Monday, August 14, 2023

Evening News with MarkZ 08/14/2023

"Index Options vs Stock Options Explained For Beginners", 14 AUGUST

Many novice options traders are initially confused by the difference between the options on cash indices like SPX and the options traded on stocks and ETFs like AAPL or SPY.

After all, you can’t trade indices like SPX on the stock market. It’s just an index!

So let’s settle a few differences. Firstly, why are there even options on a cash index like SPX when you can simply trade options on the S&P 500 ETF, SPY?

An index like SPX or NDX are simply math calculations. They take each component’s weightings in the index and automatically calculate the index price based on the price changes in the underlying components.

You can’t trade shares of these, but you can trade options on them. And the way the options trade is slightly different from the traditional stock options you’re probably used to.

On the other hand, an ETF like SPY is an actual company which holds shares that reflect index components in a trust. So when you trade SPY, you’re trading a portion of the actual trust.

Trading shares or options on SPY are structurally no different than trading shares or options of AAPL or IBM.

Before we get into the individual differences between index and stock options, let’s first settle on what an option actually is.

What is an Option?

An option is a contract between a buyer and a seller of an asset. Options contracts could be created for just about anything. They’re popular in the real estate market, for example.

An option contract grants the contract buyer the right, but not the obligation, to purchase an asset at a specified price, and on or before a specified date.

For example, you and I might agree to an option contract on your house. I pay you $1,000 for the right to buy your house at the current market price of $200,000 for the next six months.

You get to keep the $1,000 (known as the “premium” in the options market), no matter what happens, but you can’t sell the house to anyone else until our agreement expires.

Options are pretty much that simple. Perhaps I don’t have the money to buy your house today, but I want to lock in today’s price, so I’d pay you an option premium to have the right to buy it for the next six months.

In the stock market, you can buy or sell (‘write’) options on any stock/ETF/future, regardless of whether you own it.

Now let’s move onto the differences between index and stock options.

List of Index Options

Here’s a list of the most popular index options available on US exchanges:

- $NDX – NASDAQ 100 Index

- $SPX – S&P 500 Index

- $RUT – Russell 2000 Index

- $DJX – Dow Jones Industrial Average 1/100 Index

- $OEX – S&P 100 index

- $VIX – S&P 500 Volatility Index

- $XEO – S&P 100 (European) Index

Keep in mind that many brokers and charting platforms require you to prefix the ticker with the dollar sign ($), because these are ‘cash’ indices, while others just require the ticker.

Other cash-settled index options trade on US exchanges, but most of the others are thinly traded. The CBOE has a list of other index options they offer here.

Index Options Require More Capital

An index option like the SPX requires much more capital per contract than it’s ETF counterpart, SPY, because of SPX’s higher price, which is approximately ten times higher than the SPY.

For example, today’s SPY price is around $347, while today’s SPX price is around $3471.

Contracts for both tickers are denominated for 100-share lots, so you can expect SPX options to cost roughly ten times that of an equivalent SPY option.

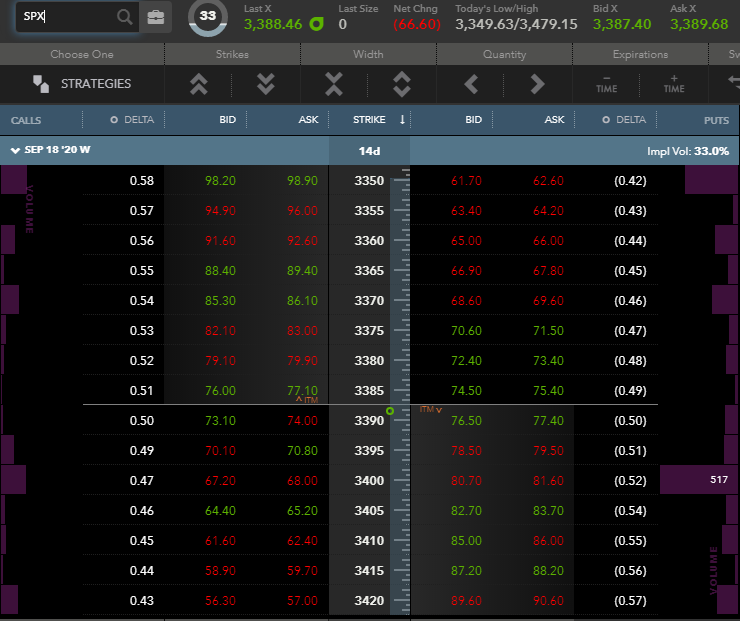

Here’s an example of an SPX option chain:

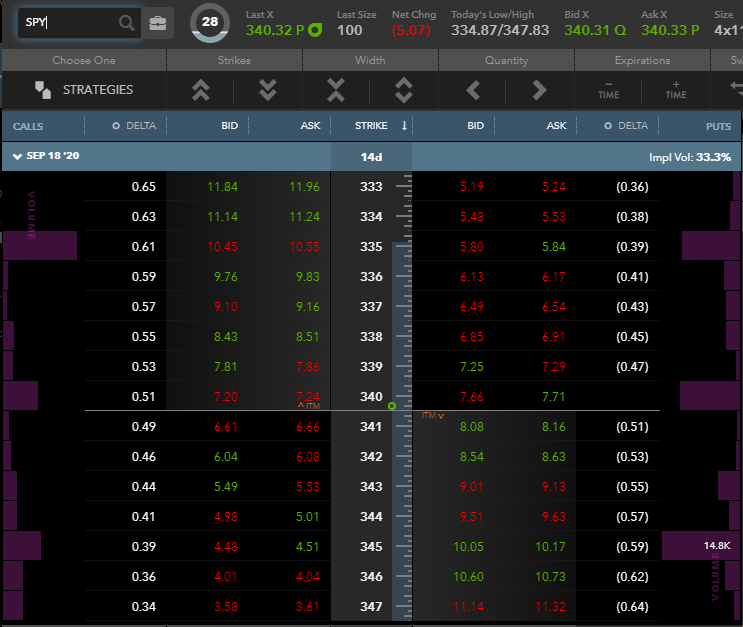

And here’s an example of a SPY option chain:

As you can see, for each equivalent strike, SPX options cost roughly 10x more than SPY options.

Index Options Are Cash Settled

Index options are European-style options, which are mostly the same as the standard American-style options we’re used to trading on individual stocks like Apple or Amazon.

Still, they do have a few key differences. One of those is the settlement.

If I were to buy one call option on an individual stock like Apple and it expired in-the-money, the option would settle in shares. So at the close of expiration Friday, 100 shares of Apple would be credited to my account at my strike price.

Index options, on the other hand, are cash-settled. This means that instead of crediting shares to your account at settlement, your account would simply be credit for the option’s intrinsic value.

Suppose we bought a $330 SPY call option for $3.00, and the price of SPY was $340 at option expiration.

At settlement, our broker would automatically purchase 100 shares of SPY at $330, leaving us a profit of $10 per share. Our net profit after factoring in the cost of the option would be $7.00.

If we bought the equivalent SPX call option, at $3300.00, paid $30.00, and the price of SPX was $3400.00 at expiration. At settlement, our broker would credit us the intrinsic value of the option in cash.

Index Options Are Taxed Like Futures

The main reason that index options typically receive more volume than their ETF counterparts is due to their tax treatments. Under the IRS code, index options are designated as “1256 contracts,” which get special tax treatment. These unique tax treatments are as follows:

- 60/40 Tax Treatment

- 60% of your P&L is treated as long-term capital gains

- 40% of your P&L is treated as short-term capital gains

- This treatment applies regardless of holding period, making futures and index options more tax-advantageous than their ETF counterparts.

- Not subject to wash-sales (a big deal for day traders)

- Your P&L is marked to market at the end of the year, regardless of whether you closed your position.

Let’s create an example to illustrate the benefit of the 60/40 rule for index options. You trade an Apple option and make $100 in gross profits with a one week holding period.

Then you trade an index option and make $100 in gross profits with a one week holding period.

For the stock option, the entire $100 is subject to the short-term capital gains tax. Of course, these tax rates vary dramatically based on your annual income. Let’s assume you’re in the top tax bracket and subject to the highest taxes to keep things simple.

Stock Option:

- $100 profit

- Subject to highest short-term capital gains tax: 37%

- Total taxes owed: $37

Index Option:

- $100 profit

- Subject to highest long-term capital gains tax for 60% of profits: 20%

- Long-term taxes owed: (100 * .6) * .2 = $12

- Subject to highest short-term capital gains tax for 40% of profits: 37%

- Short-term taxes owed: (100 * .4) * .37 = 14.80

- Total taxes owed: $12.00 + $14.80 = $26.80

Add some zeroes to the end of those numbers and see how significant the savings are at scale.

Index Options Have Different Settlement Rules

Index options and stock options have significantly different settlement rules. Not knowing these differences can land you in a world of trouble.

Talking about the nuances of settlement is boring, but these are the types of things that you really only need to learn once and can potentially save you from a big headache if you’re an active options trader.

Index options settle differently from product to product and based on whether they’re regular or weekly options. Weekly index options can settle similarly to a normal stock, while regular index options have some differences.

The first difference is the day of expiration. If you’re used to trading stock options, Friday is typically expiration day, but index options typically settle on Thursday’s close.

The time of expiration is also different. Index options settle based on the first trade made on Friday morning.

So they technically settle on Friday morning, but for all practical purposes, they settle on Thursday, because you would never be able to trade them on Friday morning.

Stock options, on the other hand, expire on Fridays.

So, as a general rule: index options expire on Thursday’s close, stock options expire on Friday’s close.

Pros and Cons of Index Options

Pros:

- Preferable tax treatment

- More liquid markets

- The small number of indices may be a benefit in that you have fewer things to focus on. The thousands of choices in the stock market can be intimidating and distracting.

- Cash settlement makes things more simple.

Cons:

- Fewer choices; there are thousands of optionable stocks, compared to a handful of optionable indices.

- Generally require more capital to trade.

- Less potential to find inefficiently priced options

Final Thoughts

Index options offer traders and investors the opportunity to easily speculate or hedge their positions in a liquid market with preferential tax treatment.

They’re not for everyone, however, as their vast buying power requirements lockout smaller traders.

To summarize:

- Index options have different expiration dates.

- Index options are cash-settled, rather than physically settled.

- Index options are generally more liquid.

- Index options receive preferential tax treatment.

- V]https://www.warriortrading.com/index-options-vs-stock-options/

"3 Sector ETFs That Beat The Market Last Week", 14 AUGUST

Wall Street wrapped up the last week with mixed performances. The Dow Jones industrial Average inched up 0.3% while the other two benchmarks fell. The S&P 500 Index slid 0.3% — its second consecutive week of decline — while the Nasdaq Composite Index dropped 0.7%.

The decline came on the back of a series of negative news on the U.S. credit rating downgrade and multiple bank downgrades. The inflation data also added to the woes.

Fitch Ratings downgraded the U.S. credit rating to AA+ from AAA, citing “expected fiscal deterioration over the next three years,” an erosion of governance and a growing general debt burden. This led to a strong sell-off in the stocks and a surge in yields. Meanwhile, ratings agency Moody's downgraded the credit ratings of several small to mid-sized U.S. banks and warned that it may downgrade some of the nation's biggest lenders too, citing a looming mild recession, higher interest rates and increased funding costs.

Inflation in the United States rose for the first time in July after 12 straight months of decline. The Consumer Price Index rose 3.2% year over year, up from an annual increase of 3% in June, which was the lowest rate in over two years (read: Inflation Moderates in July: ETFs to Gain).

The underperformance in the tech-heavy Nasdaq Index was due to concerns that interest rates could rise further. As the tech sector relies on easy borrowing for superior growth and its value depends heavily on future earnings, a rise in rates lowers the present value of companies’ future earnings, sparking fears of overvaluation.

While most of the sector lost last week, few eked out gains. In particular, the pharma and energy sectors were the biggest winners last week. Pharma stocks were driven by Eli Lilly’s (LLY) significant surge in stock prices in over two decades following the release of an impressive second-quarter 2023 earnings report and an optimistic outlook. Meanwhile, the energy sector rose on an oil price surge. A tightening oil market fueled by surging crude demand and supply reductions by major OPEC+ players — Saudi Arabia and Russia — are driving oil price higher (read: Oil Price at 2023 High: Make Profits With Leveraged ETFs).

We have highlighted one ETF from different sectors that were in green last week. These include Sprott Junior Uranium Miners ETF (URNJ - Free Report) , iShares U.S. Pharmaceuticals ETF (IHE - Free Report) and Invesco Dynamic Energy Exploration & Production ETF (PXE - Free Report) .

ETFs That Gained

We have profiled the above-mentioned ETFs in detail below:Sprott Junior Uranium Miners ETF (URNJ - Free Report) – Up 6.3%

Sprott Junior Uranium Miners ETF is the only pure-play ETF focused on small uranium miners, selected for their potential for significant revenue and asset growth. It tracks the Nasdaq Sprott Junior Uranium Miners Index, which is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining related businesses. Sprott Junior Uranium Miners ETF holds 29 stocks in its basket and charges 80 bps in annual fees.

Sprott Junior Uranium Miners ETF has accumulated $39.9 million in its asset base and trades in average daily volume of 59,000 shares.

iShares U.S. Pharmaceuticals ETF (IHE - Free Report) – Up 5.6%

iShares U.S. Pharmaceuticals ETF provides exposure to 39 U.S. companies that manufacture prescription or over-the-counter drugs or vaccines by tracking the Dow Jones U.S. Select Pharmaceuticals Index (read: Eli Lilly Soars on Blockbuster Q2 Earnings: ETFs to Tap).

iShares U.S. Pharmaceuticals ETF has $388.9 million in AUM and charges 40 bps in fees and expense. Volume is light as it exchanges about 6,000 shares a day. The fund carries a Zacks ETF Rank #3 (Hold) with a High risk outlook.

Invesco Dynamic Energy Exploration & Production ETF (PXE - Free Report) – Up 3.8%

Invesco Dynamic Energy Exploration & Production ETF follows the Dynamic Energy Exploration & Production Intellidex Index, which thoroughly evaluates companies involved in the exploration and production of natural resources used to produce energy based on a variety of investment merit criteria, including price momentum, earnings momentum, quality, management action and value.

Holding 31 stocks in its basket, Invesco Dynamic Energy Exploration & Production ETF has amassed $167.8 million in its asset base and charges 63 bps in annual fees. It trades in a volume of 51,000 shares and has a Zacks ETF Rank #3.

DINAR IRAQ & DONG VIETNAM NEWS UPDATE, 14 AUGUST

The Parliamentary Economy hosts the governor of the central bank to discuss controlling the exchange rate of the dollar

VENEZUELA BOLIVAR FORECAST, 14 AUGUST

USD to VEF Forecast, Dollar to Fuerte Currency Exchange Rate Prediction

"Should I invest in USD to VEF Currency Pair?" "Should I trade USD/VEF pair today?" According to our Forecast System,USD to VEF Forex pair is an awesome long-term (1-year) investment*. "United States Dollar / Venezuelan Bolívar Fuerte"exchange rate predictions are updated every 5 minutes with latest Forex (Foreign Exchange) rates by smart technical market analysis. Q&A about USD to VEF Fx forecast.

USD/VEF Currency Rate is 100000.00 today.

1 year USD/VEF Forecast: 107604629503.56 *

5 year USD/VEF Forecast: 482570218152 *

As of 2023 August 14, Monday current rate of USD/VEF is 100000.00 and our data indicates that the currency rate has been in a downtrend for the past 1 year (or since its inception).

United States Dollar / Venezuelan Bolívar Fuerte has been showing a declining tendency so we believe that similar market segments were not very popular in the given period.

Our site uses a custom algorithm based on Deep Learning that helps our users to decide if USD/VEF could be a good portfolio addition for the future. These predictions take several variables into account such as volume changes, rate changes, market cycles.

Future currency rate of the currencies is predicted at 107604629503.56(107604529.504% ) after a year according to our prediction system.

This means that if you invested $100 now, your current investment may be worth $107604629.504 on 2024 August 14, Wednesday.

This means that this pair is suited as a new addition to your portfolio as trading bullish markets is always a lot easier.

DOLLAR AUCTION.. WHAT IS THE TRUTH ABOUT STOPPING THE CENTRAL BANK’S PLATFORM FOR CURRENCY CONVERSION? WITH NT GOAT COMMENTS, 25 DEC

DOLLAR AUCTION.. WHAT IS THE TRUTH ABOUT STOPPING THE CENTRAL BANK’S PLATFORM FOR CURRENCY CONVERSION? A responsible source in the Central...

-

Frank26 [Bank story] This time we didn't go down, we just called [the bank]... We said we want to see if we can exchange some cu...

-

Bank appointment for Currency EXCHANGE Instructions/Checklist Bank Name_________________________________________ Bank 800#____________...

-

Walkingstick All these meetings that the CBI had with all these agencies that were helping them with their monetary reform are done. Al...