One of the simplest ways to find market beating stocks is to consult the Zacks Rank. Every day, Zacks proprietary research identifies new stocks with upward trending earnings revisions and delivers them to you. Upward trending earnings revisions is one of the most powerful investing edges in the market and investors would be wise to consult it before buying a stock.

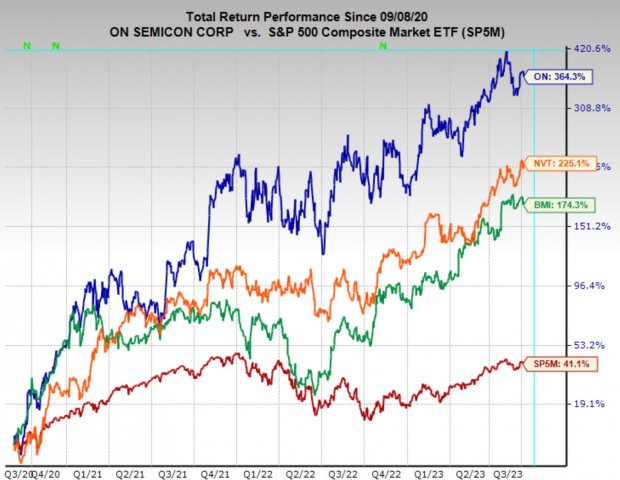

ON Semiconductor (ON - Free Report) , nVent Electric (NVT - Free Report) , and Badger Meter (BMI - Free Report) are three top ranked stocks, with businesses that provide critical infrastructure for the modern world and have strong price momentum propelling them higher.

ON Semiconductor

ON Semiconductor is a global semiconductor company headquartered in Phoenix, Arizona, USA. The company was spun off from Motorola in Aug 1999 and went public through an IPO in May 2000. It specializes in designing and manufacturing a wide range of power management, sensor, and connectivity solutions for various industries, including automotive, industrial, consumer, and computing. ON Semiconductor's products include integrated circuits, discrete components, and semiconductor-based solutions that enable the efficient and reliable operation of electronic devices and systems.

More than ever, the automobiles we drive today are turning into computing and technology machines on wheels. Car producers are stuffing more automation, digital connectivity, and electrification into their vehicles year after year, and this is a welcome development for semiconductor makers like ON Semiconductor.

Moreover, the company is winning market share in the automotive segment thanks to its silicon carbide dominance as well as intelligent power and sensing solution.

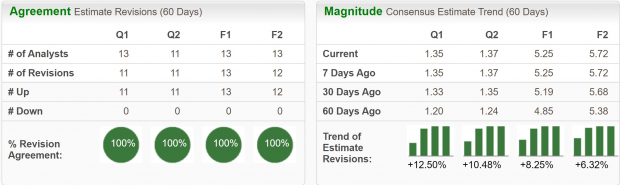

Not surprisingly, these developments among others have analysts raising earnings estimates in unison, giving ON a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have jumped by 12.5% and FY23 by 8.3% over the last two months. EPS are forecast to grow 7.5% annually over the next 3-5 years.

Image Source: Zacks Investment Research

ON Semiconductor is trading at a one year forward earnings multiple of 19x, which is in line with the industry average and above its 10-year median of 13x. However, it appears that the semiconductor industry is entering what may be an epic bullish cycle, so investors will likely be paying up for semi stocks in this environment.

Image Source: Zacks Investment Research

Badger Meter

Badger Meter is a prominent manufacturer specializing in flow measurement and control technology. Headquartered in Milwaukee, Wisconsin, USA, the company offers a diverse range of precision meters and flow instrumentation.

These products find application in various sectors, including water utilities, industrial processes, and commercial enterprises. Badger Meter's portfolio encompasses water meters, flow sensors, and accompanying software solutions, enabling precise measurement and management of liquid flows. With a history dating back to 1905, Badger Meter has solidified its position as a trusted provider of innovative and reliable flow measurement solutions worldwide. Investors keen on the stock market may find Badger Meter an intriguing company to watch.

Badger Meter’s performance is benefiting from robust demand across business segments and increased adoption of its differentiated smart water solution.

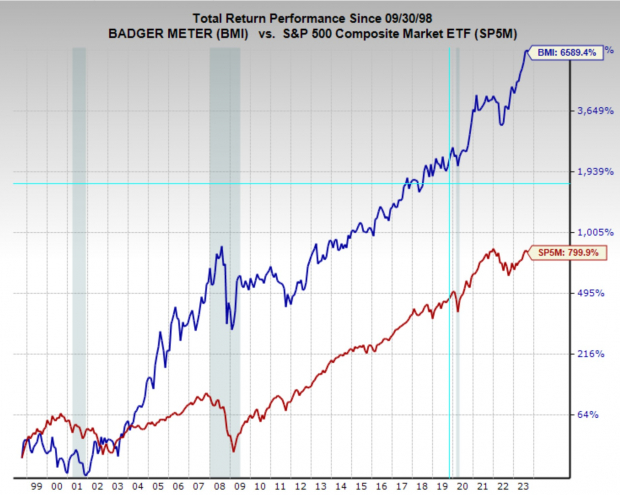

Over the past 25 years BMI stock has put up an incredible performance. Over that time it has compounded at an annual rate of 18%, double the annual return of the broad market, and significantly better than the industry.

Image Source: Zacks Investment Research

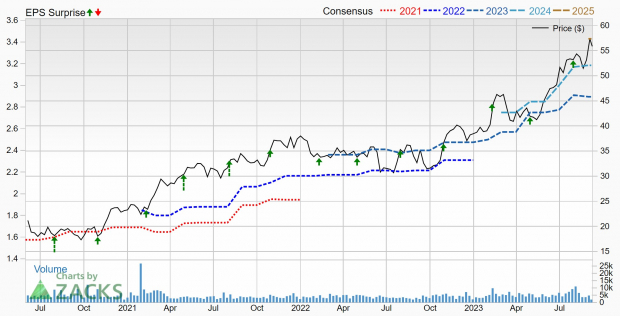

Badger Meter enjoys a Zacks Rank #1 (Strong Buy) rating, thanks to earnings estimates that are continuously creeping higher. Current quarter earnings estimates have been revised higher by 3% and are projected to grow 20% YoY to $0.74 per share. While FY23 estimates have increased by 5.2% and are expected to climb 26.5% YoY to $2.86 per share. Furthermore, sales are expected to grow 20% YoY and EPS are expected to grow 15% annually over the next 3-5 years.

Image Source: Zacks Investment Research

BMI, the steady stock it is, likes to build bases and break out over and over. Over the last two months the price has formed another consolidation to trade from. If the stock can clear the $169 level, it should initiate another move higher. Alternatively, if the stock loses support at $158, it may be worth waiting for another opportunity.

Image Source: TradingView

nVent Electric

nVent Electric is a provider of electrical connection and protection solutions which design, manufacture, market, install and service that connect and protect equipment, buildings, and critical processes. The company's operating segments consists of Enclosures, Thermal Management and Electrical & Fastening Solutions. nVent Electric plc is based in London, the United Kingdom.

Along with its stock price NVT earnings estimates continue to charge higher. NVT stock has rallied nearly 50% YTD, while current quarter earnings estimates have been lifted by 1.4% and FY23 have been increased by 4.3%. Additionally, analysts expect sales to grow 14% this year and 9% next year.

Image Source: Zacks Investment Research

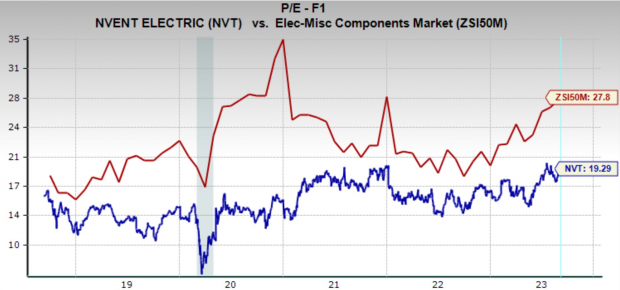

Even after such an incredible run up this year nVent Electric still trades at a relatively fair valuation. Today it is trading at a one year forward earnings multiple of 19.3x, which is well below the industry average of 27.8x, but above its five-year median of 15.2x. NVT stock sits just below its all-time high.

Image Source: Zacks Investment Research

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.