IQD Revaluation Update: Banks Are Ready as Iraq Aligns Its Financial Infrastructure

The discussion surrounding the Iraqi Dinar (IQD) revaluation has intensified following new confirmations about Iraq’s banking system. Recent developments show that Iraq is not merely discussing reform — it is executing it at a structural level.

According to updated financial alignment disclosures, Iraq’s banks are now fully positioned, compliant, and operationally ready to receive a monetary rate change. This is not speculation. This is infrastructure.

🏦 Iraq’s Banking System: Centralized, Aligned, and Ready

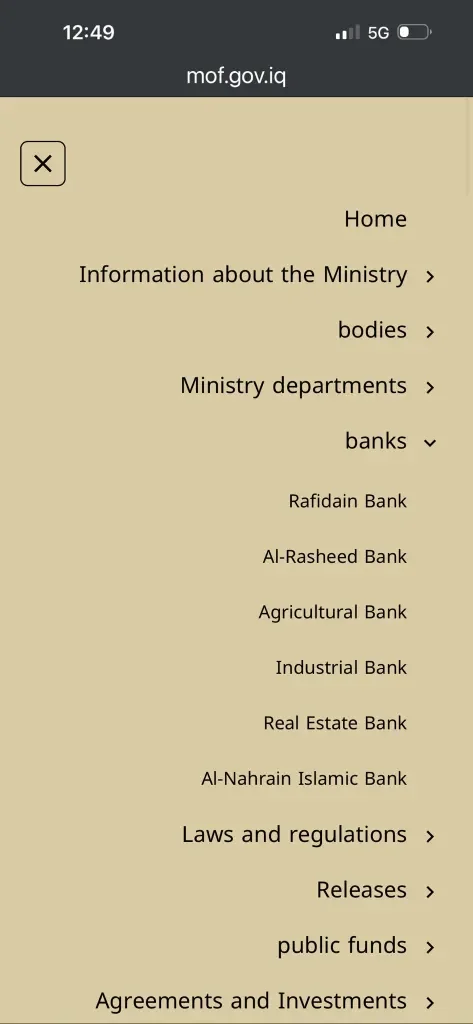

The Ministry of Finance (MOF) has officially consolidated Iraq’s state banks under a single “Banks” classification, reinforcing centralized oversight and coordinated execution.

All banks now operate under the standards, compliance requirements, and monetary framework of the Central Bank of Iraq (CBI).

This confirms one critical point:

Banks do not initiate a currency revaluation. They must be ready to receive it. And now, they are.

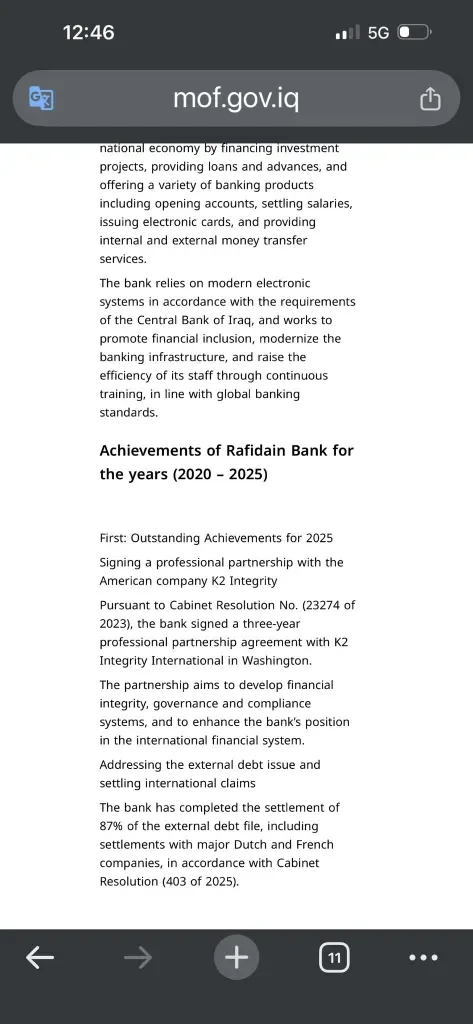

⭐ Rafidain Bank: Iraq’s Anchor Bank

Rafidain Bank has clearly emerged as Iraq’s lead anchor bank, setting the operational standard for the entire system.

Key Achievements:

Fully compliant with CBI regulations

Modern electronic banking systems implemented

Alignment with international banking standards

87% of external debt settled, including international claims

Strategic 2025 Partnership:

In 2025, Rafidain entered a three-year professional partnership with U.S. firm K2 Integrity, focused on:

Governance

Regulatory compliance

Financial integrity

Risk management

This is a major signal of international trust and readiness.

🔁 Rasheed Bank: Parallel Alignment

Rasheed Bank operates alongside Rafidain and historically moves in lockstep with:

Government accounts

Salary disbursements

Trade finance

Public sector payments

Its alignment confirms system-wide synchronization, not isolated readiness.

🌱 Development Banks: Structured Support, Not Rate Leadership

Agricultural Bank & Industrial Bank

These institutions function as development banks, meaning:

They do not set currency rates

They operate under the national monetary framework

System compatibility and compliance are the priority

Their readiness ensures economic growth channels are functional post-revaluation.

🏠 Real Estate Bank: Stability-Based Operations

The Real Estate Bank focuses on:

Domestic housing finance

Long-term lending

Mortgage infrastructure

Its role depends on currency stability, not foreign exchange exposure — another indicator that Iraq is preparing for a stable valuation environment.

☪️ Al Nahrain Islamic Bank: Fully Integrated

Although operating under Islamic finance principles, Al Nahrain Islamic Bank is:

Integrated into national payment systems

Aligned with settlement protocols

Compliant with national oversight

This confirms no fragmentation across banking models.

🧱 Featured Snippet: What This Really Means

Iraq’s banking system is now hierarchically aligned under the Ministry of Finance and Central Bank of Iraq, with anchor banks ready, development banks synchronized, and specialty banks integrated — signaling full readiness to receive an IQD rate change.

📌 Why This Matters for the IQD Revaluation

This alignment is not cosmetic.

This is financial infrastructure completion.

Banks do not lead a revaluation.

Banks must be ready to process, settle, comply, and operate when a rate changes.

That threshold has now been met.

❓ Q&A: Common Questions About the IQD RV

Q: Are banks announcing the revaluation?

No. Banks never announce rate changes. They prepare systems to receive them.

Q: Why is Rafidain Bank so important?

It serves as Iraq’s anchor bank, setting compliance, operational, and settlement standards.

Q: Does debt settlement matter?

Yes. Clearing external debt removes legal and financial obstacles to valuation changes.

Q: Are Islamic banks excluded?

No. They are fully integrated into national systems.

Q: Is this confirmation of an RV date?

No dates are announced. This confirms readiness, not timing.

🚀 Final Analysis

Iraq has quietly completed what many nations struggle to achieve:

Centralized banking oversight

International compliance

Debt resolution

Digital infrastructure

Cross-bank operational alignment

This is what readiness looks like.

Banks are not guessing.

Banks are not hoping.

Banks are ready.

🔗 Stay Connected – Official Platforms

🌐 Blog:

https://dinarevaluation.blogspot.com/

📢 Telegram:

https://t.me/DINAREVALUATION

📘 Facebook:

https://www.facebook.com/profile.php?id=100064023274131

🐦 Twitter / X:

https://x.com/DinaresGurus

▶️ YouTube:

https://www.youtube.com/@DINARREVALUATION

🔥 Hashtags

#IQDRevaluation #DinarRV #IraqBanking #RafidainBank #CBI #IraqEconomy

#CurrencyRevaluation #FinancialReform #MiddleEastEconomy #GlobalBanking

#IQDUpdate #DinarNews #EconomicInfrastructure #BankingReform

Swisher1776: IQD Revaluation, Banks are Ready

IQD RV: BANKS ARE READY. ANCHOR BANKS ALIGNED UNDER MOF AND CBI

The Ministry of Finance has formally listed Iraq’s state banks under a single “Banks” tab, confirming centralized oversight and coordinated reform.

Rafidain Bank is now clearly positioned as the lead institution. The bank is operating under Central Bank of Iraq requirements, has adopted modern electronic banking systems, and is aligned with global banking standards.

In 2025, Rafidain entered a three year professional partnership with the US firm K2 Integrity to strengthen governance, compliance, and financial integrity. The bank has also completed settlement of 87 percent of its external debt, including international claims.

Rasheed Bank is aligned alongside Rafidain and historically moves in parallel, particularly in government accounts, salary payments, and trade finance.

The Agricultural Bank and Industrial Bank are development banks. They do not set rates but operate under the national monetary framework, meaning alignment of systems and compliance is what matters, not pricing leadership.

The Real Estate Bank is domestically focused on housing finance and long term lending. Its role depends on currency stability rather than foreign exchange exposure.

Al Nahrain Islamic Bank operates under Islamic finance principles but remains fully integrated into national payment, compliance, and settlement systems.

This structure shows that Iraq’s banking system is being aligned hierarchically. Anchor banks first, development and specialty banks aligned operationally, all under centralized Ministry of Finance oversight and Central Bank standards.

This is not cosmetic. This is infrastructure.

Banks do not lead a rate change. Banks must be ready to receive the rate change. THEY ARE READY.