Sunday, June 8, 2025

FRANK26: "IRAQ WELCOMES THE WORLD TO INVEST AT 1310... NOT!!!"

KTFA

FRANK26: "IRAQ WELCOMES THE WORLD TO INVEST AT 1310... NOT!!!".....F26

Economic Council: Broad interest from regional and international companies to participate in the Iraq Investment Forum.

6/6/2025

Baghdad -

Iraqi Economic Council Chairman Ibrahim Al-Masoudi Al-Baghdadi affirmed on Friday that Iraq has become a destination for investment in the Middle East, thanks to the government's extensive support for investment and investors. Addressing the Iraq Investment Forum, he revealed widespread interest from regional and international companies to participate, noting that more than 250 investment opportunities will be showcased.

Al-Baghdadi told the Iraqi News Agency (INA): “This explains the change and geopolitical orientation towards Iraq, which has today become the investment destination in the Middle East,” noting that “just a year ago, we were facing great difficulty in inviting investors to attend conferences or forums inside Iraq, but today there is a widespread desire from important companies and countries from the Gulf, the Middle East, Europe, America and Arab countries to participate in the Iraq Investment Forum scheduled to be heldon June 14 and 15.”

He added, "There is growing demand due to the abundance of quality and profitable opportunities, especially since Iraq has lived through long years of war, siege, and terrorism, creating an urgent need for all types of projects. Today, we are beginning to see the results of the hard work and efforts of the past years."

He explained, "Today's investor is looking for an unsaturated market. For example, building a five-star hotel in Dubai means competing with 650 hotels of the same category, while Iraq currently needs approximately 60 hotels, according to the Minister of Culture, Tourism, and Antiquities. This provides a golden opportunity for any investor to operate in an environment virtually devoid of competition."

Al-Baghdadi pointed out that "Iraq is the largest market in the region, and its environment has become attractive to investments," predicting that "the next ten to twenty years will witness Iraqi superiority in investment competition with countries in the region."

Regarding the Iraq Investment Forum, Al-Baghdadi explained that "the forum will showcase more than 250 investment opportunities, including 150 direct opportunities, 31 of which are in the electricity sector, and more than 15 in the oil sector, in addition to dozens of opportunities in industry, agriculture, transportation, information technology, industrial cities, and free zones." He noted that "the Ministry of Industry will showcase 97 opportunities

within the partnership mechanism with its companies."

He explained that "these projects will contribute to creating thousands of job opportunities, and may reach hundreds of thousands in

the coming years, as part of the National Investment Commission's plans."

LINK

TIDBIT FROM PIMPY

Pimpy

What we're hoping they'll do is make it where the central bank digital currency is being used for digital banking but still allow customers to come in and be able to take out physical cash.

Doesn't sound like it. All the articles I'm reading, it's not going to happen.

So still looking into this because I'm not sure 100% what that means...for people who are holding on to the dinar as an investment. Are we going to be able to swap it for our cash or do we have to find some form of wallet so we can swap it for the CBDC?

FRANK26: "YOU ASK ME KTFA, WHAT'S THE HOLD UP?... SECURITY & STABILITY MUST BE SUPREME!!!"

KTFA

FRANK26: "YOU ASK ME KTFA, WHAT'S THE HOLD UP?... SECURITY & STABILITY MUST BE SUPREME!!!".......F26

U.S. Treasury Sanctions Iranian Shadow Banking Network Laundering Billions for Regime’s Nuclear and Terrorist Agenda

6/6/2025

By Ahora Qadi

ERBIL -

In a sweeping action aimed at disrupting the financial lifelines of the Iranian regime, the United States Department of the Treasury has designated more than 30 individuals and entities involved in a vast shadow banking network that has laundered billions of dollars for Tehran’s oil, petrochemical, and weapons programs. The announcement marks the first sanctions package targeting Iran’s clandestine banking infrastructure under the current administration’s enhanced pressure strategy.

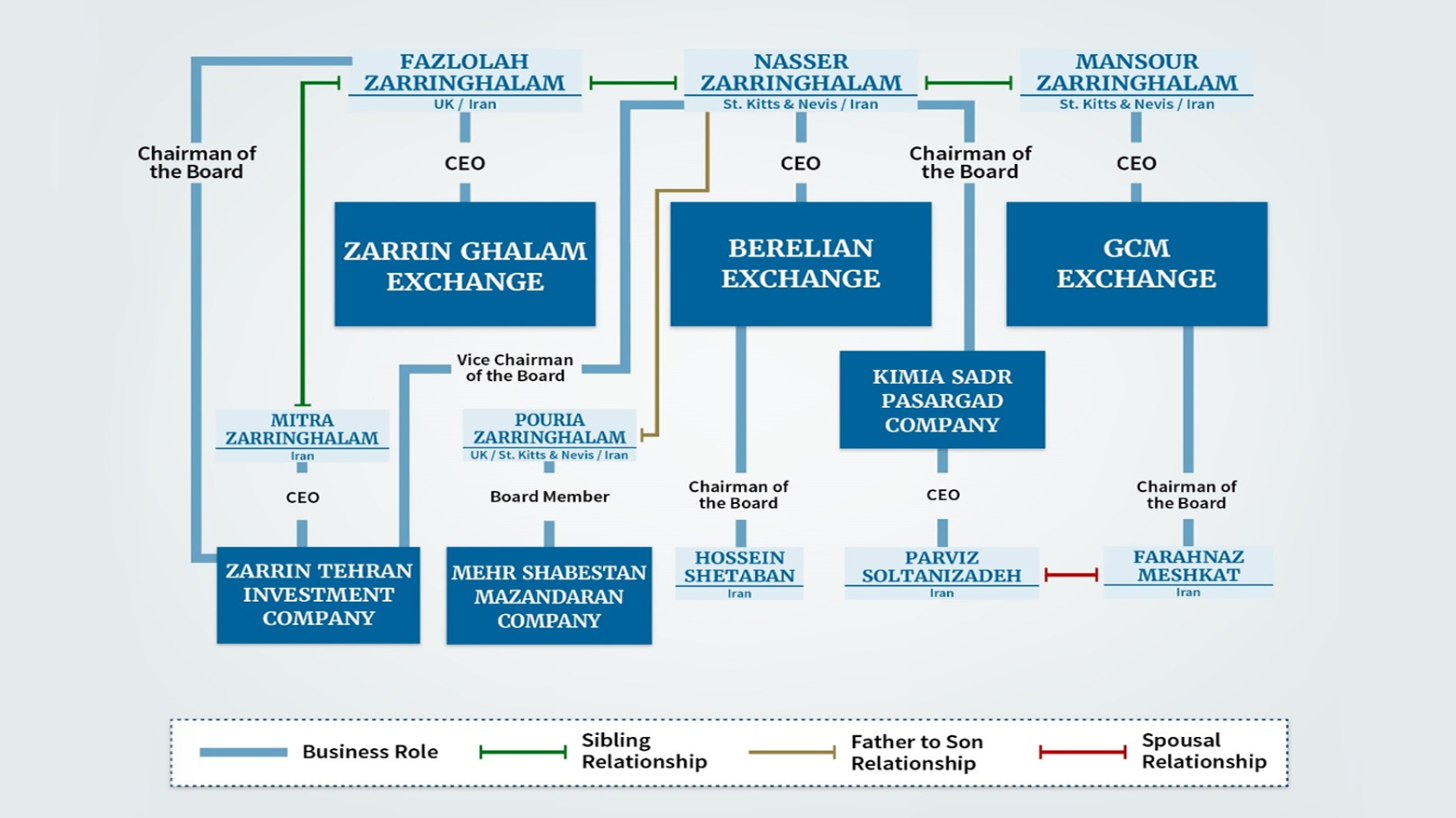

According to the Treasury’s Office of Foreign Assets Control (OFAC), the network—centered around Iranian nationals Mansour, Nasser, and Fazlolah Zarringhalam—used a system of front companies in the United Arab Emirates and Hong Kong to move illicit oil revenues and fund operations linked to Iran’s missile and nuclear development, as well as support for regional terrorist proxies.

"Iran’s shadow banking system is a critical lifeline for the regime through which it accesses the proceeds from its oil sales, moves money, and funds its destabilizing activities," said Secretary of the Treasury Scott Bessent in a statement. "Treasury will continue to leverage all available tools to target the critical nodes in this network and disrupt its operations, which enrich the regime’s elite and encourage corruption at the expense of the people of Iran." (AND THE PEOPLE OF IRAQ -F26)

A Corrupt Parallel System Undermining Global Sanctions

The shadow banking architecture allows sanctioned Iranian military entities and regime officials to access the international financial system by masking transactions through Iranian exchange houses and offshore shell companies. OFAC emphasized that the system operates as a "parallel banking system" designed to evade regulatory oversight and exploit weak jurisdictions to facilitate the flow of illicit funds.

Whistleblowers inside Iran have reported massive embezzlement and widespread corruption tied to this financial structure, underscoring the regime’s use of these mechanisms to enrich elites while the broader population suffers economic hardship.

The Zarringhalam Family at the Core of Illicit Financing

The Zarringhalam brothers orchestrated this vast laundering operation, enabling sanctioned actors to receive payments from the sale of petroleum and other commodities. OFAC has also sanctioned their family’s holdings, including Zarrin Tehran Investment Company and Kimia Sadr Pasargad Company—both active in Iran’s oil, gas, and construction sectors.

Among those designated are Mitra Zarringhalam, CEO of Zarrin Tehran Investment Company; Parvis Soltanizadeh, a board member at Kimia Sadr Pasargad; Hossein Shetaban and Farahnaz Meshkat, senior figures in the Berelian and GCM Exchanges; and Pouria Zarringhalam, a construction executive. Their affiliations demonstrate the regime’s ability to infiltrate and exploit diverse sectors of the Iranian economy through family-run enterprises.

Sanctions Enforcement and Legal Implications

The action is taken under Executive Orders 13902 and 13846, which authorize targeting Iran’s financial, petroleum, and petrochemical sectors. As a result, all U.S.-linked property and interests belonging to the sanctioned individuals and entities are now blocked, and American persons are prohibited from engaging in any transactions with them.

Treasury’s Financial Crimes Enforcement Network (FinCEN) has also issued an updated advisory to help financial institutions detect suspicious activity linked to Iranian oil smuggling and weapons procurement operations. The advisory outlines typologies and red flags to mitigate risk exposure for banks and firms operating globally.

OFAC reiterated that violations of these sanctions—whether by U.S. or foreign entities—may result in civil or criminal penalties. The department also clarified that its sanctions are ultimately intended to pressure behavioral change, not merely to punish.

This sanctions package is the latest demonstration of Washington’s intent to dismantle Iran’s economic scaffolding that underpins its destabilizing regional agenda. It comes as the administration accelerates a maximum pressure campaign designed to curb Tehran’s ambitions and support for proxy forces amid rising regional tensions.

###########

Treasury Sanctions Iranian Network Laundering Billions for Regime Through Shadow Banking Scheme

SNIPPET:

Updated FinCEN Advisory Highlights Iranian Oil Smuggling, Shadow Banking, and Weapons Procurement Typologies

WASHINGTON — Today, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) is designating over 30 individuals and entities tied to Iranian brothers Mansour, Nasser, and Fazlolah Zarringhalam, who have collectively laundered billions of dollars through the international financial system via Iranian exchange houses and foreign front companies under their control as part of Iran’s “shadow banking” network. The regime leverages this network to evade sanctions and move money from its oil and petrochemical sales, which help the regime fund its nuclear and missile programs and support its terrorist proxies. Concurrently, Treasury’s Financial Crimes Enforcement Network (FinCEN) is issuing an updated Advisory to assist financial institutions in identifying, preventing, and reporting suspicious activity connected with Iranian illicit financial activity, including oil smuggling, shadow banking, and weapons procurement.

SNIPPET:

UAE FRONT COMPANIES

OFAC is also designating five UAE-based front companies that are either owned by, or operate in support of, the Zarringhalam network. Wide Vision General Trading L.L.C and J.S Serenity FZE have been used by Mansour and GCM Exchange for coordinating shadow banking transactions. In 2023, J.S Serenity Trading FZE was used by Mansour to coordinate a brokerage agreement with U.S.-designated Sepehr Energy Jahan Nama Pars Company, a front company for Iran’s Armed Forces General Staff and its oil sales activities.

Moderate General Trading L.L.C, Ace Petrochem FZE, and Golden Pen General Trading L.L.C have each been used by Nasser and Berelian Exchange as front companies to help sanctioned Iranian entities engage in international financial transactions. For over a decade, Nasser has used Moderate General Trading L.L.C to conduct financial transactions worth millions of dollars on behalf of NIOC and NITC. In 2022, both Ace Petrochem FZE and Moderate General Trading L.L.C were listed in correspondence from Berelian Exchange confirming payments with NITC. Ace Petrochem FZE has also been used by PGPICC as a third-party account in payments to obscure the destination of funds and evade sanctions.

https://home.treasury.gov/news.....ses/sb0159

MNT GOAT: ⚠️ Iraqi Dinar Update: FACTS Only – No RV Yet, But Big Changes Are Coming! 💸🇮🇶 #iqd

Read also: THE STRUCTURED PAYOUT SYSTEM: The Amount Paid For Each Zim Dollar

-

A groundbreaking and irreversible shift is occurring in the global financial system as it rapidly transitions to a gold-backed structure. T...

-

Confirmed on Live TV – Announced Exchange Rate: $6.02! – Take Advantage!🔊 Highlights Summary Here are reports on the officially confirmed...

-

Global Currency Reset: Mon. 19 May 2025 NESARA & QFS REDEMPTION EXPOSED: THE FINAL PHASE HAS BEGUN · The RV Redemption is LIVE. The fin...