Sunday, July 23, 2023

"WHY SPECULATE IN IRAQ DINAR?" BY DINAR IRAQ AND DONG VIETNAM , 23 JULY

Why speculate in Iraq Dinar? -

"Elon Musk’s “Project Omega” (Eric Fry) Picks – 3 Stocks for Explosive Gains" BY GREEN BULL RESEARCH, 23 JULY

Elon Musk is nothing if not a prolific multi-tasker and a few years ago he and a couple of his closest billionaire pals launched what Eric Fry is calling “Project Omega.”

Eric believes the technology behind this project could create an estimated $15.7 trillion in new wealth and mint a new wave of millionaires, billionaires, and even the world’s first trillionaire.

The Teaser

These billionaires have been silently working on this project for the past seven years and on November 30, 2022, they flipped the switch on.

Eric Fry has spent the last 30 years working in Silicon Valley and on Wall Street as a broker, entrepreneur, analyst, and hedge fund manager – he must be a multi-tasker like Elon. We have previously exposed his stock picks here on Green Bull and also reviewed some of his teasers, like his “iFuel” Hydrogen Stocks.

Based on the bit of info Eric has shared so far, I think I know where this is going…

Back in 2015, Elon Musk, Peter Thiel, and Sam Altman – the billionaire pals used $1 billion of their own money to create OpenAI.

Originally a nonprofit startup focused on researching and developing artificial intelligence, it struck gold with its first chatbot – ChatGPT.

Once they realized what they had created, a for-profit subsidiary was quietly incorporated and ChatGPT was launched to the world in November 2022.

AI’s Netscape Moment

Before Google or any web browser for that matter, the internet was a place frequented only by hardcore tech geeks who knew how to navigate a complex digital maze.

Netscape changed all of this.

As the first web browser, it enabled anyone to easily view and navigate the internet, which exploded adoption.

As the first AI-enabled consumer chatbot, ChatGPT is now doing something similar with artificial intelligence.

It is making AI easily accessible to everyone, which will likely make its rate of adoption look like the internet in 1995.

The only difference is that it will all happen much faster, as ChatGPT has already been adopted 42 times faster than the internet!

We could be catching a revolutionary technology just as it goes mainstream and Eric has identified 3 companies that he believes will be the biggest winners of this AI revolution.

The Pitch

All of their details including their names and ticker symbols are inside a special report called The Top 3 Stocks for the AI Revolution.

The only way to access it is with a subscription to Fry’s Investment Report for $49, which is 75% off the regular price of $199. For this, we’ll receive 12 monthly issues, which include at least one investment recommendation per issue, three more bonus reports, access to an online archive, and a members-only website.

Warp-Speed Growth

More than just a shiny new technology, AI will fundamentally transform society and it will do so in record time.

Elon Musk believes so himself:

The way I see it, mechanization took us from an agrarian economy to an industrial one starting at the end of the 18th century.

Following this, the invention of telecommunications, electronics, and eventually the internet enabled light automation.

Now, artificial intelligence will give rise to heavy automation.

What does this mean for society at large and for us as individual investors?

In the first instance, artificial intelligence (“Project Omega”) will cause large-scale disruption.

We are already starting to see this among the corporate rank and file in the first half of the year, with some 3,900 jobs lost to heavy automation. So far, the damage has been limited to the tech sector. But other industries that are slower to adopt new technology will eventually follow suit. We are still a few years away from this happening.

As far as what it means for investors, large-scale disruption = opportunity.

Digital Gold Rush

Make no mistake…

We’re about to see a huge wealth transfer from those who are clueless about AI or dismiss it outright to those who understand it and make it work for them.

Wired Magazine has called it an “AI Gold Rush” and we are at the onset of it, like some doe-eyed miners with pickaxes during the Klondike gold rush.

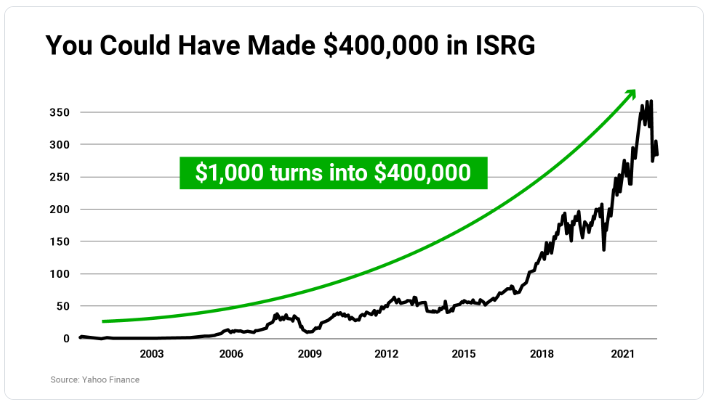

In fact, this is already happening. AI pure-plays like Intuitive Surgical (Nasdaq: ISRG)

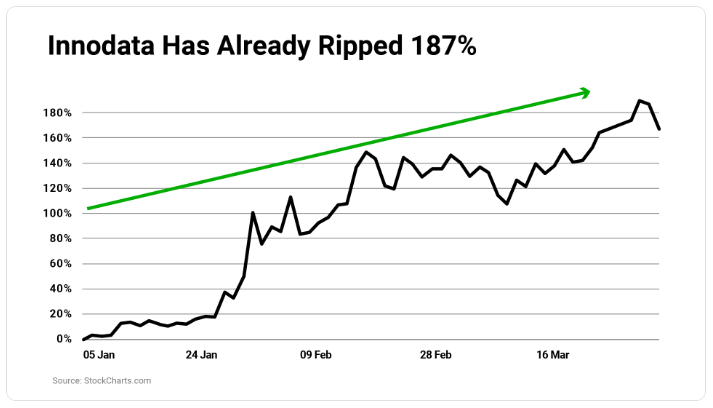

Innodata (Nasdaq: INOD)

And BigBear.ai (NYSE: BBAI) are all up big since the start of the year

These stocks have already given shareholders the chance to make two, three, and even eight times their money.

Now, Eric has 3 stock recommendations that could do as well or even better in the months ahead. Let’s find out what these are together.

Revealing Eric Fry’s “Project Omega” Picks

We are given precious few clues about each of the three stock picks. See for yourself:

AI Company #1

- This company recently started using AI to predict the onset of diseases.

AI Company #2

- It is building the infrastructure that AI is built on. Investing in it could be like “investing in steel during the construction of railroads.”

AI Company #3

- Eric believes this last company will help take AI robots mainstream.

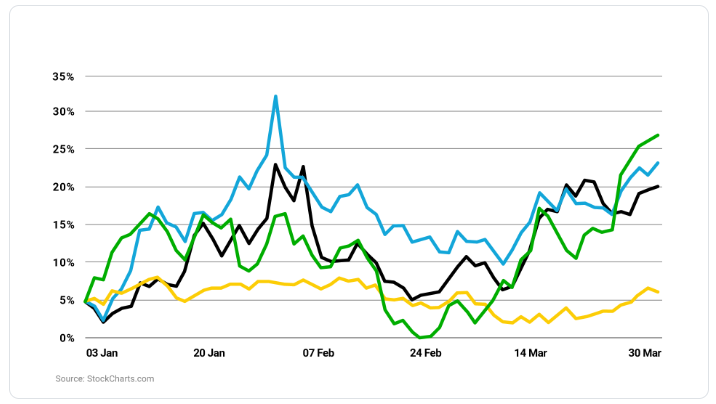

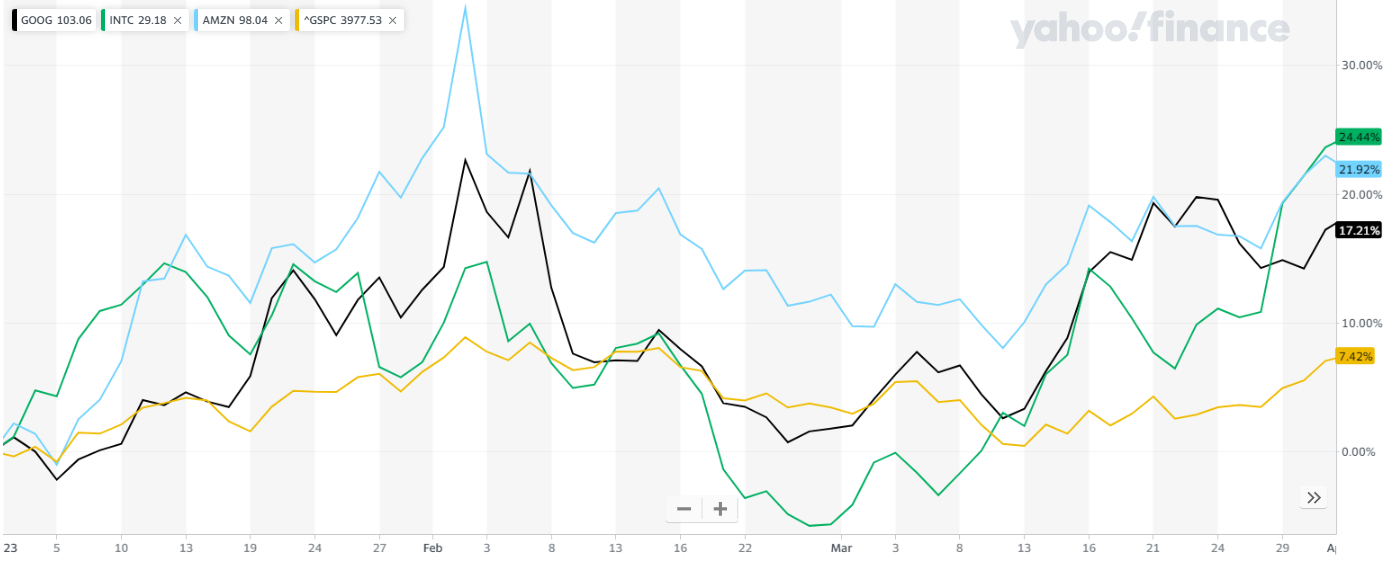

That’s it, that’s all we get folks. Eric does throw in one chart near the end of his presentation which shows how the three stocks have fared against the S&P 500 up until the end of March. This ended up being our saving grace.

If we work back from this standpoint and try and match up each pick to its stock performance through the first quarter of the year, we end up with the following:

- AI Company #1 (Black Line): Alphabet Inc. (Nasdaq: GOOG). The bit about using AI to predict the onset of diseases is likely a nod to Google Health, which is an early AI adopter.

- AI Company #2 (Green Line): The infrastructure of AI pick is Intel Corp. (Nasdaq: INTC).

- AI Company #3 (Blue Line): Finally, the company that is supposed to make AI robots mainstream is Amazon Inc. (Nasdaq: AMZN).

The chart of these stocks aligns perfectly with that of Eric’s above:

The Biggest Winners of the AI Revolution?

Historically, the winners of the last revolution have always been the victims of the next.

Could this change this time around?

It’s a possibility due to the sheer size and amount of data (the foundation of AI), the likes of Google, Amazon, and Intel now hoard like a troll under a bridge hoards gold. But I wouldn’t bet on it.

Take ChatGPT for example, the first AI-based chatbot came from a startup (OpenAI), rather than one of the big established names.

I expect the next big advances in AI like iDar technology for self-driving cars and chatbots for customer service and e-commerce to come from venture-backed startups rather than any large incumbent. The biggest winners of the AI revolution are still yet to be determined.

Quick Recap & Conclusion

- Silicon Valley hanger-on Eric Fry says the technology behind “Project Omega” could create an estimated $15.7 trillion in new wealth and mint a new wave of millionaires, billionaires, and even the world’s first trillionaire.

- We later learn that the technology behind what Eric calls “Project Omega” is actually Artificial Intelligence (AI) and he’s identified 3 companies that he says will be the biggest winners of the AI revolution.

- These 3 picks are revealed in a special report called The Top 3 Stocks for the AI Revolution. The only way to access it is with a subscription to Fry’s Investment Report for $49.

- Eric was uber stingy with his clues, but thanks to a well-placed chart we were able to reveal all of his picks for free. They are Alphabet Inc. (Nasdaq: GOOG), Intel Corp. (Nasdaq: INTC), and Amazon Inc. (Nasdaq: AMZN).

- Not very inspiring picks and most likely, not the biggest winners of the AI revolution either.

- What AI companies do you think blow Eric’s picks out of the water? Tell us your favorite in the comment section. https://greenbullresearch.com/elon-musks-project-omega-eric-fry-picks/

"LEARN ABOUTH THE EXCHANGE RATE OF USD VS. IQD IN THE IRAQI MARKETS", 23 JULY

A New Update.. Learn About The Exchange Rate Of The Dollar Against The Dinar In The Iraqi Markets

Economy | 10:16 - 07/23/2023 Baghdad - Mawazine News The exchange rate of the dollar continued, on Sunday, to rise in the Iraqi markets. The selling price of 100 dollars was recorded for 153 thousand dinars. The purchase price was recorded at 151 thousand dinars, compared to 100 dollars. Ended 29 / h

https://www.mawazin.net/Details.aspx?jimare=231876

The United Nations Reassures The Iraqis About The Mosul Dam: It Is Safe And The Water Level Can Be Raised

Local | 03:15 - 07/23/2023 Baghdad - Mawazine News Today, Sunday, the United Nations Industrial Development Organization (UNIDO) outlined the details of its support for Iraq with the water file, while noting that the Mosul Dam is safe and the water level can be raised.

"The organization's project in Iraq focuses on raising and developing the capabilities of workers in the Dams Authority of the Ministry of Water Resources, and in various dam projects in Iraq," said Harry Beechcroft, the organization's associate project manager.

Beechcroft added, "Another goal of the organization is to provide dam projects and the Dam Safety Unit, which has now become the Dam Safety Department in Baghdad, with the necessary equipment to sustain its work."

He pointed out that "an international council of experts was summoned to the Mosul Dam for the purpose of evaluation, and the results were very reassuring, and it recommended in its last visit to raise the level to 325 meters above sea level, and this means that the dam is safe and the water level can be raised without any problems."

He stressed, "The recommendation of the Council of Experts to raise the water level in the dam was very welcomed by the Ministry of Water Resources." https://www.mawazin.net/Details.aspx?jimare=231907

Al-Sudani And Al-Hakim Stress The Need To Support The Government's Measures In Implementing Economic Reforms

political | 04:39 - 07/23/2023 Baghdad - Mawazine News, Prime Minister Muhammad Shia' al-Sudani, and the head of the Wisdom Movement, Sayyid Ammar al-Hakim, stressed today, Sunday, the need to support the government's measures in implementing economic reforms.

The media office of the Prime Minister stated in a statement, that "Prime Minister Muhammad Shia'a al-Sudani received the head of the Wisdom Movement, Mr. Ammar al-Hakim, and during the meeting they discussed developments in the general situation in the country, and the need to support the government's measures in implementing economic reforms, and meeting the needs of citizens for services in various basic sectors."

He added, "The meeting witnessed an emphasis on attributing the government's steps to stabilize stability, and the importance of concerted efforts in order to face challenges in all their forms, with the aim of providing the guarantee environment for the success of investment plans and achieving sustainable development." https://www.mawazin.net/Details.aspx?jimare=231916

Iraq Reduces Its Holdings Of US Bonds To 8 And A Half Billion Dollars

Sunday 23 July 2023 10:23 | Economical Number of readings: 399 Baghdad / NINA / - The US Treasury announced, on Sunday, that Iraq had reduced its holdings of US bonds to 8 and a half billion dollars during the first five months of the year 2023.

The Treasury said in a schedule, that "Iraq reduced its holdings of bonds during the first five months of this year, starting from January to May, to 8.5 billion dollars, to reach the 36th rank among the countries with the largest possession of US treasury bonds, of the 38 countries included in the table of countries.

And she added, "Iraq's possession of US bonds in January amounted to 41.2 billion dollars, to decrease to 40.7 billion dollars in February, and to decrease to 39.3 billion dollars in March, after which it decreased again in April to 34.8 billion dollars, and decreased in May to 32.7 billion dollars," noting that "Iraq's possession of US bonds in January of the year 2022 amounted to 40.8 billion dollars."

And she indicated that "Iraq came as the fourth largest Arab country in the largest possession of US bonds, after Saudi Arabia, the Emirates and Kuwait."/ End 11

"THE IQD PAYS THE BILL FOR THE CONFRONTATION BETWEEN WASHINGTON & TEHRAN", 23 JULY

The Iraqi dinar pays the bill for the confrontation between Washington and Tehran

"What $5 “Apple Car Supplier” Is Luke Lango Teasing?" BY TIM MCKINLAY, 23 JULY

InvestorPlace has published a new Luke Lango presentation centered around a “potential backdoor Apple play” that he believes “could see 40X gains in the next few years.”

In short, it’s all about “Project Titan” (Apple’s rumored autonomous vehicle project) and one “tiny $5 tech company” that Lango believes could become a “vital Apple Car supplier.”

Lango didn’t reveal his pick in the video, but he did drop some hints about it, which I looked into to see if I could figure out what company he was teasing.

And in this post, I’ll show you exactly what I found (ticker and all).

The Pitch: Luke Lango’s “Project Titan” Prediction

Luke Lango’s latest stock teaser begins with him standing next to a briefcase that he says holds “what could be the key to Apple’s next potential trillion-dollar product.”

According to Lango, this “potential trillion-dollar product” is codenamed Project Titan and could be a “projected $46 trillion opportunity” for investors.

“When the timer on your screen hits zero…

I’m going to open this briefcase to reveal what could be the key to Apple’s next potential trillion-dollar product.

It’s known by the code name ‘Project Titan’…

And it could give investors the chance to cash in on what Bloomberg is calling a projected $46 trillion opportunity.”

What is Project Titan?

Project Titan is a codename used to describe Apple’s rumored electric vehicle project, which is said to be focused on a fully autonomous vehicle (AV) it’s developing.

At this stage, it’s mostly speculation, given Apple has never openly discussed any of its self-driving research, so we don’t know for sure if it is working on a self-driving car.

However, there is sufficient information online to suggest that it’s at least possible, and the two links I just shared go into a lot more detail if you want to know more.

I’ve also written about Project Titan in different stock teasers I’ve covered (for example, Jeff Brown’s Apple Car prediction) that are based on a similar idea to Luke Lango’s pitch. Namely, the idea that Apple is working on a self-driving car and that there’s a “little-known supplier” investors can speculate on, which could be more lucrative than buying Apple shares.

He appears to be teasing a different company from others I’ve come across, though.

In short, Lango is predicting that one “potential backdoor Apple play,” which he refers to as a “little-known $5 firm,” could “40X your money over time.”

And one of the main reasons why he’s so bullish, at least from what I can gather, is his belief that the company “could play a pivotal role in turning the Apple Car into a reality.”

“But right now, many of my Silicon Valley contacts are buzzing with excitement…

About the tiny tech firm that could play a pivotal role in turning the Apple Car into a reality.

Its stock is currently trading for around $5 a share…

But I believe it could easily surge 40X or more over the next few years… especially if a deal with Apple ends up happening.”

Why does he believe this “tiny tech firm” is so important?

According to Luke Lango, it all has to do with a “critical piece of tech” that he and his team of “elite analysts” believe Apple may need to make Project Titan possible.

“Everyone knows that Apple is extremely secretive with their new projects… especially when it comes to their suppliers.

But using my team of elite analysts , we’ve been able to put together the breadcrumbs… clues hidden in plain sight…

To predict the critical piece of tech we believe they need to make Project Titan possible!

I believe that they could partner with one little-known $5 firm to supply it.”

What “critical piece of tech” is he referring to?

Luke Lango was pretty tight-lipped about the exact technology he was referring to, but he did say that it’s what could allow Apple’s autonomous car to “see.”

“I predict the biggest gains will come from investing in the one tiny $5 tech company that could help make the Apple Car a reality!

I believe this company could provide a key piece of tech the Apple Car needs to become a truly autonomous vehicle…

Because it’s going to be what allows the autonomous Apple Car to SEE.”

He also shared some images in the presentation depicting LiDAR technology, said this tech is used in the iPhone (which it is), and as I looked into the clues he shared about the company he’s teasing, I found that LiDAR is the tech this “tiny tech firm” specializes in.

What is LiDAR? Light detection and ranging (LiDAR) technology uses lasers to measure the distance between surrounding objects and the receiver. And it’s used in autonomous electric vehicles (among other things) to essentially “map” the surrounding area.

So, long story short, the “critical tech” Lango’s talking about appears to be LiDAR, a technology that’s used to help self-driving cars navigate.

And he believes that “one tiny Silicon Valley firm” could “become a key supplier for the Apple Car” (which would presumably involve LiDAR technology). And if it does, he predicts the stock could see 40X gains over the next few years.

“I predict Apple is going to kick off the projected $46 trillion transportation revolution with Project Titan…

And I predict one tiny Silicon Valley firm is going to help Apple make it all possible.

I think this little-known tech company could become a key supplier for the Apple Car…

And if that happens…

I predict it could send their stock skyrocketing for 40X gains over the next few years!”

It’s a bold and highly speculative prediction.

And as mentioned, Lango didn’t reveal the ticker in the presentation. But I looked into his clues and managed to uncover his pick. So let’s take a look at that now.

The Pick: What “Key Supplier for the Apple Car” Is Luke Lango Teasing? (“$5 Tech Company” Revealed)

So far, we’ve learned that Luke Lango’s pick involves a Silicon Valley-based tech company that could help the Apple Car “see” and that it trades for around $5 a share.

What other clues did he share?

For one thing, Lango said that two former Apple engineers built the company:

“Surprisingly, this tech is already being used in our iPhones…

And two former Apple engineers…

Actually left to build this company and start applying it to AVs!

That’s why I believe the Silicon Valley tech firm they started is a shoe-in to become a vital Apple Car supplier.”

He also said that the company has “over 25 Apple alumni working for them” and that it doesn’t have any official affiliation with Apple:

“And they have over 25 Apple alumni working for them.

In fact, about one out of 10 employees in this tech firm are Apple alumni!

Just last year, they added a former Apple senior executive to their advisory board.

Right now, they have no official affiliation with Apple…

But I don’t think it’d be surprising for Apple to have a bias towards partnering with a company…”

And lastly, he dropped some hints about who’s using the company’s tech:

“TuSimple, an autonomous trucking company…

Has already used this company’s tech to build, on average, 35,000-pound semi-trucks that can drive down 65 mph highways without a single human driver behind the wheel.

Even crazier…

NASA is using their tech to support the next generation of lunar and planetary exploration…”

To solve this puzzle, the first thing I did was a Google search for California Lidar companies that were started by former Apple engineers. And that led me to an article on technowize.com about California-based company Aeva Technologies, Inc. (AEVA).

From there, I checked the company’s stock, which is currently sitting at under $3 (June 2022), which matches what Lango said about it “trading for less than $5.” And as a side point, it was closer to $5 when the presentation was released (April 2022).

Next, I looked into what the company does and found that one of its main focuses is LiDAR technology for autonomous vehicles, which is exactly what Lango’s teaser suggested.

According to the company website, its main product is the Aeries™ II, which it says is the world’s first 4D LiDAR. I’m not an expert on this technology, but the page I just linked to explains what this tech does in detail, so you might find that worth a look.

The gist is that it’s a (seemingly) advanced LiDAR sensor for autonomous vehicles. According to the company, it “provides up to 20 times the resolution of legacy LiDAR sensors,” can detect objects at “distances up to 500 meters,” and is smaller than the company’s previous generation LiDAR sensor.

So to sum it up…

Aeva, which is based in Mountain View, California, matches the main clues Luke Lango shared about who started the company (two former Apple engineers), what it does (makes LiDAR tech), its stock price (under $5), and where it’s located (Silicon Valley).

As for the clues about TuSimple and NASA, those match, too.

According to businesswire.com, Aeva announced a partnership with TuSimple “to deploy Aeva 4D LiDAR on TuSimple’s self-driving trucks” in early 2021.

And according to techcrunch.com, NASA is working with Aeva to “create a tool that scans the terrain when ordinary cameras and satellite instruments won’t cut it.”

So, while I can’t guarantee I’m right, the evidence suggests (overwhelmingly) that the “potential backdoor Apple play” Luke Lango’s teasing here is Aeva.

With all that said, one thing I want to emphasize is that this company doesn’t have any official affiliation with Apple. Nor is there any proof that it “could become a key supplier for the Apple Car,” which is something Lango himself clarified in the presentation.

“My contacts in Silicon Valley are currently buzzing with excitement about the key technology this company could supply Apple with…

And if they do end up working with Apple, they could turn the global auto industry on its head.

Let me make one thing clear though: none of this is officially announced yet…

And I have no information that isn’t publicly available.

This is just what I’m predicting based on the research my team and I have done over the past 7 months. I don’t have a crystal ball… so I could be wrong, and no deal could ever happen.”

So, as far as speculation goes, this pick is up there.

Not only do we not know for sure if Apple is even working on a so-called “Apple Car” in the first place, but there’s no evidence that Aeva is, or will be, a supplier.

That’s not to say that Luke Lango’s prediction is wrong, though.

Unfortunately, I don’t have a crystal ball either. And since I don’t have any special knowledge about Apple’s projects or partnerships, I don’t know how his prediction will play out. What I can say, however, is that there’s no guarantee you’ll “40X your money,” or any money at all, following his recommendation. Whatever it might be.

Nevertheless, if you want all the details on Lango’s “Apple Car” pick, he’s put together a report called “The Project Titan Prospectus: How to Cash In on Apple’s Next Potential Trillion-Dollar Product” (which, by the way, is what was inside that briefcase).

The only catch is that to access the report; you need to join Innovation Investor. So in the next section, I’ll give you an overview of what this service is about.

Recommended: Go here to see my #1 rated stock advisory of 2023

Should You Join Luke Lango’s Innovation Investor?

Innovation Investor is an investment research service run by Luke Lango of InvestorPlace focused on emerging tech companies. And as a subscriber, you get two Innovation Investor research reports each month that detail his latest recommendations.

Subscribers also receive the “The Project Titan Prospectus” report I mentioned earlier, one called “The Projected $46 Trillion Transportation Revolution Playbook,” and access to an archive of past research reports Luke Lango has put together.

There are other aspects of the service, too. Like a model portfolio and regular updates, for example. But the main aspect, as with most services, is the research and picks.

As for whether or not it’s worth it, that depends on what you’re looking for. Innovation Investor is focused on emerging tech companies and, aside from autonomous vehicles, trends like 5G, artificial intelligence, blockchain, and the metaverse, for example.

So when Lango is right, his picks can see a lot of potential upside, and he provided numerous examples of this in the presentation. However, not all of his recommendations work out, and as we have seen recently, small tech stocks can be incredibly volatile. So the service may be too speculative for some.

If you want to see what other companies Luke Lang has teased before joining, check out this archive page, which lists other Luke Lango stock teasers I’ve written about.

In any case, while there’s no guarantee that Luke Lango’s recommendations will make you money, the Innovation Investor service is legit. So it may be worthwhile depending on what you’re looking for. And it only costs $29 to join if you sign up through the presentation.

Bottom Line

There’s no shortage of rumors circulating about Project Titan, Apple’s so-called “Apple Car” project that could see them release an autonomous vehicle at some point.

And given the sheer volume of information out there, across multiple trusted sites, it’s entirely possible that Apple is working on such a project.

However, nothing has been officially announced yet. And even if the company is working on a self-driving car project, we don’t know when a finished product will be released, how successful it will be, or what companies it’s working with to make it happen.

So, while Luke Lango’s pick may have “the potential to grow 40X in the next few years,” as he said in the presentation, there’s no guarantee that will be the case.

Anyway, that’s my take.

And as always, I’m keen to hear your thoughts, so comment below if you feel like adding your two cents on Lango’s Apple Car prediction. Thanks for reading!

"PROJECT TITAN" BY LUKE LANGO'S INNOVATION INVESTOR ( NASDAQ), 23 JULY

Little-Known Apple Project Could Be 10X Bigger Than the iPad, MacBook and iPhone COMBINED

And Wall Street is OBSSESSED with it

After nearly a decade of research and development…

Apple is getting ready to unveil the fruits of a project that could fundamentally transform Apple as a company forever.

It goes by the code name “Project Titan”…

And according to Barron’s… “Wall Street is obsessed” with it.

Former hedge fund manager and Mad Money host Jim Cramer is on record saying that “the upside could be enormous…” for Apple.

Morgan Stanley analyst Katy Huberty says Project Titan is… “the clearest path to doubling Apple’s revenue and market cap.”

One article by Business Insider even says that Apple’s market cap has ALREADY grown by $102 BILLION just from the RUMORS of Project Titan’s release!

Apple stock is looking very attractive to investors right now…

No wonder Warren Buffet recently swiped up 600 million dollars worth of Apple stock — despite all the craziness the market is experiencing right now.

But while Apple would be a great investment…

The analyst who was ranked as America’s #1 stock picker back in 2020 by TipRanks has discovered a bigger opportunity lying under Wall Street’s radar.

It’s a potential backdoor play on the tiny firm Apple needs to work withif they want to make Project Titan a success…

And if someone needed to secure their nest egg… catch up on retirement… or simply make sure they’re able to provide for themselves and their family…

This could be the chance of a lifetime to do so!

The best part is that it only takes $5 to tap into this wealth-accelerating opportunity today. "ORDER $5 STOCK"

Click Here to Get the Full Story

About Luke Lango’s Innovation Investor

With Innovation Investor, Luke Lango’s goal is to offer readers research on an elevated small-cap investing strategy that goes beyond anything that’s been done before on Wall Street. Luke was ranked America’s #1 stock picker in 2020 according to TipRanks and has 15 recommendations that have soared as high as 1,000% or more over his tenure.

*All investing includes risk of loss*

MNT GOAT: ⚠️ Iraqi Dinar Update: FACTS Only – No RV Yet, But Big Changes Are Coming! 💸🇮🇶 #iqd

Read also: THE STRUCTURED PAYOUT SYSTEM: The Amount Paid For Each Zim Dollar

-

A groundbreaking and irreversible shift is occurring in the global financial system as it rapidly transitions to a gold-backed structure. T...

-

Confirmed on Live TV – Announced Exchange Rate: $6.02! – Take Advantage!🔊 Highlights Summary Here are reports on the officially confirmed...

-

Global Currency Reset: Mon. 19 May 2025 NESARA & QFS REDEMPTION EXPOSED: THE FINAL PHASE HAS BEGUN · The RV Redemption is LIVE. The fin...