Like life, Wall Street doesn’t come with a “How to” book. Reading extensive literature on the stock market can provide theoretical knowledge and insights into trading strategies, risk management, and market trends. However, success in the stock market often requires more than book knowledge. Practical experience, or what I call “seat time,” is essential for developing intuition, learning from mistakes, and adapting to real-time market dynamics. Below are 10 of the biggest lessons I have learned in my 20+ years of seat time:

Proper Position Size is Critical

In my trading and watching others trade, amateur traders often position size far too large. Investors should examine their personal risk tolerance rather than arbitrarily choosing a position size. Ask yourself, “If I took a loss in 10 straight trades, could I survive?” A good rule of thumb may be to start with a risk tolerance of no more than 1% of assets under management. For example, if you risk 1% on a $100,000 account, you lose $1,000 if the trade goes against you. Even if you were to lose in 15 straight trades, recovering your losses would not be insurmountable.

Technical Analysis Can Be a Long-Term Endeavor

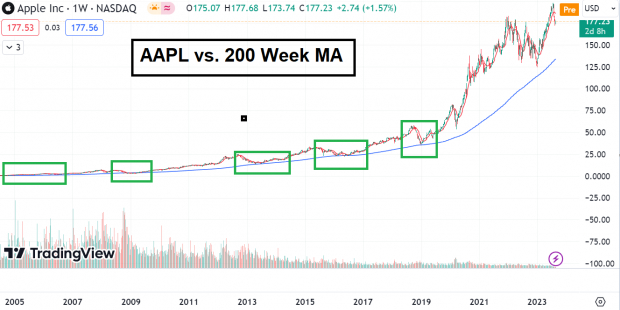

Many new traders believe that technical analysis is only for short-term, day traders. However, I have learned that my most powerful signals often come from long-term technical analysis. Below is a long-term chart of Apple ((AAPL - Free Report) ). For more than two decades, AAPL has held and found support at its longer-term 200-week moving average.

Image Source: TradingView

Cut Losses & Run Winners

Successful investing is not about being right more than you’re wrong, but rather, how much you make when you’re right and how much you lose when you’re wrong. Billionaire investor Paul Tudor Jones famously described his risk-to-reward mindset in an interview with Tony Robbins, saying, “5:1. Five to one means I’m risking one dollar to make five. What five to one does is allow you to have a hit ratio of 20%. I can actually be a complete imbecile. I can be wrong 80% of the time, and I’m still not going to lose.” Pay attention to the simple math behind trading and see your results flourish!

Earnings Estimate Revisions are a Powerful Indicator

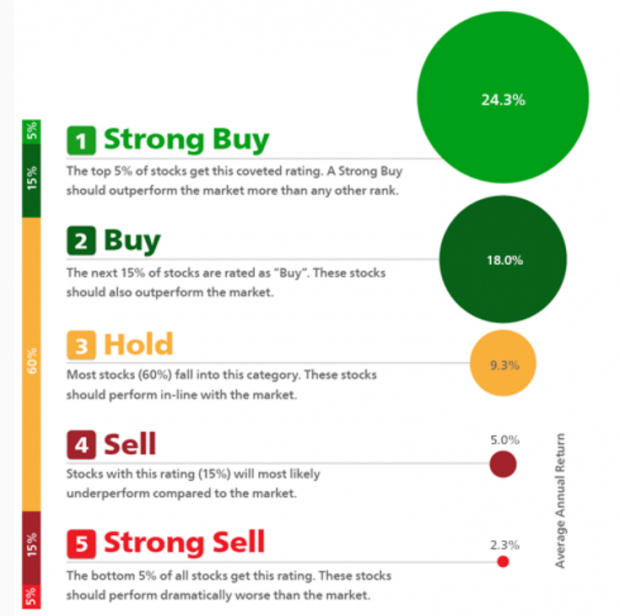

Did you know that top-ranked Zacks stocks have beaten the market 26 of the last 31 years with an average annual return of +24.30% a year, more than double that of the S&P 500’s 10.80%? The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and EPS surprises to classify stocks into five groups:

Markets are Forward-Looking

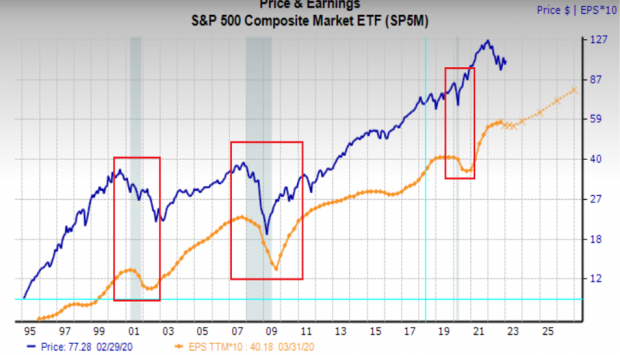

Did you know that in the past three major bear markets (internet bubble burst, housing crisis, and COVID-19 pandemic), the major US indices bottomed months before earnings did?

Image Source: Zacks Investment Research

As hockey legend Wayne Gretzky once said, “I skate to where the puck is going to be, not where it has been.”

Pay Attention to Price Action Versus News

Amateur investors often get caught obsessing over stale economic data. However, most new investors fail to understand is that markets bottom when news looks the worst because they discount the future. For example, after news broke on October 13th of 2022 that inflation hit 40-year highs, the Nasdaq 100 Index ETF ((QQQ - Free Report) ) recovered from deep early losses to finish the session higher by more than 2% on volume nearly double the average. The reversal marked the bottom for stocks.

Image Source: TradingView

When it comes to investing, it’s not so much the news itself that is important, but rather, the market’s reaction to the news.

Don’t Chase Extended Stocks

The further you stretch a rubber band, the harder it snaps back. Equity markets are the same way. Like in life, timing is everything. Avoid chasing stocks that are extended from their 50-day moving average. An excellent recent example is Super Micro Computer ((SMCI - Free Report) ). The stock was extended 32% away from its 50-day moving average before earnings. When earnings disappointed, the stock plummeted 23% in a single session.

Image Source: TradingView

Be Flexible

Flexibility is one of my biggest assets. Never be afraid to change your mind. John Maynard Keynes said it best – “When the facts change, I change my mind – what do you do, sir?”

Adhere to the General Market Trend

75% of a stock’s move depends on the general market’s direction. For example, in 2022, most long-only investors likely lost money. In 2023, the exact opposite is occurring. Use a simple trend filter like the 200-day moving average to determine whether the stock market is in a bull or bear phase. As an example, I’ve overlaid a 200-day moving average over the S&P 500 Index ETF ((SPY - Free Report) ).

Image Source: TradingView

Conduct a Post Analysis

The stock market is filled with investors who are laser-focused on finding the next hot stock. However, investing is more than simply looking for stocks. To succeed in investing, study yourself and your past trades at least once a year. I recommend finding your top 10 winners and your top 10 losers and figuring out what you did right and wrong. Calculate your win/loss ratio, average winner/loser, and equity curve. You’ll thank yourself later.