What is 13F Season?

13F season refers to the quarterly period in which institutional investment managers with over $100 million in assets under management (aum) must disclose their holdings of publicly traded securities to the US Securities and Exchange Commission (SEC). The 13F filing provides transparency and insight into the strategies and composition of large institutional investors, hedge funds, mutual funds, and pension funds. However, though 13F statements can be valuable learning tools for everyday investors, they are often misunderstood. Below are 3 pitfalls that investors fall into when following the 13F season:

Conflating Notional Value & Real Value

Earlier this morning, I read a ton of social media hysteria about Michael Burry’s 13F. Burry is a legendary short seller portrayed by Christian Bale in the hit movie “The Big Short.” At face value, Burry’s updated portfolio showed roughly 51% of his portfolio in S&P 500 ETF ((SPY - Free Report) ) put options and another 43% in Nasdaq 100 ETF ((QQQ - Free Report) ) puts.

Before investors get crazy bearish and follow Burry, it is essential to remember that 13Fs report the entire value of the underlying stock and NOT the market value of the option.Notional value refers to the nominal or theoretical value of the option without considering factors like market conditions or external influences. Conversely, real value or actual value considers a more accurate representation of the asset’s current value.

Discounting Time Frame

Without context, 13Fs have little value for investors looking to piggyback on ideas. For example, Michael Burry and Stanley Druckenmiller can be in and out of positions quickly. Conversely, Warren Buffett tends to invest in companies, not stocks, and has a theoretical time frame of “forever”.

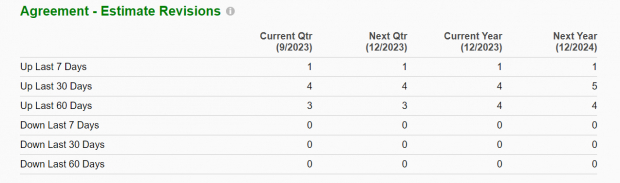

In other words, there is more value in following an investor like Buffett. Speaking of which, Buffett’s 13F just hit the news wires, and he opened new positions in homebuilders such as DR Horton ((DHI - Free Report) ), Lennar ((LEN - Free Report) ),and NVR ((NVR - Free Report) ). NVR and Lennar earn the best possible Zacks Rank #1 (Strong Buy) as several analysts have raised their EPS estimates recently.

Image Source: Zacks Investment Research

Buffett also added to oil stock Occidental Petroleum ((OXY - Free Report) ), which is breaking out.

Complete Picture is Not Clear

Because short positions are not displayed in 13F filings, investors never fully know one’s portfolio exposure (hedges? directional shorts). As always, investors should do their own due diligence when looking at 13Fs.