U.S. stock markets are directionless at present as market participants remain clueless about a near-term recession and the Fed’s decision regarding the future movement of interest rate. Year to date, the Dow — the biggest gainer of 2022 — is up 4.3%. The broad-market benchmark — S&P 500 Index — has advanced 16.1%. However, the tech-heavy Nasdaq Composite has rallied 31.5%, buoyed by a lower inflation rate and the Fed’s decision to reduce the magnitude of interest rate hike.

However, last month, U.S. stock markets faced major setbacks for the first time in 2023. The Dow, the S&P 500 and the Nasdaq Composite slid 2.4%, 1.8% and 2.2%, respectively. Market participants remained concerned after Fed Chairman Jerome Powell’s comment at the Jackson Hole Annual Monetary Policy Symposium that the central bank may pursue more hikes in interest rate depending on economic data.

At present, the interest rate is in the range of 5.25-5.5%, its highest in more than 22 years. Investors are worried about how markets will behave this month. September is historically the worst-performing month on Wall Street. In the absence of earnings results, the Fed’s September FOMC meeting will be the key focal point this month.

In this regard, investors are hopeful that a series of recently released weak economic data may act as a barrier for the central bank to hike interest rates further. Nevertheless, a large section of economists and financial analysts expects the Fed to hike interest rate by 25 basis points in its November FOMC meeting.

At this stage, it will be prudent to invest in growth stocks with a favorable Zacks Rank that pay regular dividend to strengthen one’s portfolio.

Our Top Picks

We have narrowed our search to five dividend -paying growth stocks that have solid upside left for the rest of 2023. These stocks have witnessed positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #1 (Strong Buy) and has a Growth Score A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

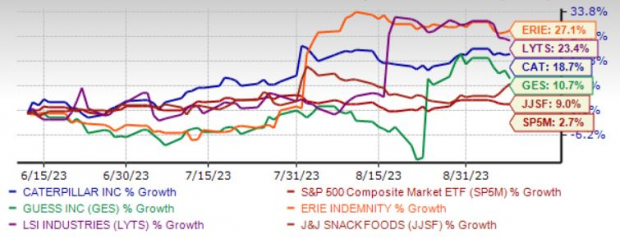

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Caterpillar Inc. (CAT - Free Report) has seen year-over-year revenue and earnings growth for nine straight quarters thanks to its cost-saving actions, strong end-market demand and pricing actions that offset the impact of supply-chain snarls and cost pressures. We expect the company’s adjusted earnings per share for 2023 to grow 19.5% and revenues to rise 7.6%.

Caterpillar has an expected revenue and earnings growth rate of 11.9% and 43.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last 30 days. CAT has a current dividend yield of 1.84%.

Erie Indemnity Co. (ERIE - Free Report) operates as a managing attorney-in-fact for subscribers at the Erie Insurance Exchange in the United States. ERIE provides sales, underwriting, policy issuance, and renewal services for the policyholders on behalf of the Erie Insurance Exchange.

Erie Indemnity has an expected revenue and earnings growth rate of 12.5% and 32.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.4% over the last 30 days. ERIE has a current dividend yield of 1.72%.

LSI Industries Inc. (LYTS - Free Report) is an Image solutions company. It combines integrated design, manufacturing, & technology to supply its own high-quality lighting fixtures and graphics elements for applications in the retail, specialty niche, and commercial markets. LYTS has two segments, Lighting and Display Solutions. LYTS operates in the United States, Canada, Mexico, Australia, and Latin America.

LSI Industries has an expected revenue and earnings growth rate of 4.2% and 27.3%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 19.1% over the last 30 days. LYTS has a current dividend yield of 1.33%.

Guess? Inc. (GES - Free Report) has benefited from strength in its businesses across Europe and Asia, along with its focus on six strategic initiatives. The core strategies include organization and culture, functional capacities, brand relevance with three main consumer groups (heritage, Millennials and Generation Z customers), customer focus, product brilliance, and an international footprint. GES is progressing with its customer-centric initiatives, including omnichannel capabilities and advanced data analytics.

Guess? has an expected revenue and earnings growth rate of 3.3% and 10.6%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the last 30 days. GES has a current dividend yield of 5.20%.

J&J Snack Foods Corp. (JJSF - Free Report) manufactures, markets, and distributes nutritional snack foods and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada. JJSF operates through three segments: Food Service, Retail Supermarkets, and Frozen Beverages.

J&J Snack Foods has an expected revenue and earnings growth rate of 3.6% and 25.9%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 6.6% over the last 60 days. JJSF has a current dividend yield of 1.66%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.