Monday, November 13, 2023

"RV UPDATE" BY BRUCE, 13 NOV

Bruce

[via WiserNow] If anybody thinks that there are no 800 numbers or actually it's probably an 800 number...They really don't know anything - if they don't know this... our contacts are at the redemption centers...

we know what's going on. We know, for example, that there was a very, very good dinar rate on the bank screens...and it'll migrate to the front screen of the banks... but realize this, our redemption center rates will be higher than the regular bank screens...Bank screens are tied to the Forex...redemption centers are not. They have their own rates and will have the very best and highest rates for us.

...first of all regarding Iraq, very early in the morning...Friday... the ATM machines which have been loaded with lower denomination dinar...meaning being 5 / 10 / 20 /50 / 100’s - sort of like we would have 20s in our ATMs.A Representative Talks About Several Reasons Behind The Dollar Crisis And Identifies The “Most Dangerous” Of Them., 13 NOV

A Representative Talks About Several Reasons Behind The Dollar Crisis And Identifies The “Most Dangerous” Of Them.

Baghdad today – Baghdad Today, Sunday (November 12, 2023), the representative in the Iraqi Parliament, Muhammad Al-Baldawi, considered that there are several reasons behind the dollar crisis in Iraq, but the most prominent of them is the American prevention of financing the Central Bank of Iraq with all its dollar needs.

Al-Baldawi said in an interview with “Baghdad Today” that “the rise in the dollar exchange rate in the parallel market has multiple dimensions, but the most important reason for it is America’s deliberate failure to disburse Iraq’s dollar dues and deliberately delaying them. That is, we are facing direct intervention by Washington in a financial file accompanied by threats.” Imposing sanctions on the central bank.

He added, "All that is happening are means of pressure adopted by the White House towards Iraq in order to achieve several goals, the most prominent of which is making Baghdad a prisoner of its plans in the region."

He pointed out that "America must realize that what it does in Iraq and other countries will ultimately reflect on it, and trying to exploit the economic dimension to harm countries will not achieve anything, especially since world opinion has become dissatisfied with its positions, especially in the recent Gaza events, which provided a cover for the Zionist entity to exterminate an entire people." With American-made missiles.

In contrast to this opinion, the Central Bank administration reiterates from time to time that the dollar is available and there is no shortage of it, and that what is happening is the presence of suspicious trades and operations to obtain the dollar and smuggle it to other countries.

The Central Bank confirms that it is able to meet all “transparent and legitimate” requests for the dollar, whether for import or cash requests, provided that they are legitimate and reveal the ultimate beneficiary to whom this dollar will reach.

However, observers believe that this is relatively inconsistent with the recent trend of the Central Bank to allow banks to import foreign currency from abroad, meaning that it suggests that the Central Bank is facing difficulty in obtaining dollars from the US Federal Bank. LINK

Coffee with MarkZ. 11/13/2023

An Economist "Limits" The Solution To The Exchange Rate Problem To One Condition: It Will Not Be Solved Without It,13 NOV

An Economist "Limits" The Solution To The Exchange Rate Problem To One Condition: It Will Not Be Solved Without It

Baghdad today – Baghdad Economist Nabil Al-Marsoumi confirmed in a blog post on Facebook, followed by “Baghdad Today”, today, Sunday (November 12, 2023), that the exchange rate crisis in Iraq cannot be solved without solving the problem of financing trade with Iran.

While exchange rates continue to rise by about (30 points) at least from the official rate decided by the Central Bank, which decided to raise the value of the official exchange rate of the dinar against the dollar by 10 percent in a measure aimed at reducing the decline in the value of the currency that accompanied the adoption of more regulations. Strictness regarding financial transfers outside the country.

The government then agreed to the Central Bank’s proposal to raise the value of the exchange rate from about 1,470 dinars to 1,300 dinars per dollar, which had a clear impact on the exchange market at that time by reducing prices that reached the level of 1,700 dinars in the parallel market.

Earlier, an Iranian official revealed that Baghdad was moving to propose dealing with Tehran in exchanges in the Iraqi dinar instead of the dollar or other foreign currencies.

The commercial advisor to the Iranian embassy in Iraq, Abdul Amir Rabihawi, said at the meeting of the Joint Iranian-Iraqi Chamber, which was held early last July, that this proposal would be in Iran’s interest, especially in view of “the sanctions on Tehran,” noting that this means implementing all exchanges between men. Business in dinars instead of dollars.

Economists believe that “making an exchange with the Iraqi dinar instead of the dollar supports the Iraqi national currency, and that this matter may also have a political message from Tehran to the United States, that dealing in the dollar can be easily abandoned, and it may involve risks that the Iraqi dinar will be exchanged by Iranians at weak prices lead to a collapse in the exchange rate of the Iraqi national currency against other currencies.

Also, “the idea of using local currencies in trade exchange between Iraq and Iran was an idea put forward by the Federal Reserve in its meetings with officials, and it is applicable despite its difficulty, and it is closely related to Iraqi payments related to the import of electricity and gas, as it was proposed that they be placed” in an account in the bank. The Central Bank of Iraq, to be used to finance purchases and imports related to the humanitarian aspect that Iran is allowed to import, but the trade balance between Iraq and Iran tends in favor of Tehran at about 10 billion dollars annually.

Despite the measures taken by the government to prevent currency speculation, experts and specialists confirmed that “the solutions did not address the structural defect in the economy, as the commercial sector was not reorganized, and the banking system did not fully comply with international standards and the Federal Reserve Bank (the US central bank) in transfer operations.” which is conducted daily.

Also, "the levels of transfers that take place daily are still high and not commensurate with the size of the Iraqi economy, which exceed 200 to 300 million dollars on some days."

On the other hand, “some merchants are complaining about the delay in executing their financial transfers, which has resulted in financial burdens, which the Central Bank’s procedures have not addressed. Therefore, many of them have returned to buying dollars from parallel markets, even if they are at prices more expensive than the banks.”

Iraqi banks must now manage these transfers through the “SWIFT” electronic platform, which is synonymous with more stringent monitoring of transactions, especially by the US Federal Reserve, which rejects any transfer deemed suspicious.

Iraqi banks must currently register “their dollar transfers on an electronic platform, which checks the requests... and the Federal Reserve examines them, and if it has doubts, it stops the transfer.”

With the beginning of the implementation of the electronic system, the Federal Reserve rejected 80 percent of requests for financial transfers to Iraqi banks against the backdrop of doubts related to the final destination of those amounts being transferred.

Source: Baghdad Al-Youm + Agencies LINK

Iraq Plans To “Neglect The US Dollar” And Parliament Proposes “Diversifying Foreign Currency Baskets, 13 NOV

Iraq Plans To “Neglect The US Dollar” And Parliament Proposes “Diversifying Foreign Currency Baskets”

Baghdad today - Baghdad The House of Representatives Finance Committee said today, Monday (November 13, 2023), that there is a necessary and important need to diversify the basket of foreign currencies in Iraq and not rely on the US dollar in commercial transactions.

Committee member Moin Al-Kazemi told “Baghdad Today” that “the basket of foreign currencies in Iraq must be diversified and not relied on the dollar in commercial transactions, whether external or even internal, as this reduces American dominance over the Iraqi economy.”

He added, "The Iraqi economic ground is ready and prepared to strengthen banks in various foreign currencies and not be limited to the US dollar, and there is a real trend by the monetary authority in this matter, and the coming days will witness various commercial transactions through the UAE dirham as well as the Chinese yuan and other currencies, and this will reduce demand." On the dollar, and it will have an impact on reducing the dollar exchange rate in the parallel market.”

Last Saturday (November 11, 2023), a government source in Iraq said that officials from the Central Bank of Iraq held “intensive meetings” with American officials in Abu Dhabi in recent days to discuss external transfers to cover imports.

The source added, according to what was reported by the “official agency,” that “Iraq has strengthened its assets denominated in the yuan through the Singapore Development Bank to finance Iraqi trade and imports with China by about 12 billion dollars annually.”

The source stated that the oil-exporting country also moved to strengthen its assets in UAE dirhams and is negotiating to increase its assets denominated in euros to finance trade with the European Union, according to what was reported by Iraqi news agency “Inaa.”

The source added that negotiations with the American side reached a set of decisions and mechanisms that contribute to facilitating procedures for foreign transfers related to imports through the foreign currency sales window.

He added, "It was agreed to enhance the advance balance of five Iraqi banks in their dollar accounts with Jordanian banks and transfers via JP Morgan Bank," noting that "the problems related to the rejected transfers were resolved, and it was agreed that the rejection of transfers should be based on strong reasons."

He continued: “There were also other meetings that brought together one of the Emirati banks, the Central Bank of Iraq, and the American side, to implement the mechanism for enhancing balances in the Emirati dirham for Iraqi banks,” indicating that “things are going well in this aspect, as all technical details related to the issue have been resolved, and it is expected to begin.” The mechanism for enhancing balances in UAE dirhams during the next few days.”

He stressed that "there are serious negotiations that have reached their final stages to enhance the balances of some Iraqi banks in euros with UBAF Bank to finance trade with the European Union," noting "an increase in the number of banks whose balances in Chinese yuan are being enhanced through the Singapore Development Bank."

The source also reported that bank accounts had begun to be opened in Indian rupees for a number of Iraqi banks at the same correspondent, the Singapore Development Bank (New Delhi branch), and operations to enhance the balance of two Iraqi banks had actually taken place as a first stage, and it is expected that this mechanism will contribute to financing Iraq’s imports from India, especially medicines and materials. Food, which is estimated at about $3 billion. LINK

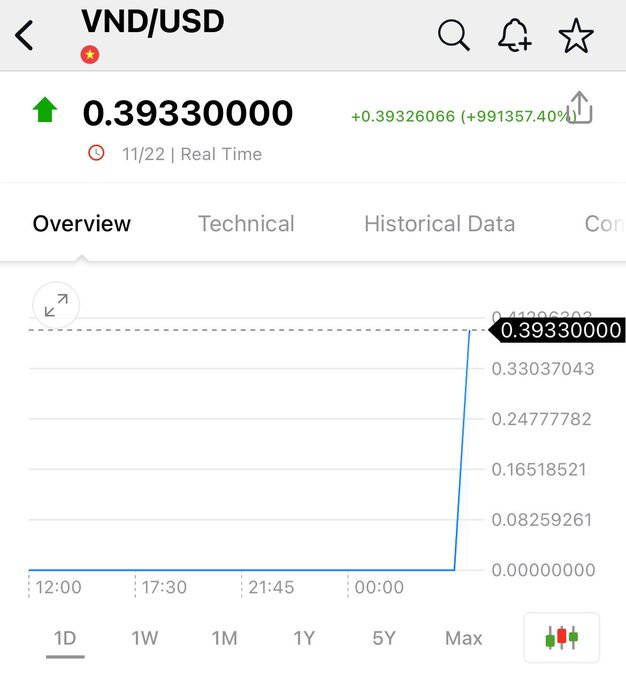

DINAR REVALUATION REPORT: " But VND Dong and Iran IRR Rials are making moves again this weekend! " 25 NOV

DINAR REVALUATION UPDATE Not getting too excited….💥💥 But VND Dong and Iran IRR Rials are making moves again this weekend! Almost looks li...

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...