KTFA

FRANK26: "THE OLD TO THE NEW ON THE MONETARY REFORM HISTORY FOR THE CITIZENS EDUCATION"........F26

Banking Reform Methodology at the Central Bank (2016-2026)

10/21/2024

Samir Al-Nusairi

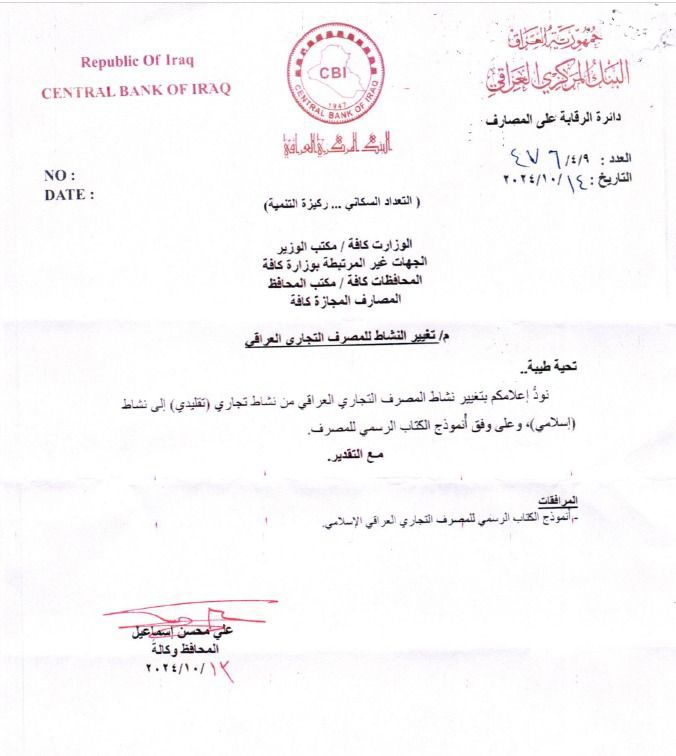

The steps of banking reform that the Central Bank has been taking since 2016 began when Mr. Ali Mohsen Al-Alaq was appointed Governor of the Central Bank of Iraq on 9/9/2014, which is a difficult and complex stage in Iraq's security and economic history. Iraq was facing security and economic shocks due to the occupation of 40% of the country's territory by the terrorist ISIS and the global drop in oil prices in June 2014 by 75%. He was reassigned again on 1/23/2023 after the emergence of new crises and challenges at the economic, financial and banking levels, focusing on the lack of control over the unprecedented rise in the US dollar exchange rate and the rise in the annual inflation rate to (7.5%) in January 2023.

The Central Bank worked from 2016 to 2020 to address the effects of the economic and security shocks, the most prominent of which was the government's inability to pay employees' salaries on time. The Central Bank was able to use its foreign exchange reserves and the method of rediscounting treasury transfers from government support in the amount of 16 trillion dinars, and the crisis was overcome at the time. In 2015, in light of these difficult economic conditions, the Central Bank began to move to develop its plans for the coming years and draw up a methodology for banking reform and structural, technical and administrative development of the Central Bank.

This resulted in the issuance of its first strategy for the years (2016-2020), which included 5 main objectives and 140 sub-objectives, 129 of which were achieved, at a rate of 92%, during the years of implementing the strategy.

It contributed to establishing the basic structures and pillars for moving to a new stage of financial and banking reform, accompanied by the strategic banking projects plan for the years (2019-2023) and the issuance of the second strategy (2021-2023) to complete the achievement of the sub-objectives that could not be implemented in the first strategy, numbering (11) sub-objectives, during which the government continued to resort to the Central Bank and obtain (30) trillion dinars, and the total amount owed by the government became (46) trillion dinars.

During the second term of the Governor, which began in 2023, the Central Bank worked on studying the achievements of the two previous strategies and diagnosing the foundations of the desired reform. The efforts to prepare the third strategy continued throughout 2023, and the foundations and foundations were built to set the goals for this new strategy for the years (2024-2026), which derived its main and sub-goals from the state's general economic policies and its strategy for financial and banking reform adopted by the government in the government program and from Central Bank Law No. 56 of 2004. It included programs with clear goals and initiatives for a period of three years in a special, complex economic and financial circumstance fraught with risks and challenges at the level of internal and external economic and financial relations.

The third strategy identified the main goals with 7 goals, 24 sub-goals and 75 initiatives to achieve the main and sub-goals, and charted the path for banking and financial reform according to the following strategic goals: -

1- Supporting and enhancing monetary stability.

2- Enhancing digital transformation, activating electronic payment and supporting cyber security.

3- Enhancing financial inclusion .

4- Maintaining a sound financial system.

5- Developing the organizational structure and developing human resources capabilities.

6- Enhancing the position of the Central Bank locally and internationally.

7- Enhancing compliance of the banking sector and the non-banking institutions sector in line with international standards.

Programs, policies and initiatives have been identified to achieve the goals, and perhaps the most prominent program is the launch of the National Strategy for Bank Lending in Iraq (2024-2029) and the approval of the Council of Ministers to implement it, which will restructure banking financing in Iraq in addition to leaving the electronic platform and adopting correspondent banks in foreign transfers, protecting the financial system, enhancing financial inclusion, managing monetary and financial stability, developing oversight and supervision, developing regulation in the banking sector, completing the development of the infrastructure for digital transformation, licensing digital banks, implementing regulatory policies in the Central Bank in accordance with the frameworks and technologies adopted in global central banks, raising the capabilities of human resources, developing banking operations, strengthening the bank's internal and external relations, and representing it locally and internationally.

What has been presented for the ten years of the financial and banking reform process confirms that the next two years will inevitably result in the transition to comprehensive and radical reform of the Iraqi banking sector and its transformation into a solid sector that contributes to sustainable development.

LINK