Welcome to Smart Money! My name is Eric Fry, and I’m glad you’re here.

Wall Street has sold investors on the idea that they should start with “micro” analysis – the idea that they should make investment decisions by comparing things like price/earnings ratios, income statements or other company details.

But I do the opposite; I start with “macro” analysis.

I look for big-picture trends that drive huge, multiyear moves in entire sectors of the market.

I’m talking about trends that can spin off dozens of triple- and even quadruple-digit gains in just a few years.

Catching just one of these trends – at the right time – can help anyone accumulate enough capital to finance their dreams and to provide themselves with an enviable retirement…

When investors use a global macro strategy, they identify investment opportunities from a broad, global, top-down perspective, rather than by examining stocks one by one (a micro, bottom-up perspective).

And today, I want to highlight a trend you’ve likely been hearing about nonstop for the last few months: Artificial intelligence, or “AI.”

Investors know it… and CEOs really know it. Almost no company dares to conduct a conference call without highlighting the AI technology it’s adopting or developing.

During this year’s first-quarter conference calls, for example, the CEOs of S&P 500 companies used the term “AI” twice as often as they did during the previous quarter’s conference calls, according to an analysis by Reuters.

Because of the growing buzz around AI technologies, investors are rushing into AI stocks of all sorts – hoping to give their portfolios a much-needed boost.

AI is an incredibly powerful – almost scary-powerful – megatrend, and the implications of its deployment will supercharge choice companies into previously unachievable milestones… including the coveted trillion-dollar market cap.

Yes, you read that right – trillion with a “t.” It’s an inconceivable number, so much so that only four companies (at the time this report was written) have achieved that value: Amazon.com Inc. (AMZN), Microsoft Corp. (MSFT), Saudi Aramco, and Alphabet Inc. (GOOGL).

But with the power of AI, I believe that the next trillion-dollar companies are out there… and will reward their investors handsomely along the way.

So, here are my three picks for the next trillion-dollar AI companies…

Trillion-Dollar AI Stock No. 1: Intel

As a Bible verse (and 1960s Byrds lyric) tells us, “There is a time for everything.”

Even a time to add Intel Corp. (INTC) to your watchlist.

Admittedly, the PC-centric tech world that Intel once dominated is a thing of the past. Further, a string of strategic missteps and manufacturing miscues caused Intel to lose market share in every key product category.

Since 2016, Intel has lost its share in both CPU chips (central processing units) and GPU chips (graphic processing units). Nevertheless, Intel remains the top dog and continues to grow revenue year by year.

And yet, in a stock market environment that’s dominated by sexy “story stocks,” Intel is a wallflower.

But Intel is not simply a “chip company;” it has the potential to become the next trillion-dollar AI company…

Ahead of the Game

Because of the release of ChatGPT, an AI-powered “chatbot” that can do everything from answering questions to writing essays, AI-focused investing has become the newest Wall Street sensation.

But that’s much easier said than done, as AI is difficult to invest in directly.

However, as we peel away at this onion, we find that a handful of semiconductor companies might offer an indirect play on AI.

Names like IBM Corp. (IBM), NVIDIA Corp. (NVDA), and, yes, Intel top the ranks of AI-chip producers. In fact, in 2017, Intel became the first semiconductor company in the world to generate more than $1 billion in sales from AI chips.

Importantly, Intel is the only company of these three that continues to operate fabs – and plans to invest tens of billions into building next-generation ones here in the United States. (IBM and NVIDIA design chips here at home, and then outsource the actual production to overseas companies like TSMC and Samsung.)

But that paradigm may be ending quickly…

Unpopular Opinion

The U.S. government is working to cut off the flow of advanced technology to China by incentivizing chipmakers like Intel to manufacture AI chips here in the States, rather than in East Asia.

The strategic thinking here is very basic: If the Chinese can’t manufacture or access cutting-edge chips, then they can’t build the data-center capacity they would need to train AI systems.

In such a world, Intel becomes an obvious go-to solution for U.S. chip designers like IBM and NVIDIA. Perhaps that’s why IBM has already structured a joint venture (JV) with Intel to develop AI chips – and why NVIDIA has stated publicly that it will consider contracting with Intel for the first time to produce some of its chips.

Apart from political considerations, the AI market itself is on the verge of explosive growth. IDC estimates that worldwide spending on AI systems will nearly triple to $300 billion by 2026. From that level, McKinsey predicts the AI market will soar to $1 trillion by 2030.

Intel stands at the ready with a roster of offerings that can help power the AI Revolution.

The company’s NCS2 is its latest chip that was developed specifically for deep learning. Also, the brand-new Gaudi2 AI chip, designed by Intel’s Israel-based Habana Labs, is twice as fast as its first-generation predecessor.

Chips like the Gaudi line accelerate the particular math calculations at the heart of today’s AI technology. A third-generation Gaudi3 is already in development.

These powerful, next-generation chips enable AI models to “learn” by processing complex real-world data to find patterns more quickly and economically.

And even though Intel is still widely unpopular, I recommend adding it to your AI watchlist… because I can see it becoming one of the next trillion-dollar AI companies.

Trillion-Dollar AI Stock No. 2: Meta Platforms

Facebook’s parent could soon regain its trillion-dollar crown.

Social media giant Meta Platforms Inc. (META) first became worth $1 trillion in June 2021 on an accelerating advertising business. At the time, analysts believed the firm would generate $33 billion the following year.

That didn’t go to plan. The company would instead post $19 billion in free cash flow due to a slowdown in online advertising and mounting losses from its virtual reality business. Meta’s market capitalization sank as low as $250 million last year. (It’s inched back up to around $600 billion.)

Nevertheless, Meta is still a promising bet.

The firm’s aggressive cost-cutting measures and improving ad business were already showing positive results. And soft inflation figures from last month set the stage for a summer stock surge. Facebook is historically more sensitive than its peers to market cycles.

That means a recovery could happen faster than expected. FCF is now expected to recover to $23 billion this year and hit the “magic” $30-billion level in 2024. Heavy advertising spending from the 2024 presidential election means these figures will likely play out this time around.

Trillion-Dollar AI Stock No. 3: International Business Machines

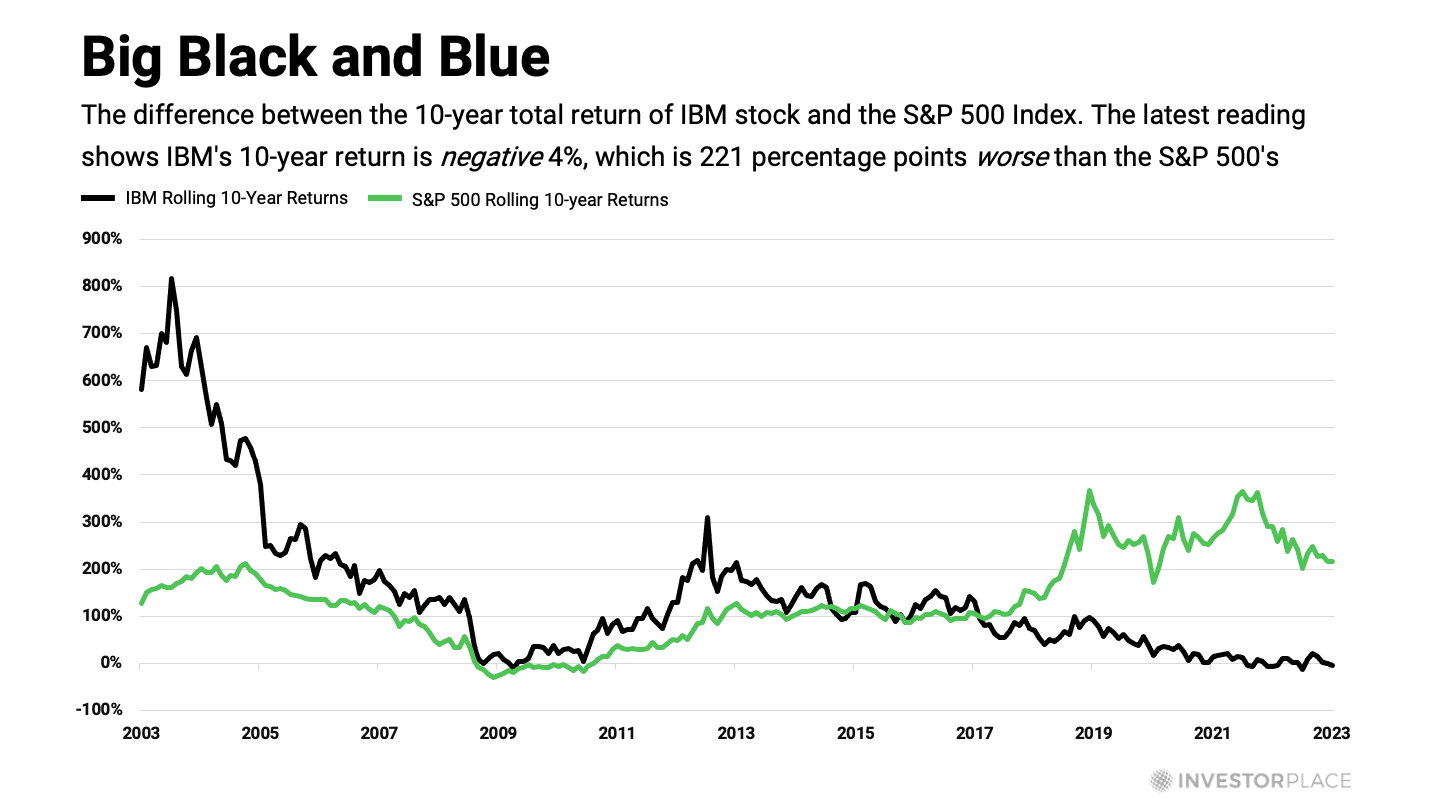

The below chart tells you almost everything you need to know about the “new” IBM…

The iconic computer company’s revenues and operating margins are no longer tumbling. They are rising once again.

After hitting a 30-year low in Sept. 2021, IBM’s revenues and margins have been making a noticeable recovery. These favorable financial trends do not prove IBM has embarked on a new growth trend, but they do support that thesis.

Underdog to Burgeoning Champion

Over the past few years, IBM has been reinventing itself as a hybrid cloud and artificial intelligence company. To accelerate this transformation, the company has been pursuing an out-with-old-in-with-the-new growth strategy.

Since 2019, IBM has divested 17 legacy businesses, while also making more than 30 acquisitions. One of the most impactful acquisitions during its shopping spree was Red Hat, which IBM acquired in 2019 for $34 billion. Although the price tag seemed a bit rich at the time, this acquisition brought a market-leading hybrid cloud platform into the IBM family.

Red Hat’s capabilities are so formidable that more than 90% of Fortune 500 companies rely on its platform.

According to Grand View Research, the global cloud-computing market will grow 150% over the next seven years – from about $600 billion this year to more than $1.5 trillion in 2030. The global artificial intelligence industry will reach a similar size by 2030, according to Fortune Business Insights.

IBM is riding the current of both of these powerful megatrends.

The AI Domination

“IBM Watson” is the company’s core AI offering. It integrates with the Red Hat hybrid cloud to enable companies to pool data from numerous sources, then process that data to achieve objectives like predicting future outcomes, automating complex processes, and optimizing employees’ time.

Out in the real world, many companies accumulate and store data in the corporate equivalent of a “junk drawer.” Valuable information exists in every imaginable form…

- Company memos…

- PDFs…

- Charts and other images…

- Databases…

- Customer records…

- Call logs…

- Handwritten documents…

- Blog posts…

- And tweets.

These data are “unstructured,” to put it politely. But Watson can use AI to synthesize and process these data so that businesses can make informed decisions.

In other words, IBM promotes Watson AI as a solution that can enhance productivity across an entire enterprise.

Increasingly, enterprises are buying the AI-empowered solutions IBM Consulting is selling. Revenues from this division have jumped 18% during the last two years.

A Positive Future

Not only are IBM’s revenues and operating margins trending higher, but profits are also following suit. Operating income has jumped 77% during the last two years.

Because IBM’s fast-growing AI and hybrid cloud businesses will power most of its future growth, I expect the company to become a dominant leader of the AI boom.

Moving Forward

I’m so glad that you decided to further your journey to wealth by joining Smart Money.

Nearly every Tuesday, Thursday, and Saturday, you’ll receive an email from me, wherein I’ll share insights on the latest market “megatrends”, how to act on them and more.

Get started by visiting your Smart Money website here.

Regards,

Eric Fry

Editor, Smart Money