After rallying almost straight up for nearly four months the stock market has taken a much-needed breather over the last couple of weeks. Rather than a sharp downward correction, many stocks have corrected in time and built out some sideways action.

For investors that like trading momentum breakouts, these sideways consolidations provide perfect setups to measure trades from.

With inflation continuing to ease, the US economy growing at an accelerating pace, and the Federal Reserve laying out a path for lower interest rates, many bullish factors are aligning for what could be an extended bull market.

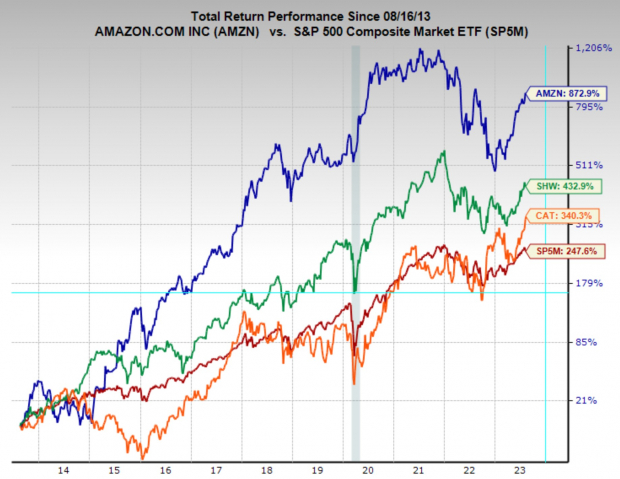

Amazon (AMZN - Free Report) , Sherwin Williams (SHW - Free Report) , and Caterpillar (CAT - Free Report) are three premier US stocks that are forming A+ trade setups. Each of these stocks have considerably outperformed the broad market over the last 10 years, enjoy top Zacks Ranks, have momentum at their back, and are building convincing technical chart patterns.

Amazon.com

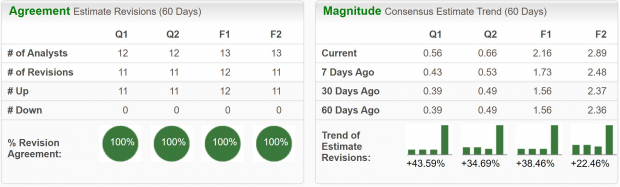

Amazon has made a stunning comeback from the bear market of 2022, rallying 65% YTD. And with some very powerful upward revisions to its earnings estimates, AMZN has jumped onto the Zacks #1 Rank.

During the last quarterly earnings report Amazon surprised to the upside by 43%, showing just how effective its restructuring has been this last year. Current quarter earnings estimates have been upgraded by 43.6% and are projected to climb 180% YoY to $0.56 per share. FY23 earnings estimates have been revised higher by 38.5% and forecast to grow 204% YoY to $2.16 per share.

Additionally, sales are projected to grow over 10% across time frames and EPS are expected to increase by 34% annually over the next 3-5 years.

Reflecting the drastically improving business performance, AMZN stock is setting up a compelling technical chart pattern. Over the last week price action in the stock has formed a tidy bull flag.

If Amazon can trade above the $139.50 level, it should initiate a breakout and draw in a rush of buyers sending the stock higher. However, if it loses the $136 level investors should remain cautious as the signal is invalid, and the stock may want to fill the earnings gap below.

Image Source: TradingView

Sherwin Williams

Currently sitting in the top 2% of the Zacks Industry Rank, Sherwin Williams stock looks primed for another move higher in the coming weeks. Bolstered by a strong economy, and upward trending earnings revisions, I think investors must keep an eye on this classic American stock.

Sherwin Williams stock has built out a prototypical cup and handle pattern, with a tight bull flag forming over the last couple of weeks.

If SHW price can break out above the $274.50 level, it should begin its next leg higher. Alternatively, if the stock can’t hold the $270 level of support, investors should wait for another opportunity as the setup is invalid.

Image Source: TradingView

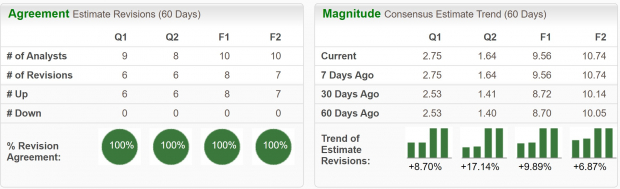

Sherwin Williams has begun to see steady earnings estimate upgrades, as analysts have unanimously agreed on upward revisions. Because of this earnings revision trend, SHW has a Zacks Rank #1 (Strong Buy) rating.

Current quarter earnings estimates have been revised higher by 8.7% to $2.75 per share, while FY23 estimates have been revised higher by nearly 10% to $9.56 per share.

Image Source: Zacks Investment Research

Caterpillar

Caterpillar stock gapped up to new all-time highs last week, following a huge earnings beat. Since the report the stock has held the gap and formed a neat bull flag consolidation to trade from.

If CAT stock can breakout above the $288.50 level, a rush of buying should propel the stock to another new all-time high. But, if the price loses the support of the $278 level, it could fill that earnings gap, so investors should be caution below there.

Image Source: TradingView

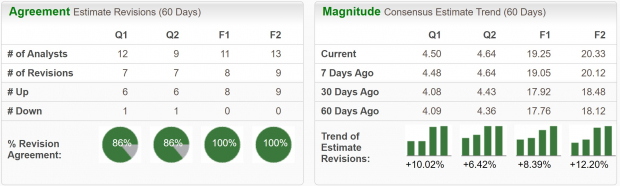

The incredibly strong construction market has been a major boon for Caterpillars stock sending sales and earnings estimates much higher and giving it a Zacks Rank #1(Strong Buy) rating.

Current quarter earnings estimates have been revised higher by 10% and are forecast to grow 14% YoY to $4.50 per share. FY23 earnings estimates have been revised higher by 8.4% and are expected to climb 39% YoY to $19.25.

Additionally, current quarter sales are projected to grow 8% YoY to $16.2 billion and FY23 sales are set to increase 11.6% YoY to $66.3 billion.

Image Source: Zacks Investment Research

Bottom Line

Here I have shared some very clean trade setups, however investors should always keep risk management top of mind. Even the best setups can fail, so we should always be aware of our max risk stop-loss and respect the trading plan.