Friday, March 28, 2025

FRANK26: "SUDANI SLOWLY TELLS PARLIAMENT.", 29 MARCH

KTFA

FRANK26: "SUDANI SLOWLY TELLS PARLIAMENT.".......F26

The Minister of Planning appears in Parliament to discuss the ministry's work and prepare budget schedules.

3/26/2025

The Parliamentary Finance Committee hosted Deputy Prime Minister and Minister of Planning, Mohammed Ali Tamim, on Wednesday to discuss the ministry's work details and the preparation of budget schedules.

A statement by the Finance Committee, received by Al-Eqtisad News, stated that “the committee, headed by MP Atwan Al-Atwani, hosted today the Deputy Prime Minister and Minister of Planning, Mohammed Ali Tamim. The representatives, the Chairman and members of the Finance Committee, listened to a detailed explanation given by the Minister about the details of the Ministry of Planning’s work and the important results it has achieved, foremost among which is the completion of the population census project, which represents one of the most important future projects for Iraq.”

She added that "Tamim spoke about the ministry's role in preparing the budget, including its investment component," noting that "MPs raised a number of questions regarding the preparation of budget schedules, mechanisms for monitoring spending and project implementation."

TIDBIT FROM MILITIAMAN, 29 MARCH

Militia Man

Article quote: "Sudanai...said the United States Treasury described the progress in reforming the banking system as the revaluation we dreamed of."

That's the United States Treasury saying that.

Quote: "He also promised to launch a reform plan to correct the banking sector which is the most important in Iraq's history."

This doesn't sound like things of the past. I've never seen this type of language before, especially coming from a prime minister...

Quote: "We will launch the reforms after EID." That's huge. If he sticks to his guns and sticks to what he says that's not very far off. Quote: " He says it will be the most important plan since the founding of the Iraqi state." Really...? Have you ever hear that before? I don't think so. I haven't...This is a Wow! Wow! Wow!

Iraq establishes private company to manage development road project , 29 MARCH

Iraq establishes private company to manage development road project

3/27/2025

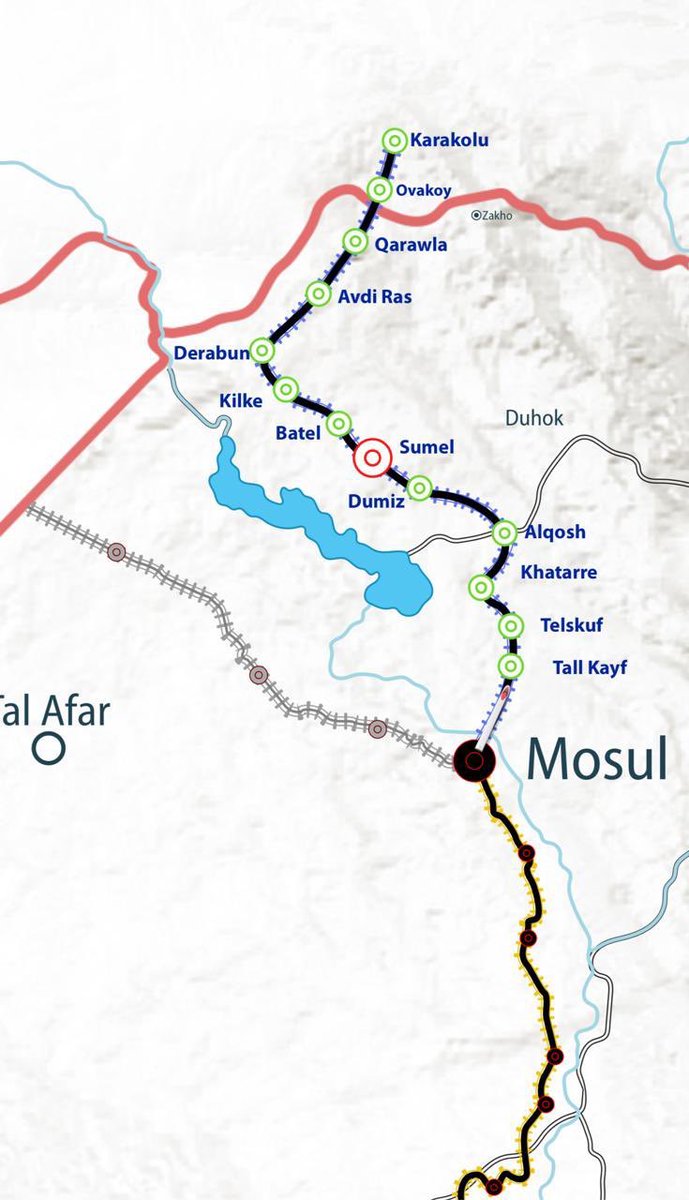

The Higher Committee for the Development Road Project, headed by Iraqi Prime Minister Mohammed Shia al-Sudani, announced on Thursday the establishment of a private company to manage the project.

His media office said in a statement received by Shafaq News Agency that Al-Sudani chaired today the regular meeting of the Supreme Committee for Monitoring the Implementation of the Development Road Project. This is the second meeting held within a week.

The statement added that the meeting reviewed the progress of the project's various phases and discussed the directives issued during the previous meeting. Approval was given for the Iraq Development Fund to establish a private company to manage the development road project, and for the Higher Committee to proceed with establishing the project's special authority.

The meeting also approved the interim governance instructions regulating the relationship between Iraq and Turkey regarding the project. In this regard, the Prime Minister directed Oliver Wyman to hold a joint meeting with the Iraqi and Turkish sides to finalize these instructions.

The statement indicated that the meeting was attended by the Minister of Transport, the Director of the Prime Minister's Office, the General Coordinator for Provincial Affairs, the Chairman of the Iraq Development Fund, the Deputy Chairman of the Parliamentary Transport Committee, a number of advisors to the Prime Minister, the Director General of Ports, and representatives from Oliver Wyman, the company providing consulting services for the project. LINK

Jon Dowling: Patience everyone, we're nearly into April, where the fun really begins!, 29 MARCH

Jon Dowling

We're coming to the end of March and with it the end of Ramadan and EID as well. We're about to see the grave surrender of the Houtis and next the grave surrender of Iran,

as both Israel and the US exert their force on the nuclear power plants, in order to flush the corrupt Iranian proxies out of Iraq and free up the Dinar, as well as the Iraqi people respectively.

Vietnam has untold mineral rights which will also free them up, alongside neighboring countries for the Dong and overall prosperity, coupled with the stable coins that each country is producing.

Gold and Silver are approaching all time highs, while oil continues to make its descent with our drill baby drill philosophy, which will being down food and energy prices at this much needed time.

Finally, now that XRP is being set free, once the lawyers for the SEC cooperate and finalize the paperwork, we will begin to see XRP finally be released and unleash itself onto the world economic stage and with it the synergy with BRICS as the preeminent driver of the new QFS Financial system.

Patience everyone, we're nearly into April, where the fun really begins!👀😎✅

Iraqi Ports Authority discusses operating mechanisms for the Grand Faw Port with the American company KBR. , 28 MARCH

Iraqi Ports Authority discusses operating mechanisms for the Grand Faw Port with the American company KBR.

3/26/2025

The General Company for Iraqi Ports announced on Wednesday that a meeting was held at the Ministry of Transport headquarters with representatives from the American company KBR, in the presence of representatives from the Ministry of Planning, to discuss the mechanisms for the actual transition to operating the Grand Faw Port after the completion of the project's basic work.

Farhan Al-Fartousi, Director General of Iraqi Ports, told Shafaq News Agency, "The Grand Faw Port is going through a pivotal phase, as many preliminary works have been completed. This meeting is a strategic step to coordinate efforts between government agencies and international companies, ensuring the success of future operations."

Al-Fartousi pointed out that "the meeting comes within the framework of preparing for the transition to the actual operational phase of the port, relying on available international expertise and in line with the Prime Minister's government program," stressing that "qualifying Iraqi cadres to manage and operate the port is a key priority in the programs for contracting with international companies."

The cost of the Faw Port is approximately 4.6 billion euros, with an estimated capacity of 99 million tons annually, making it one of the largest ports overlooking the Gulf and the tenth largest in the world. The foundation stone for this project was laid on April 5, 2010.

The Grand Faw Port issue and the delays in its completion have sparked widespread controversy in Iraq. MPs have accused successive governments of striking deals with neighboring countries that squandered the port's construction in favor of those countries' ports. The project has also experienced some delays following the mysterious suicide of the technical director of the South Korean company Daewoo, which was implementing the Grand Faw Port project. LINK

TIDBITS FROM MNT GOAT, 29 MARCH

Mnt Goat

the Oil and Gas Law...is NOT all about oil revenue sharing to the citizens...Instead it is a law to be put in place to govern how oil in general will be managed in Iraq.

Article: “DISTRIBUTING OIL REVENUES TO IRAQIS: “ECONOMIC COLLAPSE INEVITABLE WITHIN TWO YEARS“

This controversy is escalating in Iraq over lawsuits filed by citizens demanding their share of oil revenues.

An expert has warned of the disastrous economic consequences of such demands at this time. This revenue sharing can only happen once the economy is stable and these other sources of revenues rival the oil revenues...

Will oil profit sharing happen?

Yes, I believe it will happen... just not now...I would not place my time of concentration on this event as a trigger for the RV.

After salaries are paid, Erbil markets are crowded with shoppers before Eid al-Fitr (photos), 28 MARCH

After salaries are paid, Erbil markets are crowded with shoppers before Eid al-Fitr (photos)

Erbil's markets are witnessing a brisk trade movement as Eid al-Fitr approaches. Demand for clothing, sweets, and gifts is on the rise, amid a noticeable recovery in sales, driven by several factors, most notably the start of salary distributions and commercial offers .

Ahmed Saeed, owner of a clothing store in Al-Qaysariyah Market, told Shafaq News Agency, "We are witnessing a greater turnout this year, especially after salaries were paid. Families come to buy Eid clothes, mainly for children, and there is a high demand for both traditional and modern clothing ."

As for Mohammed, a sweets shop owner, he confirms, “Demand for Klicha and oriental sweets has increased significantly. Every year, demand for sweets increases as Eid approaches, but this year there is more activity, especially since customers prefer to buy Klicha and pastries in large quantities .”

On a related note, some citizens believe that prices are relatively high. Umm Saifan, a housewife, told Shafaq News Agency, "Prices are slightly higher than last year, but we cannot ignore the children's joy of Eid. We are trying to take advantage of the offers and discounts to buy clothes for them, especially since salaries have been paid ."

For his part, Ali, a government employee, explained, "The disbursement of salaries has helped many shop more comfortably. Delays in some months of salaries have affected purchasing power, but now, with salaries being disbursed before Eid, things have become easier ."

A number of merchants confirm that "the last few days before Eid typically witness peak shopping, with some people preferring to buy their necessities at the last minute, after iftar link

ARIEL: Huge News for America and the World, 28 MARCH

ARIEL: Huge News for America and the World

Huge News For America And The World

Let’s go through some quick bullet points as to why. Shall we?

1. Shatters the Globalist Leash: Cutting WTO funds snaps a chain that’s tethered U.S. sovereignty to a faceless bureaucracy, freeing America to forge trade deals that don’t kneel to 164 nations’ consensus deals that prioritize its own steel, farms, and factories.

2. Starves the Paper Tiger: The WTO’s $232 million budget (2024) is a bloated hog—m 11% from U.S. pockets feeding endless debates while China skirts rules. Starving it forces a leaner, meaner system or its collapse, either way ending the charade of “fair trade” theater.

3. Unmasks Hidden Players: With the U.S. out, shadow influencers—m think corporate lobbyists and state-owned enterprises lose their Geneva puppet strings, exposing who’s really been rigging the game behind WTO’s marble facade.

4. Ignites Regional Power Blocs: No WTO cash flow sparks a scramble NAFTA 2.0, EU trade forts, Asian pacts reshuffling global alliances into tighter, more accountable units, not some utopian one-world mess that never worked.

5. Kills the Arbitration Farce: The WTO’s dispute system, crippled since 2019 by U.S. judge blocks, gets a mercy k**l. Nations now settle trade scores bilaterally, mano-a-mano, cutting the middleman who couldn’t enforce jack anyway.

6. Boosts the Underdog Hustle: Smaller nations, freed from WTO’s rigid script, can barter directly with the U.S., leveraging raw deals think rare earths from Africa or lithium from South America over China’s chokehold, shaking up global supply chains.

7. Defangs China’s Dodge: Beijing’s “developing nation” status at WTO long a loophole for subsidies and dumping crumbles without U.S. dollars propping the system. America can now hit back with tariffs that bite, not beg for Geneva’s nod.

8. Reclaims Tech Edge: The WTO’s stalled digital trade rules (U.S. dropped demands in 2023) kept tech giants caged. Suspension lets America unilaterally lock down data flows and IP, shielding its silicon crown from foreign poachers.

9. Lights a Fire Under Congress: No WTO safety net forces D.C. to get off its a*s craft trade laws with teeth, not just react to global edicts. It’s a wake-up call for a legislature that’s sleepwalked through decades of outsourcing.

10. Unleashes Economic Darwinism: Without WTO’s nanny-state rules, markets turn b****l l survival of the fittest. U.S. industries either adapt fast innovate, retool or die, purging the weak and forging a harder economic spine.

This isn’t about cheerleading it’s about seeing the dominoes fall, the masks drop, and the game reset. For Americans, it’s a s**t at clawing back what’s theirs; for the world, it’s a mirror to its own grit or lack thereof.

11. Cracks the Green Agenda : WTO’s limp climate trade talks (stalled since 1995) lose steam without U.S. funds. America can now push bilateral green tech deals think solar with India, wind with Brazil skipping the eco-preaching gridlock.

12. Frees the Dollar’s Muscle: Less tied to WTO’s trade web, the U.S. can wield its currency like a sledgehammer sanctions, incentives, whatever works without Geneva’s red tape slowing the swing.

13. Sparks a Trade Renegade Wave: Other big players EU, Japan might follow, ditching WTO’s sinking ship. A fractured system births a new order, one where power, not bureaucracy, dictates terms, shaking the world out of its trade coma.

14. Ends the Fentanyl Excuse Game: WTO’s paralysis on d**g precursors (China’s exports untouched) gets no more U.S. cover. Suspension lets America hammer direct trade bans, targeting the flow that’s k*****g its streets, no diplomatic dance required.

15. Reveals the Void’s Hunger: If the WTO folds, the gap it leaves unregulated trade chaos shows the world what the Ark felt like: a force unbound, eating control. Nations either step up or get devoured, proving order’s price in real time.

CBL introduces the new LD 5 banknote, 28 MARCH

CBL introduces the new LD 5 banknote

The CBL has introduced the new LD5 denomination into circulation (Photo: CBL).

The Central Bank of Libya (CBL) announced yesterday the issuance of a new 5 dinar banknote bearing the signature of the new Governor Naji Issa.

The CBL said the new denomination will go into circulation along with the currently circulating issuances, starting today, Thursday, 27 March.

The LD note introduced on 20 March

It will be recalled that the CBL had announced on 20 March the issuance of a new 20-dinar polymer banknote (second issue) into circulation alongside the currently circulating issue.

On 20 January, the CBL had announced the issuance of new banknotes in the 5-, 10- and 20-dinars denominations in the coming weeks and months.

The LD 10 denomination was issued on 26 January. All the new denominations bear the signature of the new CBL Governor, Naji Issa. link

BRUCE UPDATE, 28 MARCH

Thurs. 27 March 2025 Bruce

- Bond Holder Paymasters were saying Bond Holders would have access to their accounts over the weekend.

- As of ten this morning 12% of Bond Holders had gone through.

- The full revaluation will happen after the first of April.

- The Iraqi Dinar, Dong and Zim dollar were the keys to the gateway for Tier4b (us, the Internet Group) exchanges and that gate has been opened.

- Multiple sources say Tier4b could get appointments tomorrow, but more likely Sat. or Sun.

- Today the 800 number was being loaded in the various systems.

- Emails would be sent out from Wells Fargo that will tell you how to set your exchange appointment.

- Tues. 2 April 2025 is Liberation Day and the day the DOGE checks and deposits are supposed to start.

- The month of April will see an increase in Social Security payments.

- R&R payments will be in our accounts at the Redemption Center.

- You can have up to three bank accounts associated with your Quantum Account.

IRAQ NEWS HEADLINES, 28 MARCH

IRAQ NEWS HEADLINES

-PM Sudani highlighted the government’s success in controlling the dollar sale and ensuring financial transfers follow global procedures. He also noted partnerships with global companies to reform the private banking sector, stressing that banking system development will drive economic growth.

: Ministry of Transport and Communications

: Ministry of Transport and CommunicationsNADER FROM MID EAST: Digital trade Iqd, 28 MARCH

NADER FROM MID EAST: Digital trade Iqd

Highlights

Summary

In a recent announcement, Central Bank Governor Ali Al-Alak emphasized the significant role that digital currency will play in enhancing transparency and reducing the cash flow outside banks.

He identified the rapid evolution of financial technologies as a crucial factor that aligns with the banking sector’s need for speed, accuracy, economic efficiency, transparency, and oversight. Al-Alak underscored the broad implications of the digital revolution across various sectors, notably in finance, where digital currency can play multiple roles.

It is anticipated that digital currency will vastly improve transparency in transactions, whether for consumption, investment, savings, or even tracking illicit financial flows. The Central Bank is currently active in coordinating with international organizations to review initial experiments in digital currency, indicating a proactive approach to this technological shift.

Another key point made was the need for robust infrastructure to support these changes, with the Central Bank working effectively to establish a data center that will facilitate a successful digital transformation.

- 🌐 Digital currency integration: The introduction of digital currency is aimed at improving transparency and diminishing cash flow outside banks.

- ⚙️ Technological advancements: Financial technologies are evolving rapidly, prompting necessary adaptations within the banking industry.

- 📊 Analytical benefits: Digital currency will provide essential databases for analysis, supporting various financial activities.

- 📉 Limited cash flow: Implementation of digital currency will help limit the cash flow outside of formal banking systems, yielding greater control.

- 🏢 Infrastructure development: The Central Bank is developing advanced infrastructures, including a sophisticated data center to facilitate digital initiatives.

- 🌍 Regional coordination: The bank is collaborating with international and regional organizations, such as the Arab Monetary Fund, to explore and implement digital currency experiments.

- ⏳ Proactive measures: The Central Bank is already engaging with ongoing experiments in various countries, emphasizing their commitment to not delaying progress.

Key Insights

💡 Emphasizing transparency: Digital currencies inherently foster an environment of transparency within the financial sector. This can significantly cut down on money laundering and other financial crimes as all transactions can be traced accurately. By maintaining a transparent digital ledger, banks can better monitor the flow of money, ensuring compliance with regulations and reducing the potential for illegitimate businesses to operate unnoticed.

🏦 Banking sector transformation: The rapid pace of digital transformation across sectors underscores the banking sector’s necessity to adopt these technologies. Digital currency is not merely an innovation but a vital update to existing banking frameworks that can enhance operations significantly. As financial technologies develop, banks must evolve to include real-time processing capabilities, data analytics, and enhanced customer experiences.

📈 Economic efficiency: The implementation of digital currency promises increased economic efficiency by minimizing costs associated with printing and distributing physical cash. It can streamline transaction processes, reduce fraud, and enhance the overall operational efficiency of banks. The digital currency’s capacity for faster transactions aligns with consumer demands for immediacy in financial dealings.

🗄️ Data utility for analytics: The establishment of comprehensive databases through digital currency transactions allows for advanced analytics that could strengthen financial analytics capabilities. Organizations could harness this data for various purposes, including economic forecasting, risk assessments, and demand analysis. The shift from managing paper currency to digital transactions potentially transforms how banks strategize and operate.

🌐 Need for robust infrastructure: To support the digital currency initiative, a strong and resilient digital infrastructure is paramount. The Central Bank’s ongoing efforts to build a state-of-the-art data center illustrate their commitment to ensuring that these technological advancements have a solid foundation. Such infrastructure will facilitate future innovations, support a stable banking environment, and enhance service delivery to customers.

🤝 International collaboration: The proactive communication and collaboration with international bodies show the Central Bank’s recognition of the global nature of finance. By observing and learning from experiments in other countries, they can adopt best practices and tailor solutions to fit local needs. This collaborative approach positions them to develop a competitive and responsive digital currency framework.

⚖️ Balancing innovation with regulation: As digital currencies forge ahead, it becomes essential to strike a balance between fostering innovation and maintaining appropriate regulations. By implementing a controlled environment for digital currency trials, the Central Bank can better manage potential risks related to cyber threats and regulatory compliance, ensuring a secure banking system while capitalizing on the benefits of technological advances.

In summary, the transition to digital currency, led by the Central Bank, presents exciting opportunities for transparency, efficiency, and innovation within the banking sector. By emphasizing the importance of strong infrastructure and international cooperation, the Central Bank not only positions itself at the forefront of financial technology but also lays the groundwork for a more accountable and streamlined financial system.

FRANK26….12-17-25……AGAINST THE LAW

Read also: 💰 “Zim Cap Bond Payouts: Private Appointments & Project Plans Update”

-

A groundbreaking and irreversible shift is occurring in the global financial system as it rapidly transitions to a gold-backed structure. T...

-

Confirmed on Live TV – Announced Exchange Rate: $6.02! – Take Advantage!🔊 Highlights Summary Here are reports on the officially confirmed...

-

Global Currency Reset: Mon. 19 May 2025 NESARA & QFS REDEMPTION EXPOSED: THE FINAL PHASE HAS BEGUN · The RV Redemption is LIVE. The fin...