since Washington imposes Chapter VII restrictions on Iraq verbally in order to achieve its own interests.”On the other hand, the economist, Safwan Qusai, confirmed to Al-Maalouma, that “the money changers in Iraq receive an appropriate commission when buying and selling dollars, which requires them to adhere to their commission, at a time when there must be a financial policy that is complementary to the central bank in its policy related to selling dollar in the parallel market.He added, “There is an urgent need to control border crossings, as well as reduce the volume of imports without the presence of external money transfers, in addition to pushing banks towards a flexible banking system and relying on documentary credits, so that all merchants are allowed to deal with reliable suppliers.”

almaalomah.me-----

Parliamentary finance indicates the reluctance of traders to enter the “platform” for selling the dollar, and gives reasons for its rise

A member of the Parliamentary Finance Committee, Moein Al-Kadhimi, stated that merchants are hesitant to use the electronic platform for buying and selling dollars. As a result, they resort to the black market, which drives up the dollar prices in the local markets.

Al-Kadhimi told Shafaq News that the US Federal Bank complicates the central bank’s daily sales of foreign remittances, which range from $150-200 million.

Merchants avoid buying dollars on the electronic platform, resorting to the black market instead. This increases demand and raises prices, with the exchange rate reaching over 150,000 dinars for $100.

Al-Kazemi stated that the central bank has enough dollars, but the issue lies in its procedures and restrictions on transferring funds to US-prohibited countries. This forces merchants to turn to the black market to purchase goods and foodstuffs from abroad.

Since the beginning of the year, the Central Bank of Iraq has implemented an electronic platform and the international financial transfer system, “SWIFT.” However, despite government and central bank efforts to stabilize the exchange rate in the parallel (black) markets, the dollar exchange rates have not improved in Iraq.

The official exchange rate in the Iraqi budget is 1320 dinars to the dollar, but in the markets of Baghdad and Erbil, the parallel price has continued to rise, reaching 154,000 dinars for every $100 on Monday.

DINARLAND UPDATE, 15 AUGUST

MarkZ

[via PDK]

No negative news over the weekend…We are expecting a very busy week between now and the 20th….

…in the news “Argentina has a 18% devaluation of their currency” Just Boom and they flipped the switch. This is what a number of countries are facing if they do not asset back their currency. Argentina may be a “motivator” for Iraq, Vietnam and other countries to go ahead and pull their triggers…in a positive way on their values.

MilitiaMan (KTFA)

It’s been weeks…and still to this day they haven’t actually shown us the spending ability of the budget.

Why is that? It’s obvious – they’re not coming out at 1310, 1320 or 1305…

The House of Representative …Central Bank of Iraq…the legal departments all got together. What are they talking about? They’re talking about implementing allocating and spending money for this budget. Anybody thinking this is not happening I have to disagree with you…

…Alaq, the Central Bank Governor, he’s not new to Iraq. This man’s been involved for many many years. He led the Arab Monetary Fund. He spent time there as the head honcho and now he’s back here to do what? To finish this process. He recently stated the Iraqi dinar and/or subsequently the project to delete the zeros from the exchange rate still exists. If anybody’s telling you this is a joke you really got to think about it and say did he really say that?

Frank26 (KTFA)

The CBI cannot change the rate of the American dollar…but they can change the rate of the Iraqi dinar…which will affect the rate of the American dollar to the point of not being used in Iraq any longer and that gives birth to a new sovereign national currency…

Question:

“Has the oil and gas law been passed and implemented as the articles indicated?“

Yes but IMO it too has to wait for the new exchange rate.

Nader From The Mid East

What’s slowing down the RV…and it’s going to slow it down more and more until they find a solution for it. It’s not the HCL…budget….What’s slowing down the RV is the corruption…You guys have no idea how much corruption going on in Iraq…It’s like a big mafia…bigger than the government for now…It’s going to be a big fight…When the corruption goes to 20%, 15%, 10% that’s where the RV is gonna happen…Jeanine Hennis-Plasschaert, UN Special Representative in Iraq “Pervasive corruption is a major root cause of Iraqi dysfunction. And frankly, no leader can claim to be shielded from it.” There will be little to no increase in currency value in Iraq until multinational companies can safely invest in Iraq without corruption or safety issues.

JUDY NOTE, 15 AUGUST

Global Currency Revaluation:

Mon. 14 Aug. MarkZ: “We are expecting a very busy week between now and the 17th. … On the news front most of my sources are expecting things more like Wed. 16 Aug. and Thurs.17 Aug. There is some news out of Zimbabwe just a few hours ago. Their Central Bank is close to releasing the gold backed digital tokens into retail for peer to peer, store to store, and individual use. They have announced that they are close – which means they are probably already done with the tech. This is the way most of these nations operate.”

Sun. 13 Aug. American Patriot: “The Military Earth Alliance Covert Operations have neutralized covert operations and all 209 countries were now gold/asset-backed. The Star link Satellite System has been interconnecting computerized unmanned stations to monitor the Quantum System that’s been connected and synched up.”

By Mon. 7 Aug. the Iraqi Parliament had approved their budget with the new Iraqi Dinar Rate in it and published it in the Gazette the next day Tues. 8 Aug.

On Wed. 9 Aug. the new Iraqi Dinar Rate was believed to have revalued at a 1:1 with the USD and then began trading up on the Forex back screens.

On Thurs. 10 Aug. the direct payment system was activated to send funds internationally person to person.

Tier 4b should be notified to receive appointments to exchange foreign currencies and redeem Zim bonds within 48 hours of Bond Holders.

The Gold/asset-backed USN was expected to be announced between Aug.18-21, or most certainly at the BRICS Summit in Johannesburg South African Aug. 22-24.

Monday, August 14, 2023

"13F Season: Avoid These 3 Pitfalls", 14 AUGUST

What is 13F Season?

13F season refers to the quarterly period in which institutional investment managers with over $100 million in assets under management (aum) must disclose their holdings of publicly traded securities to the US Securities and Exchange Commission (SEC). The 13F filing provides transparency and insight into the strategies and composition of large institutional investors, hedge funds, mutual funds, and pension funds. However, though 13F statements can be valuable learning tools for everyday investors, they are often misunderstood. Below are 3 pitfalls that investors fall into when following the 13F season:

Conflating Notional Value & Real Value

Earlier this morning, I read a ton of social media hysteria about Michael Burry’s 13F. Burry is a legendary short seller portrayed by Christian Bale in the hit movie “The Big Short.” At face value, Burry’s updated portfolio showed roughly 51% of his portfolio in S&P 500 ETF ((SPY - Free Report) ) put options and another 43% in Nasdaq 100 ETF ((QQQ - Free Report) ) puts.

Before investors get crazy bearish and follow Burry, it is essential to remember that 13Fs report the entire value of the underlying stock and NOT the market value of the option.Notional value refers to the nominal or theoretical value of the option without considering factors like market conditions or external influences. Conversely, real value or actual value considers a more accurate representation of the asset’s current value.

Discounting Time Frame

Without context, 13Fs have little value for investors looking to piggyback on ideas. For example, Michael Burry and Stanley Druckenmiller can be in and out of positions quickly. Conversely, Warren Buffett tends to invest in companies, not stocks, and has a theoretical time frame of “forever”.

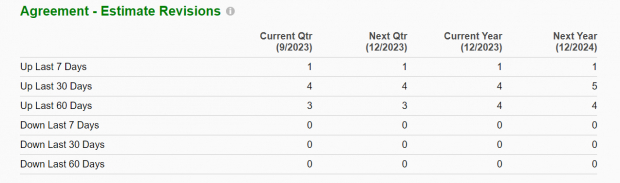

In other words, there is more value in following an investor like Buffett. Speaking of which, Buffett’s 13F just hit the news wires, and he opened new positions in homebuilders such as DR Horton ((DHI - Free Report) ), Lennar ((LEN - Free Report) ),and NVR ((NVR - Free Report) ). NVR and Lennar earn the best possible Zacks Rank #1 (Strong Buy) as several analysts have raised their EPS estimates recently.

Image Source: Zacks Investment Research

Buffett also added to oil stock Occidental Petroleum ((OXY - Free Report) ), which is breaking out.

Complete Picture is Not Clear

Because short positions are not displayed in 13F filings, investors never fully know one’s portfolio exposure (hedges? directional shorts). As always, investors should do their own due diligence when looking at 13Fs.

"Is commercial policy or banks bear the instability of the exchange rate?", 14 AUGUST

Is commercial policy or banks bear the instability of the exchange rate?

the most important of which is the growth of Iraqi per capita consumption, which was accompanied with external openness, which caused an increase in the volume of imports. Any controls and are not subject to taxes and fees as a result of rampant corruption in government departments and other factors.

All these factors produced an unregulated commercial system, for example, a merchant who deals in millions of dollars is not officially registered and ships goods in the names of customs clearance companies and does not have a commercial record, for fear of the tax system in Iraq, and therefore the system destroyed the banking system, through unregulated trade And financial transfer according to messages via social media applications, which transfer money in moments, which has become more flexible for the commercial sector , but it had adverse and negative results on the banking sector, which exposed it to risks and obtained a low rating in compliance with the rules of money laundering and terrorist financing.

The commercial sector received a shock from the US Federal Bank, which changed the rules of financial transfer from old rules established by the banking system based on the requirements of the commercial sector to solid rules through the remittance platform (despite our reservations about some technical failures in this platform), but the question is whether the commercial sector is able to adapt himself according to these banking requirements in order to be able to continue, by implementing the procedures represented in establishing an official company first and opening bank accounts for it, and obtaining a tax record despite the harshness and brutality of the Iraqi tax system, and shipping in the names of the importers themselves and transfer by the banking system and according to international norms and the required compliance rules..

A warning was issued against the attempts of some people to drag the banking sector to adapt its situation to a distorted commercial policy, and he opposite must be to support the commercial sector by adapting its legal status , creating tax and customs reforms to serve this sector, which has been exposed and is subject to many calamities and calamities, and maintaining a strong, discreet banking sector with the ability To keep abreast of developments and is able to meet the requirements of correct trade, and here is the role of the Central Bank of Iraq and its ability to exercise its supervisory role on banks and motivate them in order to develop their practical tools, and the results will be positive if the vision is completed between the commercial sector and the reforms that the government must consider, which contributes to reducing the price of dollar exchange.

https://economy-news.net/content.php?id=35633

------

Al-Nusairi: The Battle For The Stability Of The Exchange Rate With Speculators In The Black Market Will End With The Recovery Of The Dinar

Money and business Economy News _ Baghdad Samir Al-Nusairi, an adviser to the Association of Iraqi Private Banks, confirmed today, Monday, that the battle led by the government and the central bank with speculators to control the stability of the dinar exchange rate against the dollar on the black market will end with the gradual recovery of the dinar and that the rise in the exchange rate is temporary, and will inevitably decrease back to the target rate of The central bank in Iraq, because the dollar that is traded in, if it does not come from the central bank, then its source is illegitimate and is held accountable by Iraqi law for its negative effects on the national economy .

Al-Nusairi said in an interview with "Al-Iqtisad News", that "one of the most prominent reasons for the dollar's rise is the news of depriving 14 banks of dealing in US dollars and what the big speculators did in withdrawing cash dollars and the manipulation of unauthorized exchanges with exchange rates." In addition, some small retailers did not enter the electronic platform for external transfer.

And he added, “Some media outlets and analysts exacerbated the confusion of the market by amplifying unreal and incomplete data and information, as well as websites and microbes that announce daily the exchange rate on the black market despite the warnings of the Central Bank and its clarification by its statements issued successively that the offer of foreign currency is available for all requests submitted to the electronic platform by companies.”

And merchants and businessmen, and that the platform is the only approved system for external transfers, which achieves the real guarantee for the safety of external financial transactions in accordance with international standards, which guarantee the arrival of transfers to the final beneficiary.

Al-Nusairi pointed out, "The Central Bank follows up and monitors the markets in cooperation with the concerned government agencies, and takes urgent measures to address the situation and stop all countermeasures that harm the national economy." In particular, limiting illegal trade through unofficial outlets.

And he continued, “The Central Bank is working to diagnose and study the causes and obstacles to entering the electronic platform, delaying some transfers, and setting up procedures that facilitate merchants’ conduct of their business smoothly and easily, and taking possible flexibility to accelerate external transfers in banks, the Central Bank, and in the relevant international banking agencies.”

Al-Nusairi noted that “the measures will inevitably result in a decrease in the exchange rate on the black market for the illegal dollar, and that the Central Bank is currently working on adopting new mechanisms and work contexts to control monetary stability, and their results will appear soon.” We urge all government agencies, wholesalers, and businessmen to support the Iraqi dinar and deal with it in all local monetary activities and transactions, as it is strong and covered by foreign monetary reserves that exceed $113 billion, and that its purchasing power is gradually recovering. In addition to being an essential pillar of national sovereignty. 08/14/2023 https://economy-news.net/content.php?id=35658

Iraq announces great strides in digital transformation, 25 DEC

Iraq announces great strides in digital transformation Economy News – Baghdad The Ministry of Finance announced on Tuesday that it had mad...

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...