Wednesday, August 23, 2023

Al-Sudani chairs a meeting on the budget.. This is what resulted, 23 AUGUST

Al-Sudani chairs a meeting on the budget.. This is what resulted

Today, Wednesday, the State head, Muhammad Shia’a Al-Sudani, led a gathering to follow up the transportation projects in the general spending plan.

An assertion from Al-Sudani’s office got by expressed that the last option “directed today, a gathering dedicated to following up the vehicle projects in the government financial plan for the year 2023, went to by clergymen of arranging, transport and money, and various experts, specialists and head supervisors in the concerned divisions and specialists.

The social affair inspected “the assistance’s endeavors inside the citizen upheld drive game plan for the foreordained periods, and taking into account the three-year spending plan, as for presenting government needs, the part of posting, financing, execution, and flowing these exercises among the governorates.”

The State leader focused, “the significance of resolving the issues of execution and supporting for these undertakings, and creating proactive answers for them, and options in contrast to any snag that might confront the work, whether it is managerial and legitimate obstructions or deterrents connected with funding.”

The gathering checked on the advancement of work in the Al-Faw Fabulous Port tasks, and the phases of straight finishing Basra-Shalamja, and Sawa-Hijama, for the rail lines, as Al-Sudani focused on the significance of fostering the rail line transport area, with what it addresses of the spine for the improvement of framework and an additional help that works with the development of resident.

Iraqi Aviation routes And the advancement of its specific staff and administration projects supporting it.

----

Dollar retreats against Dinar in Baghdad, Erbil

Shafaq News / The exchange rates of the US dollar against the Iraqi dinar witnessed a decline on Wednesday in the markets of Baghdad and the capital of the Kurdistan Region, Erbil.

According to a correspondent from Shafaq News Agency, the Al-Kifah and Al-Harithiya central exchanges in Baghdad reported a morning exchange rate of 152,000 dinars per 100 dollars, as compared to the selling rates of 152,900 dinars registered yesterday morning, Tuesday.

Meanwhile, the dollar rates in local exchange shops in the domestic markets of Baghdad experienced a dip, reaching a selling price of 153,000 dinars per 100 dollars. The purchase rates stood at 151,000 dinars for every 100 dollars.

In Erbil, the capital of the Kurdistan Region, the stock exchange also marked a descent. The selling price there amounted to 150,500 dinars, while the purchasing price settled at 152,950 dinars per 100 dollars.

https://shafaq.com/en/Economy/Dollar-retreats-against-Dinar-in-Baghdad-Erbil

"JUST BE PATIENT, THE RI IS COMING", 23 AUGUST

The saga about the Iraqi dinar RV only gets better as the months roll on.

10 Lessons from 2 Decades of Investing Experience, 23 AUGUST

Like life, Wall Street doesn’t come with a “How to” book. Reading extensive literature on the stock market can provide theoretical knowledge and insights into trading strategies, risk management, and market trends. However, success in the stock market often requires more than book knowledge. Practical experience, or what I call “seat time,” is essential for developing intuition, learning from mistakes, and adapting to real-time market dynamics. Below are 10 of the biggest lessons I have learned in my 20+ years of seat time:

Proper Position Size is Critical

In my trading and watching others trade, amateur traders often position size far too large. Investors should examine their personal risk tolerance rather than arbitrarily choosing a position size. Ask yourself, “If I took a loss in 10 straight trades, could I survive?” A good rule of thumb may be to start with a risk tolerance of no more than 1% of assets under management. For example, if you risk 1% on a $100,000 account, you lose $1,000 if the trade goes against you. Even if you were to lose in 15 straight trades, recovering your losses would not be insurmountable.

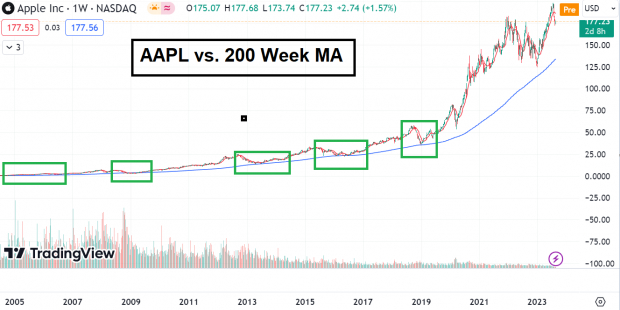

Technical Analysis Can Be a Long-Term Endeavor

Many new traders believe that technical analysis is only for short-term, day traders. However, I have learned that my most powerful signals often come from long-term technical analysis. Below is a long-term chart of Apple ((AAPL - Free Report) ). For more than two decades, AAPL has held and found support at its longer-term 200-week moving average.

Image Source: TradingView

Cut Losses & Run Winners

Successful investing is not about being right more than you’re wrong, but rather, how much you make when you’re right and how much you lose when you’re wrong. Billionaire investor Paul Tudor Jones famously described his risk-to-reward mindset in an interview with Tony Robbins, saying, “5:1. Five to one means I’m risking one dollar to make five. What five to one does is allow you to have a hit ratio of 20%. I can actually be a complete imbecile. I can be wrong 80% of the time, and I’m still not going to lose.” Pay attention to the simple math behind trading and see your results flourish!

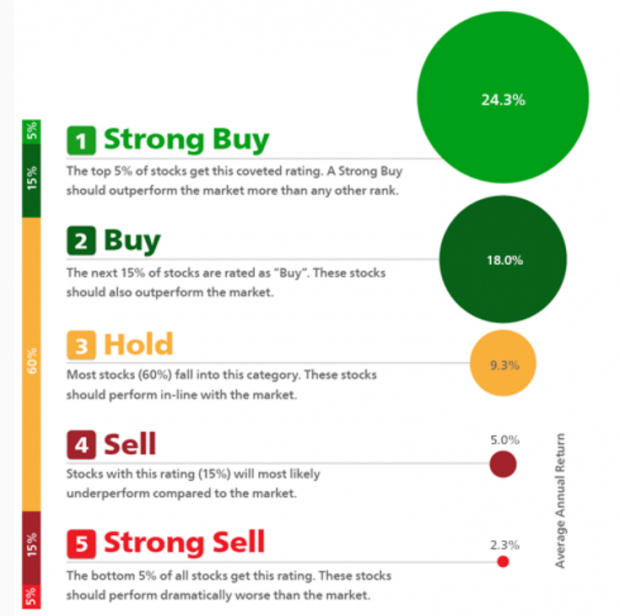

Earnings Estimate Revisions are a Powerful Indicator

Did you know that top-ranked Zacks stocks have beaten the market 26 of the last 31 years with an average annual return of +24.30% a year, more than double that of the S&P 500’s 10.80%? The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and EPS surprises to classify stocks into five groups:

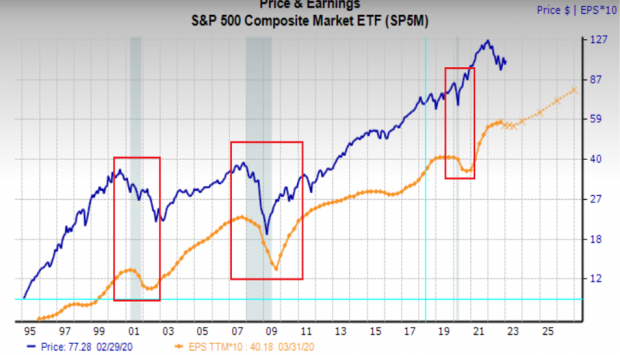

Markets are Forward-Looking

Did you know that in the past three major bear markets (internet bubble burst, housing crisis, and COVID-19 pandemic), the major US indices bottomed months before earnings did?

Image Source: Zacks Investment Research

As hockey legend Wayne Gretzky once said, “I skate to where the puck is going to be, not where it has been.”

Pay Attention to Price Action Versus News

Amateur investors often get caught obsessing over stale economic data. However, most new investors fail to understand is that markets bottom when news looks the worst because they discount the future. For example, after news broke on October 13th of 2022 that inflation hit 40-year highs, the Nasdaq 100 Index ETF ((QQQ - Free Report) ) recovered from deep early losses to finish the session higher by more than 2% on volume nearly double the average. The reversal marked the bottom for stocks.

Image Source: TradingView

When it comes to investing, it’s not so much the news itself that is important, but rather, the market’s reaction to the news.

Don’t Chase Extended Stocks

The further you stretch a rubber band, the harder it snaps back. Equity markets are the same way. Like in life, timing is everything. Avoid chasing stocks that are extended from their 50-day moving average. An excellent recent example is Super Micro Computer ((SMCI - Free Report) ). The stock was extended 32% away from its 50-day moving average before earnings. When earnings disappointed, the stock plummeted 23% in a single session.

Image Source: TradingView

Be Flexible

Flexibility is one of my biggest assets. Never be afraid to change your mind. John Maynard Keynes said it best – “When the facts change, I change my mind – what do you do, sir?”

Adhere to the General Market Trend

75% of a stock’s move depends on the general market’s direction. For example, in 2022, most long-only investors likely lost money. In 2023, the exact opposite is occurring. Use a simple trend filter like the 200-day moving average to determine whether the stock market is in a bull or bear phase. As an example, I’ve overlaid a 200-day moving average over the S&P 500 Index ETF ((SPY - Free Report) ).

Image Source: TradingView

Conduct a Post Analysis

The stock market is filled with investors who are laser-focused on finding the next hot stock. However, investing is more than simply looking for stocks. To succeed in investing, study yourself and your past trades at least once a year. I recommend finding your top 10 winners and your top 10 losers and figuring out what you did right and wrong. Calculate your win/loss ratio, average winner/loser, and equity curve. You’ll thank yourself later.

"RV UPDATE" BY MILITIAMAN, 23 AUGUST

MilitiaMan (KTFA)

I think as far as everything being in place where Iraq is concerned with their re-instatement timeframe…I think the writing is on the wall that they are going to go into the international financial system…And we also expect to see the new small category notes (lower denominations) released in Iraq…and I am hoping this will happen in the next short period of time.…I believe there was an article from the courts that Iraq had 30 days from July 26th for the budget to be implemented and for them to start spending… for them to start spending –it’s a heck of a lot cheaper to buy things to rebuild with a at least a rate of $1 then 1310…Whatever rate they come out at I believe it will have to be strong. Alaq has said he is not going to float the currency…suggesting it’s going to be a strong rate.

Federal Court specified their own timelines…They specifically stated 30 days from July 26, 2023 that the 2023-2024-25 budget has to be implemented by that date. That’s 30 days.

"PARALLEL MARKET" , 23 AUGUST

Parallel market

Economical 2023/08/15Muhammad Sharif Abu Maysam

The statement issued by the Central Bank on the third of August, regarding the rise in the exchange rate, is among the most important statements issued by this bank in this regard.

The statement clarified all the circumstances that stood behind the speculation market in exchange rates over the years, and presented the motives of monetary policy and its tools aimed at achieving monetary stability. before the law.

The media and many specialists in economic affairs used to call the black market the “parallel market” in which foreign currencies are traded as a market that operates away from government control, as the price in it is much higher than the official price.

What is new in this matter is that the Central Bank confirms, for the first time, that “no party or person has the right to trade in dollars issued by the Central Bank, and that trading and trading with it outside the licensed authorities is a prohibited activity according to the law, according to the text of Banking Law No. (94) of 2004.”

This matter, if applied on the ground, could contribute significantly to achieving monetary stability as soon as possible, without underestimating the importance of other monetary policy tools referred to in the statement.

The parallel market must have its own sources of foreign currency, as it is.

In many countries, the demand for foreign currency is met by private sector exports, domestic tourism, remittances from residents abroad, or other market activities governed by legal market relations.

While the central bank intervenes in cases of imbalance in the exchange rate between the official market and the parallel market with the aim of creating stability in exchange rates, as in cases of “managed floating of the currency”, not that the source of foreign currencies traded in the local markets is from one source, the central bank, and the market is black market parallel.

Accordingly, and as stated by the Central Bank, such a market is a “speculative market,” and The Central Bank has the right to follow legal methods to sue speculators and those who promote them through the media or through social networking sites, as long as it is its only source, and whoever proves otherwise has the right to trade at the prices it decides.

Because legitimizing illegal practices through these media tools has contributed over the years to shuffling the cards and harming the national economy.

https://alsabaah.iq/82403-.html

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...