Monday, September 11, 2023

Federal Prime Minister: We Are Committed To The Budget Law And We Refer Those Accused In The Kirkuk Events To The Law, 11 SEPT

Federal Prime Minister: We Are Committed To The Budget Law And We Refer Those Accused In The Kirkuk Events To The Law

Iraq 14:25 - 2023-09-10 Federal Prime Minister Muhammad Shiaa al-Sudani announced his commitment to the general budget law and dealing with the region’s entitlement to the budget on the basis of the general budget law issued by the House of Representatives. Regarding the outbreak of the crisis that occurred around the building of the advanced headquarters of the Joint Operations Command in Kirkuk, which the Democratic Party left after the referendum, the Prime Minister confirmed Federal Ministers refer those accused of martyring and wounding citizens in Kirkuk to law.

Muhammad Shiaa Al-Sudani said during a statement to the Kurdsat News satellite channel: “There are numbers and statistics that govern everyone’s budget entitlements, and we, in turn, are committed to the general budget law.”

The Prime Minister of the Federal Council added: “We deal with the region’s share on the basis of the general budget law, and we are also awaiting the result of hosting the Minister of Finance of Iraq and the region to the Finance Committee and the House of Representatives to address budget-related disputes.”

Regarding the tensions and disturbances that occurred in the past few days in Kirkuk over a building belonging to the Democratic Party, which it left as a result of the Kurdistan Region’s referendum and occupied by the General Command of Joint Operations in the city, Muhammad Shiaa al-Sudani pointed out that: “Kirkuk must be removed from disputes and conflicts, and we will remove anyone whose hands are dirty.” "With the blood of the citizens of Kirkuk, it will be transformed into the law."

"RV UPDATE" BY MILITIAMAN, 11 SEPT

Militia Man

The news outlets and the media doesn't quite paint the picture in a cut and dry manner. That's not their job is to babysit us and it's not their job to tell you every specific thing that they're going to do, how they're going to do it, what the exchange rate is, what the date is. Anybody that thinks that is going to ever be possible I'm not sure you should be in this investment. The fact remains we all have curiosity so fair enough. We're all curious to what that is and we're going to have to wait to find out...

Iraq's gearing to go internationaland you can see that with all the trade that's done with China, Japan, United States of America, Canada, Jordan, Saudi Arabia, Iran, the borders, trucking everything is coming together...Iraq's oil capacity and output is increasing, the non-oil revenues are increasing and they're exporting agriculture and their credit rating is in good standing. They're basically saying we're open for business...It's stuff we've never seen before. It's phenomenal...

2023-24-25 budget has not been opened. They're not spending money yet. I don't think anybody out there has any data to support the fact that they have. I haven't seen it.

Article quote: "...Many Iraqi people including the Kurds may not have known in order to clarify part of the secrets of the crisis despite Baghdad's efforts to overcome them." What are they talking about?

They're giving an excuse why some things didn't happen. They're giving themselves a way out and that way out was something that was secret. What could not be disclosed to them until the last minute? ...My view on it is that secret, that unknown, is likely going to turn out to be an exchange rate change...

5 Dividend-Paying Growth Stocks for an Uncertain September, 11 SEPT

U.S. stock markets are directionless at present as market participants remain clueless about a near-term recession and the Fed’s decision regarding the future movement of interest rate. Year to date, the Dow — the biggest gainer of 2022 — is up 4.3%. The broad-market benchmark — S&P 500 Index — has advanced 16.1%. However, the tech-heavy Nasdaq Composite has rallied 31.5%, buoyed by a lower inflation rate and the Fed’s decision to reduce the magnitude of interest rate hike.

However, last month, U.S. stock markets faced major setbacks for the first time in 2023. The Dow, the S&P 500 and the Nasdaq Composite slid 2.4%, 1.8% and 2.2%, respectively. Market participants remained concerned after Fed Chairman Jerome Powell’s comment at the Jackson Hole Annual Monetary Policy Symposium that the central bank may pursue more hikes in interest rate depending on economic data.

At present, the interest rate is in the range of 5.25-5.5%, its highest in more than 22 years. Investors are worried about how markets will behave this month. September is historically the worst-performing month on Wall Street. In the absence of earnings results, the Fed’s September FOMC meeting will be the key focal point this month.

In this regard, investors are hopeful that a series of recently released weak economic data may act as a barrier for the central bank to hike interest rates further. Nevertheless, a large section of economists and financial analysts expects the Fed to hike interest rate by 25 basis points in its November FOMC meeting.

At this stage, it will be prudent to invest in growth stocks with a favorable Zacks Rank that pay regular dividend to strengthen one’s portfolio.

Our Top Picks

We have narrowed our search to five dividend -paying growth stocks that have solid upside left for the rest of 2023. These stocks have witnessed positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #1 (Strong Buy) and has a Growth Score A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

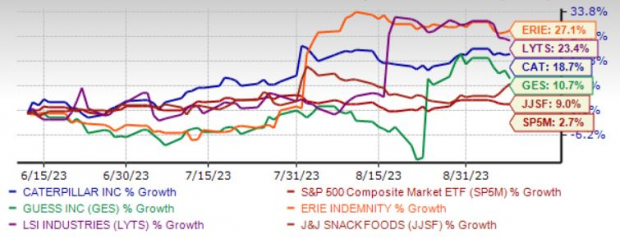

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Caterpillar Inc. (CAT - Free Report) has seen year-over-year revenue and earnings growth for nine straight quarters thanks to its cost-saving actions, strong end-market demand and pricing actions that offset the impact of supply-chain snarls and cost pressures. We expect the company’s adjusted earnings per share for 2023 to grow 19.5% and revenues to rise 7.6%.

Caterpillar has an expected revenue and earnings growth rate of 11.9% and 43.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last 30 days. CAT has a current dividend yield of 1.84%.

Erie Indemnity Co. (ERIE - Free Report) operates as a managing attorney-in-fact for subscribers at the Erie Insurance Exchange in the United States. ERIE provides sales, underwriting, policy issuance, and renewal services for the policyholders on behalf of the Erie Insurance Exchange.

Erie Indemnity has an expected revenue and earnings growth rate of 12.5% and 32.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.4% over the last 30 days. ERIE has a current dividend yield of 1.72%.

LSI Industries Inc. (LYTS - Free Report) is an Image solutions company. It combines integrated design, manufacturing, & technology to supply its own high-quality lighting fixtures and graphics elements for applications in the retail, specialty niche, and commercial markets. LYTS has two segments, Lighting and Display Solutions. LYTS operates in the United States, Canada, Mexico, Australia, and Latin America.

LSI Industries has an expected revenue and earnings growth rate of 4.2% and 27.3%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 19.1% over the last 30 days. LYTS has a current dividend yield of 1.33%.

Guess? Inc. (GES - Free Report) has benefited from strength in its businesses across Europe and Asia, along with its focus on six strategic initiatives. The core strategies include organization and culture, functional capacities, brand relevance with three main consumer groups (heritage, Millennials and Generation Z customers), customer focus, product brilliance, and an international footprint. GES is progressing with its customer-centric initiatives, including omnichannel capabilities and advanced data analytics.

Guess? has an expected revenue and earnings growth rate of 3.3% and 10.6%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the last 30 days. GES has a current dividend yield of 5.20%.

J&J Snack Foods Corp. (JJSF - Free Report) manufactures, markets, and distributes nutritional snack foods and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada. JJSF operates through three segments: Food Service, Retail Supermarkets, and Frozen Beverages.

J&J Snack Foods has an expected revenue and earnings growth rate of 3.6% and 25.9%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 6.6% over the last 60 days. JJSF has a current dividend yield of 1.66%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

“Black gold mafias” in Iraq...holes that generate billions of dollars in the pockets of influential parties , 11 SEPT

“Black gold mafias” in Iraq...holes that generate billions of dollars in the pockets of influential parties - Urgent

Today, Sunday (September 10, 2023), oil affairs specialist Ghanem Hassan revealed the truth about the existence of crude oil “mafias” in Iraq.

Hassan told "Baghdad Today", "Crude oil mafias exist in the country, especially the southern governorates, and they are basically arms of powerful parties that steal oil by bypassing the main pipelines, but they are not able to drill any well and steal crude oil because the well-drilling mechanism is complex and requires huge resources." It can only be provided through the Ministry of Oil and international investment companies.”

He added, "The theft of oil takes place in the remote areas through which crude oil pipelines pass and is monitored from time to time," pointing out that "the Ministry of Interior dismantled, months ago, the largest network in the history of Iraq for stealing and smuggling oil in which senior officers were involved," noting that “The network revealed many secrets.”

He continued: "There are wells in northern Iraq being drilled by specialized companies, and oil is being smuggled away from the Iraqi Marketing Company (SOMO), and there are important parties involved in this act and they are monitored and known by those concerned."

He pointed out that "Iraq's problem is smuggling, which represents a huge waste of the country's wealth, as it is sold for up to 40% less than its real price, and the money goes into the pockets of corrupt people, mafias, and the economic arms of certain parties."

Black gold mafia

Observers indicate that due to the weakness of government oversight and the difference in fuel prices between the provinces of the region compared to other provinces and neighboring countries, oil smuggling operations are carried out by creating holes in the main transport pipelines by connecting high-pressure pipes to withdraw and smuggle the oil .

Prime Minister Muhammad Shiaa Al-Sudani announced on November 2, 2022, “the dismantling of the largest oil smuggling network in Basra Governorate, at a time when the National Security Service revealed the involvement of senior officers and employees, directors in the Energy Police and a number of associates in Basra Governorate, and the confiscation of 49 tanks.” With wheels prepared for smuggling, 93 dens and 496 tanks violating controls were found, in addition to the closure of 11 stations violating controls as well, while the smuggled quantities were estimated at 75 million barrels per month.

By calculating the minimum return on sales from the smuggling network. If the value of one barrel is estimated at $50, the revenues generated from selling 75 million barrels would be approximately four billion dollars per month.

The revelation of the dismantling of a number of oil derivatives smuggling networks opens the door to the file of the “black gold mafia,” which has spread in the country under the auspices of a number of senior officials and police commanders, causing severe damage to the Iraqi economy and negatively impacting the livelihood of citizens link

To end the dispute between the region and Baghdad. Parliament intends to legislate the oil and gas law in its current session, 11 SEPT

Time : 2023/09/10 13:09:44

{Political: Euphrates News} Member of the House of Representatives Zainab Al-Khazraji confirmed the determination of the House of Representatives to approve the oil and gas law during the current session to end all differences between Baghdad and the region.

Al-Khazraji said in a statement drawn by {Euphrates News}, that "the adoption of the oil and gas law will end all the differences that exist between Baghdad and the region, which have been pending for years."

He added, "Among the important laws that the House of Representatives intends to approve is the oil and gas law, which has been suspended since 2005," indicating that "its approval will contribute to preserving the fair distribution of wealth throughout Iraq. LINK

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...