Including Facilitating Legitimate Trade.. Customs Explains The Advantages Of Implementing The Electronic System

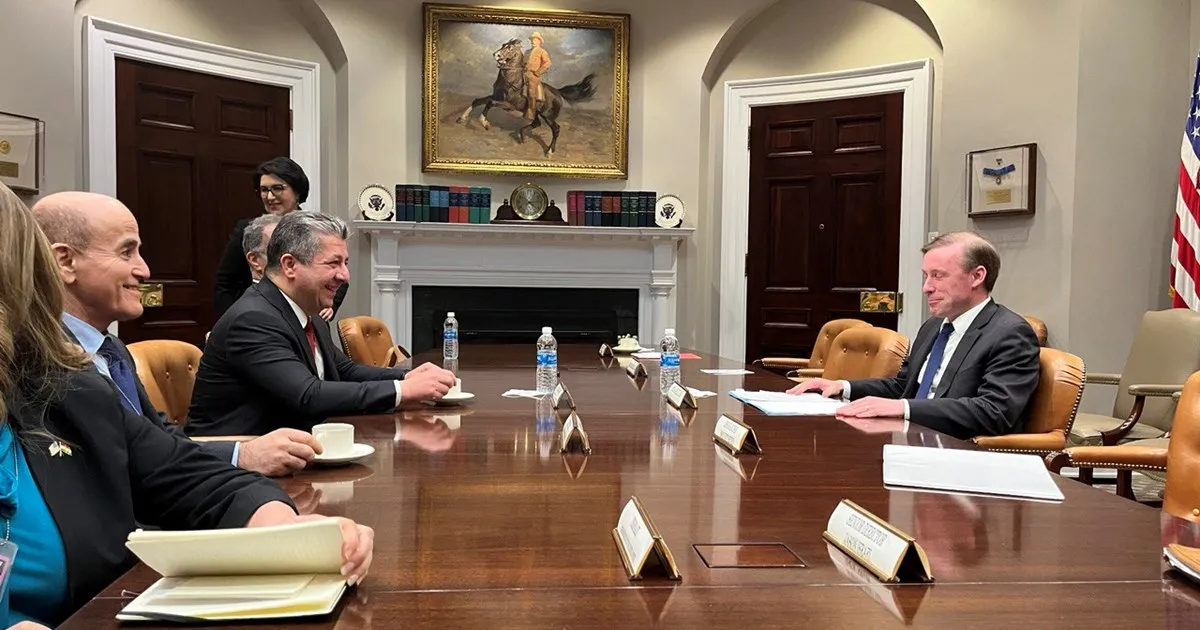

local Basra - IA - Saad Al-Sammak Today, Sunday, Director General of the General Authority of Customs, Hassan Al-Ugaili, explained the advantages of implementing the electronic system in the country, while defining the duties of the Authority in three main axes.

Al-Ugaili said in his speech during the inauguration of customs automation at the Umm Qasr port, followed by the Iraqi News Agency (INA):

“The efforts of the General Authority of Customs, which were made over several years and with direct support by the Minister of Finance and direct follow-up from the Prime Minister, culminated this day in the electronic system that We hope that it will cover all the activities of the General Authority of Customs and customs activity.” Al-Ugaili added,

“The General Authority of Customs is committed to carrying out its duties, which focus on three main axes, the first of which is facilitating legitimate trade, as the current government has issued a set of decisions that help facilitate legitimate trade, and the General Authority of Customs is responsible for implementing those decisions, including:

canceling tax deposits that were collected.” At border crossings, which were obstructing or delaying the completion of customs transactions, as well as

canceling the import license for most imported materials, and

reducing duties on some imported materials.” He continued,

"The General Authority of Customs has begun reviewing many procedures and moving towards simplifying procedures.

Today, the electronic system is one of the tools of the General Authority of Customs to facilitate legitimate trade.

According to the system, transactions are supposed to be completed in a faster manner and with unified customs procedures, meaning that there will be no discrepancy in procedures between one center and another."

Pointing out that, “Under the system, the discretionary power of the employee will be greatly limited and thus the system will be dealt with, as there will be no role for people’s moods in completing these transactions.”

He explained that “the other axis that the General Authority of Customs is working on is protecting or implementing the state’s decisions in the field of restriction and prevention, and this protects the consumer and society from the entry of prohibited materials,” noting that “the third axis of the Authority is revenues or collection, as the system will collect according to Electronic mechanisms that are clear, transparent and announced at the same time, meaning that they provide real-time data to the decision maker at the level of the Ministry of Finance or at the government level that the revenues received by this body are in the amount and at the moment when the information is requested.” He pointed out that

"the system offers great advantages that we will feel by implementing it, as well as the dealing agents of customs clearance companies and the extent of the benefit achieved from this system in their work, as they can complete customs clearance procedures online." https://www/ina.iq/204286--.html