Monday, January 8, 2024

The gap between supply and demand ‘strills’ the Iraqi dinar. Two paths of low dollar prices, 8 JAN

The gap between supply and demand ‘strills’ the Iraqi dinar. Two paths of low dollar prices, 8 JAN

The former Director of the Bureau of Financial Supervision, Salah Nouri, today, Sunday, identified two paths through which the exchange rate of the US dollar against the Iraqi dinar can be reviewed.

Nouri told {Euphrates News}, “the exchange rate is determined between supply and demand,” noting that “the demand for dollars from traders for the purpose of import, which is very diverse due to the disruption of industry and agriculture, while the supply is sourced by the Central Bank through banks, banking offices and foreign transfers.”

He added, “The central bank has taken many measures in accordance with the agreement with the US Federal Bureau to legalize foreign transfers and eliminate dollar smuggling outside the controls and procedures of the Central Bank.”

However, “in any case, a gap between supply and demand remains, and demand is met by banks with their dollar balances, and this remains fluctuating up and down,” Nouri said.

The former director of the Bureau of Financial Supervision continued, “If the situation of traders adapts to the procedures of the Central Bank, the difference between the official exchange rate and the parallel market price will be small, but some traders complain about the complexity and slowness of the central bank’s procedures, which pushes them to demand from the parallel market.”

He pointed out that “the exchange rate is falling as a result of the central bank’s dealing with several import currencies with foreign and Arab banks.”

On February 7, the Council of Ministers announced the approval of the amendment of the dollar exchange rate to 1320 dinars per dollar.

About a year ago, specifically since the Central Bank began working on the electronic platform and the international financial transfer system “SWIFT” (SWIFT), dollar exchange rates in Iraq have not stabilized despite the government and the central bank’s attempts to control the exchange rate in parallel markets.

From.. Raghad Daham

"RV UPDATE: TWO BANKING ANNOUNCEMENTS" BY GOLDILOCKS, 8 JAN

Two Banking Announcements:

* Basel Committee finds Mexico compliant with its Net Stable Funding Ratio standard and large exposures framework, and largely compliant with its Liquidity Coverage Ratio.

* Assessments find Switzerland largely compliant with the Committee’s Net Stable Funding Ratio standard and large exposures framework.

https://www.bis.org/press/p231213.htm

~~~~~~~~~~

“Mortgage demand plummets again despite drop in interest rates”

Let me give you an idea of just how big the Mortgage Market really is: Residential Mortgage Market Size: Residential $13.864 trillion. This is not counting Corporations and Business offices.

The Housing Market is still in the process of resetting their prices to coordinate their values with the Banking System’s new Basel 3 Capital requirements being implemented on January the 16th, 2024.

Look for new market valuations to form in the near term inside this multi-trillion-dollar business. Coordinating real-world values between the markets and the banking system is a phase of the global economic reset that is just beginning to come to a head.

© Goldilocks

FOXBusiness Link

BankingStrategist Link

Sudani: Using electronic card payment is a key pillar of economic reform vocabulary, 8 JAN

Sudani: Using electronic card payment is a key pillar of economic reform vocabulary

Mawazine News – Baghdad

Prime Minister Mohammed Shiaa Al-Sudani stressed that the use of electronic card payment is a key pillar of the vocabulary of economic reform.

The Sudanese office said in a statement that “the Sudanese chaired, on Sunday morning, a meeting dedicated to following up the financial and economic transformation to electronic payment, points of sale and financial trading with electronic cards (POS), in the presence of the Governor of the Central Bank, the advisers of the Prime Minister for strategic, economic and banking affairs, and the Director General of Payments at the Central Bank.”

He added, “The Prime Minister listened to a summary of the latest procedures and executive details of the transition to electronic card payment, in various public and private sector institutions, and what is being implemented by the agencies concerned with follow-up and control of transformation and use. ”

Al-Sudani pointed out, during the meeting, that “the use of electronic card payment and digital payment is a key pillar in the vocabulary of economic reform adopted in the government program.”

The statement continued: “The meeting also witnessed the discussion of the tariffs and commissions charged by financial and banking authorities, as Al-Sudani stressed that citizens should be spared additional financial burdens as a result of these commissions, and that the goal is to facilitate dealing and facilitate payment in all fields, while ensuring the highest levels of security.”

"RV UPDATE" BY GOLDILOCKS, 8 JAN

Goldilocks and Seeds of Wisdom

“In response to a surge in attacks on merchant ships, 18 significant shipping companies have opted to avoid transiting the Red Sea, as reported by the International Maritime Organization (IMO). IMO Secretary-General Arsenio Dominguez informed the UN Security Council on Wednesday that a substantial number of companies have rerouted their vessels around Africa to mitigate the impact of attacks on seafarers.”

“While we continue to hope for a sustainable resolution in the near future and do all we can to contribute towards it, we do encourage customers to prepare for complications in the area to persist and for there to be significant disruption to the global network,” it added.

K News Link

Port Calls Link

~~~~~~~~~~

The moment we see a revalued price on gold, at some level all currencies will be partially gold-backed.

© Goldilocks

~~~~~~~~~~

A full revaluation of the gold price to its real value will give us a fully gold-backed system.

© Goldilocks

~~~~~~~~~~

Bank Indonesia (BI) has confirmed plans to move ahead with exploring a central bank digital currency (CBDC) in 2024, with full-scale trials in partnership with leading commercial banks.

Coin Geek Link

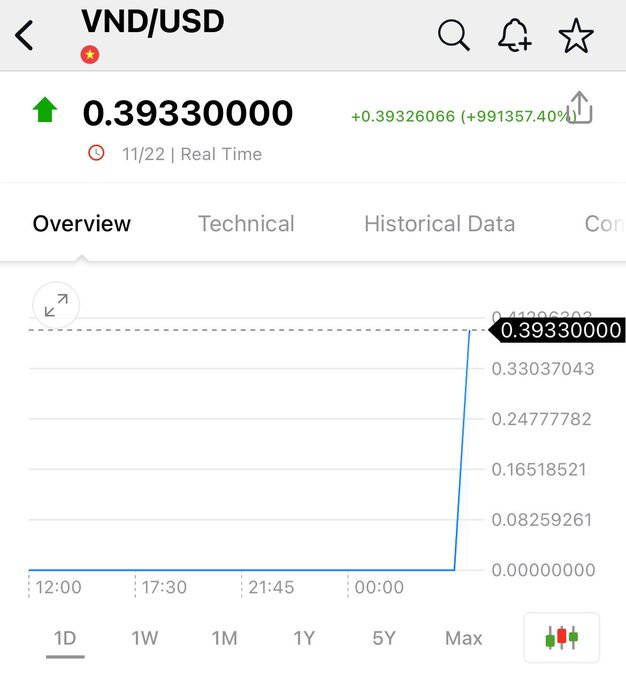

DINAR REVALUATION REPORT: " But VND Dong and Iran IRR Rials are making moves again this weekend! " 25 NOV

DINAR REVALUATION UPDATE Not getting too excited….💥💥 But VND Dong and Iran IRR Rials are making moves again this weekend! Almost looks li...

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...