CONCERNS ABOUT THE DINAR.. WHAT IS THE BENEFIT OF IMPORTING THE DOLLAR FROM OUTSIDE IRAQ?

Wednesday, November 29, 2023

CONCERNS ABOUT THE DINAR.. WHAT IS THE BENEFIT OF IMPORTING THE DOLLAR FROM OUTSIDE IRAQ?, 29 NOV

"IRAQI BAN FRIEND AKI REPORT" BY WALKINGSTICK, 29 NOV

Walkingstick

[Iraqi Bank friend Aki report]

[lower note tests] are happening now. Where? North [Perhaps Kurdistan] ...He said it's happening right now. In fact he says it's been happening...for about a week...We're looking for any rumors or scuttlebutt in the markets. Look everywhere. We're looking for 6 currencies - 1, 5, 10, 20, 50 and 100. Do we have colors for them? Yes, yellow, green, blue, tan, orange and light red. And coins...they're going to come out with coins too.

It's all about the accounting in order to make the exchange rate easier to transition for the accounting. It's all about...the numbers...once they are done with the accounting, once the rate is at 1000 to 1, stand by.

[Aki Iraqi Bank Friend Update]

Number 1 [Aki’s Boss] has informed Aki the CBI is going to have…’All hands on meeting’ to share the results of a recent CBI meeting. These meetings are continual and only with the banks, no politicians.

These meetings were with all the upper management of every bank in Iraq…IOO they’re talking about the new exchange rate of the Iraqi dinar and the new small category notes…We told you there would be one last rate change on the exchange rate of the Iraqi dinar. Aki suggested to us it would be 1,200 to 1…

WALKINGSTICK: …Look more for 1000 to 1 because when they get there then they can lift the three zeros.

Remember, we started with a MR that led to an RV that leads now today to an RD that will lead to an international float. Now...When it gets to the point of the float, a supply and demand of the Iraqi dinar...will determine which exchange rate of the RV that they cap it at.

[Iraqi bank friend Aki update] How will Aki profit by having these banks ? >By exchanging the Iraqi dinar for dollars. This is a profit for the bank. For Aki...

[Iraqi bank friend Aki update]

How will Aki profit by having these banks? By exchanging the Iraqi dinar for dollars. This is a profit for the bank. For Aki...

The economic reform is blossoming...because the monetary reform was a success...It is due to the security and stability that Sudani and Alaq have created for the reforms.

Masrour Barzani: The regional government delegation is holding discussions in Baghdad to resolve the issue of the budget, salaries, and oil, 29 NOV

Masrour Barzani: The regional government delegation is holding discussions in Baghdad to resolve the issue of the budget, salaries, and oil

Sudanese Financial Advisor: The informal exchange market represents only 10% of trading volume, 29 NOV

Sudanese Financial Advisor: The informal exchange market represents only 10% of trading volume

Vietnam upgrades ties with Japan to highest level, 29 NOV

Vietnam upgrades ties with Japan to highest level

November 27, 2023 at 6:26 AM

HANOI (Reuters) – Vietnam and Japan on Monday officially upgraded their relations to a “comprehensive strategic partnership” during a visit by Vietnamese president Vo Van Thuong to Tokyo.

The move underlined Vietnam’s increasingly strategic role as an important link in global supply chains amid trade tension between China and the West, which is helping to bring foreign investment to the southeast Asian country as some companies relocate operations from China.

“This is an important event, opening a new chapter in the Vietnam-Japan relation,” Thuong said in a speech broadcast on national television.

The elevation of ties with Japan followed Vietnam’s historic upgrade of relations with the United States in September, when the former foes signed multiple cooperation agreements, including on semiconductors and critical minerals.

Vietnam has designated five other countries as comprehensive strategic partners, including China, India, Russia, South Korea and the United States.

Japan is Vietnam’s third-largest source of foreign investment and its fourth-largest trading partner, with bilateral trade reaching $50 billion last year.

Several Japanese multinationals, such as Canon, Honda, Panasonic and Bridgestone, are among the largest foreign investors in Vietnam, turning it into a regional manufacturing hub, with one of the fastest-growing economies in Asia.

Vietnam and Japan, both embroiled in separate maritime disputes with China, in 2020 reached a $348 million Japanese loan agreement for Vietnam to build six patrol vessels.

(Reporting by Khanh Vu, editing by Ed Osmond) LINK

BIG CALL HIGHLIGHTS, 29 NOV

Tues. 28 Nov. 2023 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#, 667-770-1865

- ATMs with the new Dinar rate have been placed at the Iraqi Airports.

- The new Iraqi Dinar coins are minted and will be made available to citizens on Wed. 28 Nov.

- On Wed. 28 Nov. the new Iraqi Dinar Rate will be printed in the Gazette.

- Currency dealers will be changing their currency rates Wed. 28 Nov. night after midnight.

- A top Wells Fargo Bank source said Tier4b would be exchanging either Wed. or Thurs. of this week.

- Another source said Tier4b would be exchanging on Thurs. 30 Nov.

- On Wed. 29 Nov. the Sovereigns and the Chinese Elders will be paid (starting overnight Tues. into Wed. overnight). Depending on how that goes will determine when Tier4b will be notified to set appointments.

- One Source said that notification for Tier4b (us, the Internet Group) will come after midnight Wed. night, early Thurs. morning 30 Nov.

- The Admirals Group exchanges were done, but won’t receive liquidity until Tier4b notification.

- Restitution and Recreation Allowances (a lump sum payment) and a significant increase in Social Security starts the first week of Dec. for ages 62 and over.

- NESARA came in on Thanksgiving night 11-23-2023 at 11:11pm.

- President Trump was planning on coming back in the first week of December.

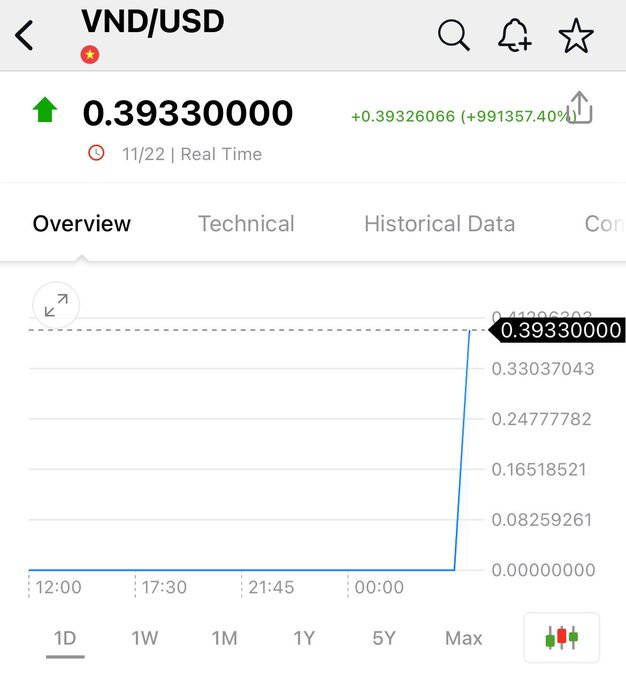

DINAR REVALUATION REPORT: " But VND Dong and Iran IRR Rials are making moves again this weekend! " 25 NOV

DINAR REVALUATION UPDATE Not getting too excited….💥💥 But VND Dong and Iran IRR Rials are making moves again this weekend! Almost looks li...

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...