Tuesday, September 5, 2023

Iraq Achieves The Highest Trade Surplus In History.. An Expert Summarizes The Reasons And Clarifies The "Restrictions", 5 SEPT

Iraq Achieves The Highest Trade Surplus In History.. An Expert Summarizes The Reasons And Clarifies The "Restrictions" - Urgent

Baghdad today - follow-up Today, Monday (September 4, 2023), economist Nabil Al-Marsoumi announced that Iraq achieved the highest trade surplus in the past year 2022, while he indicated that the trade surplus had increased unrelated to reform.

In his post, Al-Marsawi outlined the reasons for Iraq achieving the highest trade surplus in the past year, pointing out that the surplus is "the difference between merchandise exports and imports."

And he continued, "The surplus achieved for the year 2022, over the course of the history of the oil industry, which is close to a hundred years old, as the surplus amounted to 53.54 billion dollars due to the increase in oil exports in 2022 to about 120 billion dollars, of which 115 billion dollars came from crude oil exports, and 5 billion dollars most of it." of black oil exports.

Al-Marsoumi added, "This means that the increase in the trade surplus in Iraq has nothing to do with reform, development, diversification of the economy, or any self-efforts, but rather is linked to an external variable, which is oil prices, whose annual rate in 2022 reached more than $95 a barrel."

Trade Surplus

In addition, statistics conducted by the German company Statista , which specializes in market and consumer data, today, Monday (September 4, 2023), revealed that Iraq achieved the largest trade surplus for the past year 2022 over the past ten years.

The trade balance indicates the differences in imports and exports of goods in the country during the year. If the value of its exports during a period exceeds the value of its imports, it is called a surplus in the trade balance. If the total value of imports exceeds the total value of exports, it is called a deficit in the trade balance.

And the company stated in a table it published today, that Iraq achieved the highest trade surplus for goods in 2022 over the past ten years, as the surplus last year amounted to $53.54 billion, up by 64% from 2021, when the trade surplus for goods in that year reached $20.08 billion.

He pointed out that Iraq achieved a deficit in its trade balance for two years, the first in 2020, when the deficit amounted to 4.11 billion dollars, and the second in 2015, when the trade deficit amounted to 0.94 billion dollars.

And the report continued, while in 2019 the balance achieved a trade surplus of $16.62 billion, in 2018 the trade surplus reached $35.95 billion, and the trade surplus in 2017 reached $15.1 billion, indicating that the trade surplus in 2012 amounted to $35.39 billion.

Oil Export

And Iraq had achieved during the past year (2022) financial revenues of more than 115 billion dollars from the export of crude oil, to be the highest in years, according to official figures announced by the Iraqi Ministry of Oil.

According to those figures, the daily export rate amounted to 3,320,000 barrels, which is a total of one billion, 211,800,000 barrels for a full year.

Reflections

And about the repercussions of these financial revenues on the economy and the citizen, and their impact on resolving the economic crises facing the country, whose budget depends more than 95% on oil sales, the financial advisor to the Iraqi government, Mazhar Muhammad Salih, says that these revenues were subject to two restrictions in financial behavior due to the absence of the budget law for the year 2022:

The first is by adhering to Article 13 of the amended Financial Management Law No. 6 of 2019, which requires spending 1/12 of the total actual ongoing or current expenditures in the previous budget estimated at 115 trillion dinars ($70 billion).

The second restriction refers to the allocations contained in the Emergency Law for Food Security and Development No. 2 of 2022, amounting to 25 trillion dinars ($17 billion), which means that the total expenditures for 2022 amount to 140 trillion dinars ($88 billion).

Saleh explains that the remaining financial surplus from the 2022 revenues is 27 trillion dinars ($18.5 billion), and it will be an opening balance in the 2023 budget.

Sovereign Fund

For his part, the economic academic at the University of Baghdad, Ali Dadoush, stresses the need to invest the financial surplus in developing industry and agriculture and supporting the foundations of the real private sector, to operate factories and factories and produce locally manufactured goods and services, in conjunction with the gradual re-imposition of taxes on goods that are produced locally, in line with Activating the role of oversight and preventing the removal of locally produced commodities and keeping them within prices equal to or a margin lower than the prices of competing foreign commodities.

Dadush added, "All of the aforementioned is achieved through the method of balancing programs and performance with the establishment of the sovereign fund," which he considers "the first step towards diversifying the sources of the Iraqi economy."

The academic indicated that this guarantees the solution of several problems rooted in the Iraqi economy, such as unemployment and corruption, in both its financial and administrative aspects, the imbalance of the trade balance and the smuggling of foreign currency abroad.

Source: "Baghdad Today - Agencies" LINK

"RV UPDATE" BY MILITIAMAN, 5 AUGUST

MilitiaMan (KTFA)

I wrapped up this week talking about all the progress that has been made. What has been done since January. Big things like joining the World Trade organization as an observer status…which has been ongoing since 2004…in February to August we see they are gearing up for full ascension to the WTO and this is a big deal. They will be out in the world economy again and in the global financial system.

My understanding is they have the security and stability in the country…enough that we can see all the countries making deals and doing things with Iraq. …Iraq is going to make a lot of money…once they have an article 8 exchange rate …that is required…For full ascension…all of us will have a different venue in a short period of time.

Article:

“Deal with the International Finance Corporation for the development and rehabilitation of the Baghdad International Airport”

It’s going to be just like the Saudi Arabia International Airport, Los Angeles International Airport. It’s going be a big hub and they’re gateway to the country…It shows a sign of sovereignty …internationalism …it’s a massive thing…When it says it’s going to qualify Baghdad as an international airport, it comes will a lot of different things. We’re not talking about an international currency at 1310. It doesn’t work that way…

Iraq is ready to go international. What we're hoping and praying for is they show us an Article VIII compliant exchange rate and show us their new currency they're going to be using in the near future. I think those new small category notes that were printed back in 2018 need to get exposed to the world...

What does it mean to achieve Iraq’s largest trade surplus? Government advisor answers, 5 SEPT

What does it mean to achieve Iraq’s largest trade surplus? Government advisor answers

Three Investments That Put Your Money to Work With Less Risk, 5 SEPT

Editor’s note: This is part three of a five-part series on supplemental income streams in retirement. Part one, Could Supplemental Income Strategies Work for Your Retirement?, is an introduction to the series. Part two: A Managed Account Offers Optimization and Tax Efficiency. Part three: Annuities Provide Peace of Mind and Lifetime Income. Part five, about putting the cash in your emergency fund to work, arrives on Tuesday, Sept. 12.

As you near the end of your prime earning years, it can be harder to confidently weather fluctuations in the markets. Still, you may be unwilling to give up your retirement assets’ power to grow. Shifting assets to safer classes of investments may be an effective strategy for supplementing your retirement income without sacrificing the safety of your principal investment.

When looking for the most reliable way to grow investable assets, most people turn to the stock market. With an average annual return over the last 50 years of 10%, investing in the market is a great way to help grow your principal retirement assets — when you have time on your side. But as you near retirement, your investments become more susceptible to short-term market dips and may leave you with little time to recover losses. There are less-risky investment classes and financial products that can still put your money to work while hedging against swings in the market. Here are some of them:

Government-backed Treasuries

One of the safest investments during periods of market volatility or high inflationare government-backed Treasuries such as savings bonds and Treasury bills. Treasuries are backed by the U.S. government and can be purchased to mature at varying intervals from as little as a few months to several decades. While you shouldn’t expect a rate of return comparable to most stocks, government Treasuries — in most cases — will at minimum keep pace with inflation and can even be smarter investments as interest rates rise to bring inflation down.

The barrier for entry in Treasury securities is also low, with bonds available in a variety of denominations at or above $1,000. In the event you have a need for immediate cash, government bonds may be sold for at least the value you purchased them for — but you’ll miss out on the bond’s maturity value and any future interest payments.

Despite their low risk, bonds are not always a perfect solution — particularly when the markets are stable. Because of their lower rate of return, investors should expect only modest gains, which means lost opportunity for more rewarding returns from other investments in good economic times. Also, while Treasury-backed bonds are typically non-callable — meaning the issuer cannot pay off the bond before it matures — other short-term bonds can be called, closing the investor off from additional interest payments.

Brokered CDs

Another potential consideration for investors looking for more predictable or lower-risk returns on investment is a brokered certificate of deposit (CD). A brokered CD differs from a traditional bank CD in that the investor purchases a portion of a larger bank CD from a brokerage firm. The brokered CD earns interest and has a maturity date just like a traditional CD, but also typically has higher yields for investors due to the larger underlying investment from the brokerage firm.

Brokered CDs can be advantageous options for investors who need flexibility with their investable assets. In the event that an investor needs access to their capital before the maturity date of the CD, brokered CDs often can be sold on the secondary market without the high penalty fee you’d pay to withdraw money from a bank CD.

While brokered CDs offer more flexibility and higher yields, they can be problematic for investors in a shifting interest rate environment. As rates rise, investors in a brokered CD may have difficulty selling their lower-interest investment on the secondary market. Conversely, if interest rates drop over the life of the CD, investors run the risk of their CD being called — recouping their principal investment but missing out on future interest earnings.

Short-duration fixed income

Another option for investors to consider: short-duration, fixed-income solutions. These products are offered as either short or ultra-short bonds. Common solutions in this category would be short-term corporate bonds, bond mutual funds or bond ETFs.

Short-duration fixed-income solutions offer investors a capital preservation strategy with strong liquidity, which generally provides a greater yield than the assets in your emergency fund, like money market or bank deposit sweep vehicles.

Fixed annuities

While not fully liquid, fixed annuities can also be a great option when looking to provide a fixed rate of return for a set period that can allow you to plan for sustained growth with certainty. Annuity products will also provide for tax deferral on earnings while the contract is in force, allowing for a more efficient means to accumulate and protect assets.

Often, fixed annuities also can include a return-of-premium feature, which allows the investor to surrender the policy while maintaining the invested principal. While some annuities may offer a return of premium, most contracts may be assessed a surrender penalty (or contingent deferred sales charge, or CDSC) if the policy is surrendered before the end of the required term, generally three to seven years.

Approaching retirement can mean it’s time to re-evaluate how you’re investing your money, but it doesn’t mean you have to pull your funds out of appreciating assets altogether. Working with your financial adviser to ladder these strategies can help provide liquidity at various intervals so you don’t need to surrender or sell before maturity.

Exploring investment opportunities that pay a fixed yield and may be quickly liquidated — such as bonds, brokered CDs and fixed annuities — may provide a worthwhile return on assets without the risk of a significant loss.

Next week, look for the last part of this five-part series, about low-risk, low-yield investment vehicles for your emergency fund.

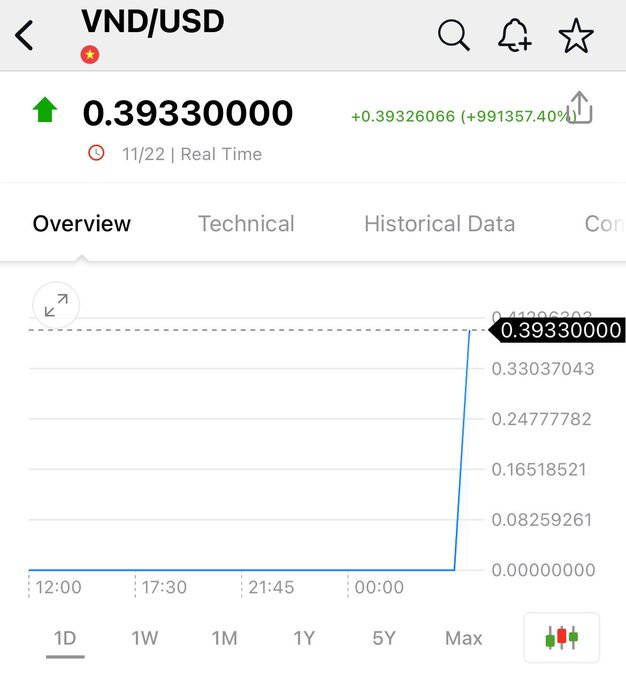

DINAR REVALUATION REPORT: " But VND Dong and Iran IRR Rials are making moves again this weekend! " 25 NOV

DINAR REVALUATION UPDATE Not getting too excited….💥💥 But VND Dong and Iran IRR Rials are making moves again this weekend! Almost looks li...

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...