Saturday, September 2, 2023

The New ETF That Protects Against All Market Losses

- (1:30) - The Innovator Equity Defined Protection ETF: TJUL

- (6:40) - What Are The Risks And What Do Investors Give Up In Return For The Downside Protection?

- (9:30) - Breaking Down The Market For Protection Products: What Are The Advantages To Owning TJUL?

- (14:20) - How Does TJUL Fit Into Your Portfolio Right Now?

- (18:20) - What Can Investors Expect From The Growing ETF Industry?

- Poddcast@Zacks.com

In this episode of ETF Spotlight, I speak with Bruce Bond, co-founder, and CEO of Innovator Capital Management, about the world’s first ETF that offers 100% downside protection.

Defined-outcome ETFs, which allow investors to participate in the market's upside up to a cap while limiting losses if the market falls, are one of the fastest-growing segments of the ETF market. They continue to see record inflows amid market turbulence.

Last month, Innovator Capital Management, which pioneered buffer ETFs, launched a new fund, the Innovator Equity Defined Protection ETF (TJUL - Free Report) , that seeks to track the return of the SPDR S&P 500 ETF Trust (SPY - Free Report) , up to a cap of 16.6%, while buffering investors against 100% of losses over the outcome period of two years.

Like other buffer ETFs, this product also invests in a basket of FLEX options with varying strike prices. Investors forgo dividend income and pay an expense ratio of 0.79%.

Some products, such as fixed indexed annuities and market-linked CDs, protect against any downside but come with much higher fees, carry high investment minimums, long lockup periods, and unfavorable tax treatment. ETFs like TJUL are a much better option for investors.

Investors should remember that stocks tend to go up over the long term, and they should generally ignore short-term noise. By seeking downside protection, investors forgo any potential upside beyond the cap.

Since its inception in January 1993, SPY has returned a little over 10% annualized. The Nasdaq 100 ETF ( QQQ - Free Report) has produced almost 19% average annual return over the past 10 years.

At the same time, many risk-averse investors, particularly those in or nearing retirement, have been reluctant to buy stocks after last year’s brutal performance. There’s a tremendous amount of cash sitting on the sidelines. Such investors should look at TJUL and other defined outcome ETFs.

Tune in to the podcast to learn more.

Make sure to be on the lookout for the next edition of the ETF Spotlight and remember to subscribe! If you have any comments or questions, please email podcast@zacks.com.

"RV UPDATE" BY MILITIAMAN & FRANK26, 2 SEPT

Militia Man

It hasn't been their job to tell us everything. It's because we're outsiders. It's their country and they keep it to themselves as best as they possibly can. We should be able to understand that that's a big component of this whole process...

What's this business about this 1132 that Alaq mentioned? Alaq is the central bank governor...He said the official exchange rate for the Iraqi currency is 1132...A lot of people are going, 'Well that's not true!'. The fact remains...he said it...as the official rate of the Iraq dinar but it's not on their website. I'm not making it up. I'm not giving you accusations...it's proved...

You're going from an old style to a new style in this new world economy...the triple zero notes aren't going to be a thing of the future. They're going to be a thing of the past...

Frank

It's not like you're going to need a receipt [from when you bought your dinars] when you exchange. No body at at a bank is going to say, 'Greetings, Mr. Smith. You have a million dinars, let me see your receipt.'

All they care about is, let me see the dinar. And you say, 'Here's my certificate of authenticity.' Well you can take that and throw it in the garbage. Look, we'll [The bank] tell you if these dinar are good are not...

You still see whatever you see as the exchange rate on the CBI website. You can go to the...airport and it's still at 13-whatever. But you see the [CBI] articles tell you, 'Our official exchange rate is 1132...' I'm going to believe the CBI. I'm going to say, 'Yes sir, understood!'

Economist: The path of development will reduce unemployment and reduce dependence on oil as a source of budget, 2 SEPT

Economist: The path of development will reduce unemployment and reduce dependence on oil as a source of budget

Is It Really the Right Time to Invest in the Stock Market? Here's What Warren Buffett Says, 2 SEPT

The stock market has been on a wild roller-coaster ride over the past couple of years, and if you're feeling nauseated by all the ups and downs, you're not alone.

Currently, the S&P 500 is up by nearly 18% so far this year and around 26% from its lowest point last October. While many people are optimistic that this is the start of a new bull market, others remain skeptical, especially since the long-awaited recession still isn't off the table.

If you're feeling conflicted about whether to invest right now or wait, it can sometimes be helpful to look to the experts.

While nobody can say for certain where the market is headed in the short term, legendary investor Warren Buffett can offer some reassuring words when it comes to investing during periods of volatility.

Is it safe to invest right now?

While the market's short-term movements can be daunting, they generally shouldn't affect your strategy. Even if stock prices fall in the coming weeks or months, it's still a good idea to invest now.

The stock market will always be unpredictable in the near term, and even the experts can't say where prices will be in the coming weeks or months. So if you're waiting for the perfect opportunity to invest, that moment might never arrive.

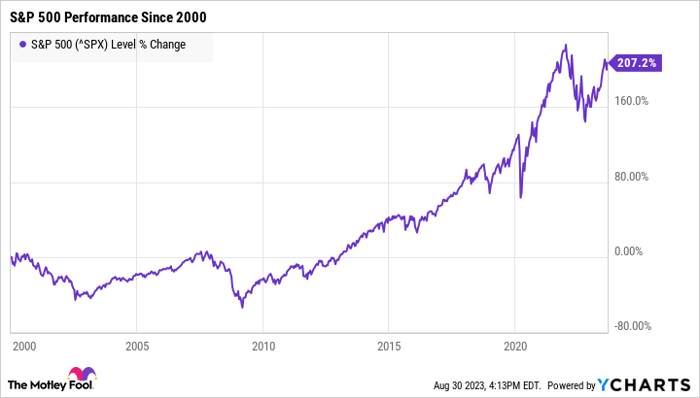

In the long term, though, the market is incredibly resilient. Over the past two decades alone, it has experienced multiple major recessions, countless corrections, and plenty of other ups and downs along the way. Yet the S&P 500 is still up by more than 207% since 2000.

In short, as long as you're a long-term investor, it doesn't necessarily matter what the market is doing today, next week, or even next month. Over many years, it's extremely likely it will see positive total returns.

Buffett's best advice for surviving volatility

This long-term investing strategy is also Warren Buffett's go-to approach, especially during periods of volatility.

In 2008, at the height of the Great Recession, Buffett wrote an opinion article for The New York Times to help reassure worried investors.

In it, he explained that he was continuing to invest in stocks even as prices plummeted.

"Let me be clear on one point: I can't predict the short-term movements of the stock market," he wrote. "What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over."

While it might sound counterintuitive, investing consistently during the market's rough patches can actually be more lucrative over time than waiting for the perfect time to buy. Many stocks are still priced well below their peaks, meaning now is your chance to load up on quality investments at a fraction of the cost.

"In short, bad news is an investor's best friend," Buffett wrote in the Times article. "It lets you buy a slice of America's future at a marked-down price."

One key to ensuring your investments thrive

Continuing to invest throughout the market's ups and downs is only one part of the equation. It's equally important to make sure you're investing in the right places.

The key to choosing the right stocks is to focus on companies with solid underlying business fundamentals -- such as healthy finances, a capable leadership team, and a competitive advantage in their industry. These stocks will still often take a hit in the short term when the market is volatile, but there's a good chance they will recover.

This is also Buffett's tried-and-true approach when buying stocks. In a 2021 letter to Berkshire Hathaway shareholders, he explained the strategy behind his and business partner Charlie Munger's investing success.

"[W]e own stocks based upon our expectations about their long-term businessperformance and not because we view them as vehicles for timely market moves," he wrote. "That point is crucial: Charlie and I are not stock-pickers; we are business-pickers."

The stock market can be intimidating during periods of volatility. But if you maintain a long-term outlook and choose the right investments, the short-term ups and downs shouldn't affect your strategy. By continuing to invest consistently, you'll be on your way to generating wealth that lasts a lifetime.

"RV UPDATE" BY MARKZ & BRUCE, 2 SEPT

MarkZ

[via PDK]Question: Can Iraq do everything in their budget with the 1100 rate that is going now?

MarkZ answer: No, it will be in the hole if they do it with the 1132 rate…but it gets them a lot closer though.

Question: What do you estimate the NEER [Nominal Effective Exchange Rate] rate would be necessary to do their projects?

MarkZ answer: About $1.30 based on all the math that we have done, that many have done, would be the cheapest NEER rate that they can get away with, but then again they won’t be able to achieve the final value that they want if the come in that low.

A specialist presents 7 observations related to the oil and gas law and points out several negatives,2 SEPT

A specialist presents 7 observations related to the oil and gas law and points out several negatives

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...