Wednesday, October 18, 2023

Iraq Just BANNED The Dollar | Sets A New Tone For Global Dollar Dump, 18 0CT

Tech Revolution: 10-18-2023

Iraq has shared an important announcement. Starting on January 1, 2024, Iraq will no longer allow people to take out or make transactions using U.S. dollars.

They're doing this to stop bad people from using the U.S. dollar for illegal activities and to avoid getting in trouble with the United States over sanctions on Iran.

The idea is to prevent about half of the $10 billion that Iraq brings in from the New York Federal Reserve each year in cash from being used in bad ways.

Mazen Ahmed, who works at Iraq's central bank, explained this to. This move is also part of a bigger plan to use the U.S. dollar less in Iraq. People in Iraq have been using the U.S. dollar a lot because they've had many problems like wars and crises since 2003 when the United States invaded their country.

If you put your U.S. dollars in a bank before the end of 2023, you can still take them out in 2024. But if you deposit dollars in 2024, you'll only be able to take out the local currency at a rate set by the government.

The government has one rate for the Iraqi dinar, which is their currency, but on the street, people exchange money at a different rate. Starting in the year 2024, if you happen to possess U.S. dollars in Iraq, there will be some significant changes in how you can use them.

You will have two main options. First, you can use your U.S. dollars with a specially designed card that will allow you to make purchases and transactions inside Iraq at the official government exchange rate.

The second option is to convert your U.S. dollars into the local Iraqi dinar at the rate set by the government.

In simpler terms, if you have U.S. dollars and want to spend money in Iraq, you'll need to convert them into the local currency at the government's exchange rate, and then use the dinar for your transactions.

However, here's an important clarification: These new rules apply primarily to accounts that receive money from other countries. In other words, if you're receiving funds from abroad, these regulations will affect you.

If you're only dealing with money generated within Iraq, you may not be subject to these specific restrictions.

This shift is aimed at controlling the use of foreign currencies, particularly the U.S. dollar, in international transactions within Iraq, ultimately promoting the use of the Iraqi dinar and formalizing the country's financial system.

Iraq has already put a system in place to keep an eye on the money coming in and going out of the country, especially wire transfers, which are like electronic money transfers. This was a big problem before because some people were doing fake transactions and sending money to Iran and Syria, which were under U.S. sanctions.

Iraq has established a new system, with assistance from the United States. This system plays a crucial role in managing Iraq's substantial income from selling oil, a valuable resource for the country.

Over time, this system has become increasingly effective in its operation. One of its key functions is to ensure that U.S. dollars are available at the official exchange rate for individuals and businesses engaged in legitimate international trade.

This means that when Iraqis or businesses want to buy essential items like food and consumer goods from other countries, they can access U.S. dollars at a fair and standard rate.

Imagine you're buying groceries at a store, and you want to use your local currency to purchase imported products. Thanks to this system, Iraqis can easily obtain U.S. dollars, which are widely accepted in international trade, to pay for these goods.

This simplifies the process and ensures that transactions are carried out smoothly, without any unexpected currency complications.

So, this system not only helps Iraq manage its oil revenue but also supports the everyday needs of its people by providing access to U.S. dollars for essential imports, all while maintaining a fair and consistent exchange rate.

But, according to Mr. Ahmed, people were still finding ways to misuse cash withdrawals, especially travelers who were allowed to take out up to $3,000. Iraq wants to make sure it doesn't upset the United States because it relies on U.S. help to manage its money and oil.

At the same time, Iraq's government, which is supported by powerful groups close to Iran, doesn't want to make Iran mad or upset the groups that are deeply involved in Iraq's informal economy.

More Details In The Video

Iraq’s Ambition: From Dates Industry to Gaza Conflict, 18 OCT

Iraq’s Ambition: From Dates Industry to Gaza Conflict

In the heat of the recent conflict between Israel and Hamas, another narrative quietly unfolded in the Middle East’s labyrinth of connections and loyalties. This narrative, away from the Gaza Strip’s smoke and rubble, involves Iraq, one of the world’s leading date producers. While this might seem unrelated to the conflict, the interplay of regional politics and global trade offers a nuanced understanding of the Middle East’s dynamics.

Shaping the Date Industry

Iraq has taken a significant step to solidify its position in the global market: it has voted to join the International Dates Council. This move may appear inconspicuous amidst the region’s political turmoil, but it is a manifestation of Iraq’s ambition to capitalize on its agricultural resources. As one of the world’s leading date producers, Iraq’s involvement in this global body will help it manage and promote its dates industry, potentially influencing global prices and trade policies.

The Proxy Web in Gaza Conflict

While Iraq is making strides in the date industry, its factions loyal to Iran have reportedly been involved in supporting Hamas during the Israeli war on the Gaza Strip. These factions have allegedly established a ‘resistance operations room,’ signaling Iran’s influence reaching beyond its borders. The leaders of these factions visited Syria and Lebanon to coordinate with regional groups, indicating a complex network of alliances and proxies.

Photographs of these leaders, including the head of Kata’ib Sayyid al-Shuhada, Abu Alaa al-Walae, in Lebanon, circulated among activists, confirming their presence. This intricate web of connections echoes the region’s complexity, where power dynamics are often manifested through proxies rather than direct involvement.

A Media War or a Ground Offensive?

Despite the intensity of their support for Hamas, these Iraqi factions have ruled out the possibility of a traditional confrontation with Israel in response to a ground attack. This stance suggests that their involvement is primarily centered on providing support and gathering intelligence rather than direct combat.

However, the implications of this ‘media war’ are profound. It underscores Iran’s expansive influence in the region and its ability to coordinate various proxy groups. It also adds another layer of complexity to the conflict, with multiple actors involved on different levels. The potential for escalation cannot be ignored if these factions decide to take direct action against Israel.

Future Implications

The interplay of Iraq’s agricultural ambitions and its factions’ involvement in the Gaza conflict paints a comprehensive picture of the region’s complexities. It highlights the country’s wider aspirations to strengthen its global influence while illuminating the intricate network of alliances on the ground.

As the geopolitical chessboard continues to evolve, the role of Iraq and its proxies will undoubtedly shape the region’s future. Their involvement in the Gaza conflict, coupled with their ambition in the dates industry, signifies a nation attempting to balance its regional loyalties with its global ambitions.

https://bnn.network/world/russia/iraqs-ambition-from-dates-industry-to-gaza-conflict/

Finance and Politics Intertwine: A Deep Dive into the KRG-Iraqi Finance Committee Meeting, 18 OCT

Finance and Politics Intertwine: A Deep Dive into the KRG-Iraqi Finance Committee Meeting

Amidst the labyrinth of political tensions and economic hardships, a slender thread of dialogue has been extended between the Kurdistan Regional Government (KRG) and the Iraqi Finance Committee. In a four-hour discourse held in the heart of Baghdad, Awat Sheikh Janab, leading the KRG delegation, and his counterparts from the Finance Committee, sought to untangle the knot of financial burdens plaguing the salaried employees in the Kurdistan Region.

A Struggle for Sustenance

The KRG, grappling with financial difficulties, has found itself in the throes of escalating disagreements with the central Iraqi government over the distribution of the region’s budget share. The result is a singularly human crisis: the inability of the KRG to pay its employees, triggering a wave of unrest and protests within the Kurdistan Region.

A Step towards Resolution

The recent diplomatic rendezvous is hailed as a promising step towards resolving the salary issue and thawing the frosty relations between the KRG and the central government. Both parties, recognizing the need to prioritize the welfare of Kurdistan’s salaried employees, have agreed to separate this matter from the broader political disputes. A beacon of hope, perhaps, in the murky sea of uncertainty.

Seeking Support in a Tumultuous Economy

The KRG’s financial struggles are largely attributed to the plummeting oil prices and the economic fallout of the COVID-19 pandemic. The region, heavily reliant on oil revenues, has been severely impacted, pushing it to seek financial support from the central government. In an attempt to diversify its economy, the KRG has been encouraging investment in industries such as agriculture, tourism, and manufacturing. However, these efforts are continuously undermined by the financial constraints faced by the region.

Meanwhile, the geopolitical landscape of the region continues to shift. From Libya, where protests erupted over a deadly strike on a Gaza hospital, to Israel, where the government halted military operations during US President Joe Biden’s visit. In Iraq, the development of a ‘Dry Canal’ road project is underway, aiming to connect the north and south, boost investments, and significantly alter international transport routes. Amidst these changes, the Iraqi government is courting foreign investment, inviting Spanish companies to contribute to the development road project and invest in sectors like transport and renewable energy.

But hurdles remain. Economic experts point out the lack of an industrial base and agriculture in Iraq, potentially impeding its entry into the BRICS group. Furthermore, the Central Bank of Iraq’s decision to raise the interest rate for bank depositors, part of its banking reform measures, reflects the country’s ongoing efforts to revitalize its banking system.

While these developments unfold, Huawei, the Chinese multinational technology company, showcased its latest artificial intelligence and digital transformation solutions at the GITEX Global 2023 exhibition in Dubai. A testament to the relentless march of technological evolution, even amidst political and economic turmoil.

In summary, the dialogue between the KRG and the Iraqi Finance Committee is not merely a meeting; it is a manifestation of the shared human will to overcome adversity. It is a testament to the power of dialogue in resolving crises and the potential for cooperation amidst conflict. As the region witnesses a confluence of protests, diplomatic visits, infrastructure projects, and technological advancements, the plight of the salaried employees of Kurdistan remains a stark reminder of the human element embedded in the grand narrative of politics and economics.

The Central Bank Denies “Information” Issuing A New Category Of Local Currency, 18 OCT

The Central Bank Denies “Information” Issuing A New Category Of Local Currency

October 16 14:18 Information / Baghdad.. The Central Bank of Iraq denied, today, Monday, that the bank has any intention to issue a new currency or a small or large denomination during the current period.

A member of the Board of Directors of the Central Bank of Iraq, Ahmed Barihi, said in a statement to “Al-Ma’louma” that “talk about issuing a new currency by the Central Bank of Iraq is not true at the present time.” Berihi added, “If a new denomination of currency is issued, whether small or large, it will not affect the exchange rate of the dollar against the dinar, but rather it will only serve and facilitate transactions in the simple market.”

A member of the Board of Directors of the Central Bank of Iraq pointed out that

"the Iraqi currency is stable and the existing denominations are sufficient."

A member of the Parliamentary Finance Committee, Representative Nermin Maarouf, announced in press statements that

the committee will discuss with the Governor of the Central Bank the feasibility and motives behind taking the decision to issue the 20,000 dinars denomination, the

financial value of this denomination and other details related to its expected issuance. Ended / 25 AD

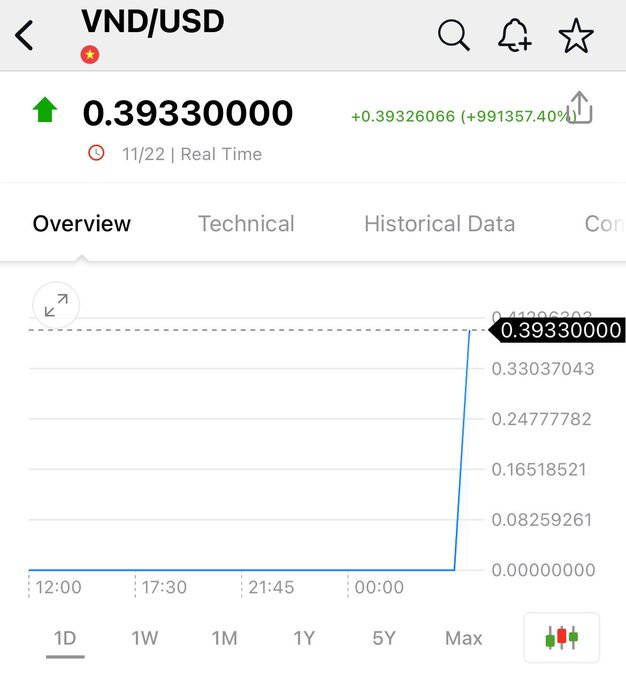

DINAR REVALUATION REPORT: " But VND Dong and Iran IRR Rials are making moves again this weekend! " 25 NOV

DINAR REVALUATION UPDATE Not getting too excited….💥💥 But VND Dong and Iran IRR Rials are making moves again this weekend! Almost looks li...

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...