Monday, August 7, 2023

"3 Top-Rated Stocks to Buy as Earnings Approach" BY ZACKS, 7 AUGUST

In a week where investors will be primarily focused on July’s CPI numbers, several top-rated stocks are worthy of attention.

Here are three top-rated stocks worthy of investors’ consideration ahead of their quarterly reports on Wednesday, August 9.

The Trade Desk (TTD - Free Report) )

Coveting a Zacks Rank #1 (Strong Buy) The Trade Desk’s stock is certainly one to pay attention to ahead of its second-quarter earnings report. Those on the prowl for tech stocks that could have more upside may have the opportunity with Trade Desk.

Trade Desk’s Internet-Services Industry is currently in the top 31% of over 250 Zacks industries and the company looks poised to benefit with its platform providing digital advertising services.

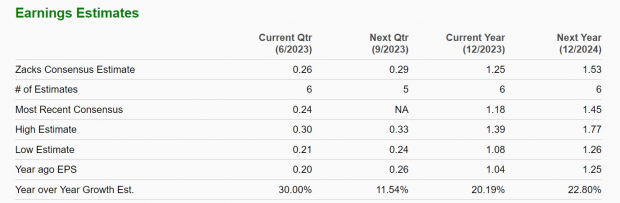

Slowly but surely ad spending has increased with inflation beginning to ease and Trade Desk’s Q2 earnings are expected to climb 30% at $0.26 per share. This compares to EPS of $0.20 in the prior-year quarter with Q2 sales forecasted to jump 21% to $455.21 million compared to $376.96 million a year ago.

Image Source: Zacks Investment Research

Shares of TTD have soared 89% YTD to easily top the Nasdaq’s +33% and this strong performance could continue if Q2 results help reconfirm Trade Desk’s intriguing growth trajectory.

As shown above, annual earnings are now expected to climb 20% in fiscal 2023 and soar another 23% in FY24 at $1.53 per share. Earnings estimates have remained higher over the last quarter with sales now forecasted to jump 22% this year and soar another 25% in FY24 to $2.42 billion.

Image Source: Zacks Investment Research

Honda Motor Co. (HMC - Free Report) )

Several automakers have stood out this earnings season and Honda Motors joins the club with its stock sporting a Zacks Rank #2 (Buy). Notably, Honda’s Automotive-Foreign Industry is in Zacks top 18%.

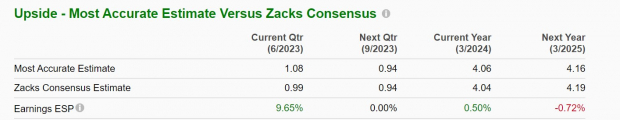

Set to report its fiscal first-quarter results on Wednesday, Honda’s earnings are projected to soar 48% at $0.99 a share versus EPS of $0.67 a year ago. First-quarter sales are anticipated to rise 13% to $33.57 billion. It’s also noteworthy that the Zacks Expected Surprise Prediction (ESP) indicates Honda could surpass earnings expectations with the Most Accurate Estimate having Q1 EPS at $1.08.

Image Source: Zacks Investment Research

More impressive, annual earnings are expected to climb 33% in Honda’s current fiscal 2024 to $4.04 per share compared to EPS of $3.03 in FY23. Fiscal 2025 earnings are expected to rise another 3%.

On the top line, FY24 sales are expected to jump 13% and then dip -4% in FY25 to $134.84 billion. Still, earnings estimates have trended higher with Honda stock up +36% this year to outperform the broader indexes.

Image Source: Zacks Investment Research

Jack In The Box (JACK - Free Report) )

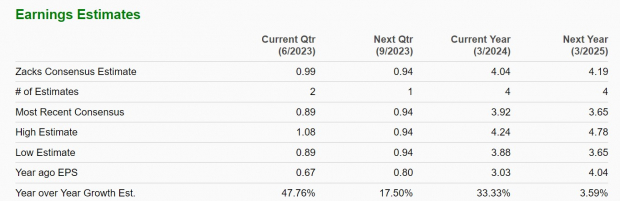

Lastly, the Retail-Restaurants Industry is also in Zacks top 18% and Jack In The Box stock sports a Zacks Rank #2 (Buy). Set to report its fiscal third-quarter results on Wednesday, the trend of earnings estimate revisions is compelling for Jack In the Box ahead of its report.

This is despite Q3 earnings expected to dip -3% at $1.33 per share following a tough to compete-against quarter. First quarter sales are forecasted to dip -1% to 393.53 million. However, earnings estimates are up and the Zacks ESP now indicates Jack In The Box could beat expectations with the Most Accurate Estimate having Q3 EPS at $1.34.

Image Source: Zacks Investment Research

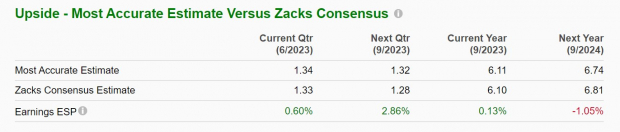

Furthermore, annual earnings are now projected to rise 4% in FY23 and jump another 11% in FY24 at $6.81 per share. Total sales are forecasted to climb 16% this year and then dip -3% in FY24 to $1.65 billion. With that being said, annual earnings estimates are still noticeably higher and Jack In The Box stock is up +40% YTD to also top the broader indexes.

Image Source: Zacks Investment Research

Bottom Line

These companies are benefitting from strong business environments at the moment. Rising earnings estimates are a great sign they may be able to reach or exceed their quarterly expectations and offer positive guidance. More importantly, this could extend the strong performances of Trade Desk, Honda, and Jack In The Box stock this year.

https://www.zacks.com/commentary/2133289/3-top-rated-stocks-to-buy-as-earnings-approach

"Best index funds in August 2023", 7 AUGUST

An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. This index may be created by the fund manager itself or by another company such as an investment bank or a brokerage.

These fund managers then mimic the index, creating a fund that looks as much as possible like the index, without actively managing the fund. Over time the index changes, as companies are added and removed, and the index fund manager mechanically replicates those changes in the fund.

Some of the most watched indexes fill up the financial news every night and are often used as shorthand for the performance of the market, with investors tracking them to get a read on how stocks as a whole are faring.

Most popular indexes:

Here’s everything you need to know about index funds, including ten of the top ones to consider adding to your portfolio this year.

Why are index funds a popular investment?

Index funds are popular with investors because they promise ownership of a wide variety of stocks, greater diversification and lower risk – usually all at a low cost. That’s why many investors, especially beginners, find index funds to be superior investments to individual stocks.

- Attractive returns: Like all stocks, major indexes will fluctuate. But over time indexes have made solid returns, such as the S&P 500’s long-term record of about 10 percent annually. That doesn’t mean index funds make money every year, but over long periods of time that’s been the average return.

- Diversification: Investors like index funds because they offer immediate diversification. With one purchase, investors can own a wide swath of companies. One share of an index fund based on the S&P 500 provides ownership in hundreds of companies, while a share of Nasdaq-100 fund offers exposure to about 100 companies. You can even buy a whole industry, such as energy ETFs.

- Lower risk: Because they’re diversified, investing in an index fund is lower risk than owning a few individual stocks. That doesn’t mean you can’t lose money or that they’re as safe as a CD, for example, but the index will usually fluctuate a lot less than an individual stock.

- Low cost: Index funds can charge very little for these benefits, with a low expense ratio. For larger funds you may pay $3 to $10 per year for every $10,000 you have invested. In fact, one fund (listed below) charges you no expense ratio at all. When it comes to index funds, cost is one of the most important factors in your total return.

While some funds such as S&P 500 or Nasdaq-100 index funds allow you to own companies across industries, other funds own only a specific industry, country or even investing style (say, dividend stocks).

Best index funds to invest in for August 2023

The list below includes index funds from a variety of companies tracking a broadly diversified index, and it includes some of the lowest-cost funds you can buy and sell on the public markets. When it comes to index funds like these, one of the most important factors in your total return is cost.

- Fidelity ZERO Large Cap Index

- Vanguard S&P 500 ETF

- SPDR S&P 500 ETF Trust

- iShares Core S&P 500 ETF

- Schwab S&P 500 Index Fund

- Shelton NASDAQ-100 Index Direct

- Invesco QQQ Trust ETF

- Vanguard Russell 2000 ETF

- Vanguard Total Stock Market ETF

- SPDR Dow Jones Industrial Average ETF Trust

Best S&P 500 index funds

The S&P 500 is one of the most widely-followed stock market indices in the world and there are many funds that invest based on the index. These five stand out.

Fidelity ZERO Large Cap Index (FNILX)

Overview: The Fidelity ZERO Large Cap Index mutual fund is part of the investment company’s foray into mutual funds with no expense ratio, thus its ZERO moniker.

The fund doesn’t officially track the S&P 500 – technically it follows the Fidelity U.S. Large Cap Index – but the difference is academic.

The real difference is that investor-friendly Fidelity doesn’t have to cough up a licensing fee to use the S&P name, keeping costs lower for investors.

Expense ratio: 0 percent. That means every $10,000 invested would cost $0 annually.

Who is it good for?: Great for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

Vanguard S&P 500 ETF (VOO)

Overview: As its name suggests, the Vanguard S&P 500 tracks the S&P 500 index, and it’s one of the largest funds on the market with hundreds of billions in the fund.

This ETF began trading in 2010, and it’s backed by Vanguard, one of the powerhouses of the fund industry.

Expense ratio: 0.03 percent. That means every $10,000 invested would cost $3 annually.

Who is it good for?: Great for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

SPDR S&P 500 ETF Trust (SPY)

Overview: The SPDR S&P 500 ETF is the granddaddy of ETFs, having been founded all the way back in 1993. It helped kick off the wave of ETF investing that has become so popular today.

With hundreds of billions in the fund, it’s among the most popular ETFs. The fund is sponsored by State Street Global Advisors — another heavyweight in the industry — and it tracks the S&P 500.

Expense ratio: 0.095 percent. That means every $10,000 invested would cost $9.50 annually.

Who is it good for?: Great for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

iShares Core S&P 500 ETF (IVV)

Overview: The iShares Core S&P 500 ETF is a fund sponsored by one of the largest fund companies, BlackRock. This iShares fund is one of the largest ETFs and it tracks the S&P 500.

With an inception date of 2000, this fund is another long-tenured player that’s tracked the index closely over time.

Expense ratio: 0.03 percent. That means every $10,000 invested would cost $3 annually.

Who is it good for?: Great for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

Schwab S&P 500 Index Fund (SWPPX)

Overview: With tens of billions in assets, the Schwab S&P 500 Index Fund is on the smaller side of the heavyweights on this list, but that’s not really a concern for investors.

This mutual fund has a strong record dating back to 1997, and it’s sponsored by Charles Schwab, one of the most respected names in the industry.

Schwab is especially noted for its focus on making investor-friendly products, as evidenced by this fund’s razor-thin expense ratio.

Expense ratio: 0.02 percent. That means every $10,000 invested would cost $2 annually.

Who is it good for?: Great for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

Best Nasdaq index funds

The Nasdaq-100 Index is another stock market index, but is not as diversified as the S&P 500 because of its large weighting in technology shares. These two funds track the largest non-financial companies in the index.

Shelton NASDAQ-100 Index Direct (NASDX)

Overview: The Shelton Nasdaq-100 Index Direct ETF tracks the performance of the largest non-financial companies in the Nasdaq-100 Index, which includes primarily tech companies.

This mutual fund began trading in 2000 and has a strong record over the last five and ten years.

Expense ratio: 0.5 percent. That means every $10,000 invested would cost $50 annually.

Who is it good for?: A good fit for investors looking for an index fund that gives them exposure to the tech industry and growth-oriented companies.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

Invesco QQQ Trust ETF (QQQ)

Overview: The Invesco QQQ Trust ETF is another index fund that tracks the performance of the largest non-financial companies in the Nasdaq-100 Index.

This ETF started trading in 1999, and it’s managed by Invesco, a fund giant. This fund is the top-performing large-cap growth fund in terms of total return over the 15 years to Sept. 2022, according to Lipper.

Expense ratio: 0.20 percent. That means every $10,000 invested would cost $20 annually.

Who is it good for?: Great for investors looking for a relatively low-cost index fund that focuses on technology and growth companies.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

More top index funds for August 2023

While the S&P 500 and Nasdaq are two of the most popular stock market indexes, there are many others that track different parts of the investment universe. These three index funds are also worth considering for your portfolio.

Vanguard Russell 2000 ETF (VTWO)

Overview: The Vanguard Russell 2000 ETF tracks the Russell 2000 Index, a collection of about 2,000 of the smallest publicly traded companies in the U.S.

This ETF began trading in 2010, and it’s a Vanguard fund, so it focuses on keeping costs low for investors.

Expense ratio: 0.10 percent. That means every $10,000 invested would cost $10 annually.

Who is it good for?: This fund is great for investors who want a low-cost fund that gives them broad exposure to small-cap companies.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

Vanguard Total Stock Market ETF (VTI)

Overview: Vanguard also offers a fund that covers effectively the entire universe of publicly traded stocks in the U.S., known as the Vanguard Total Stock Market ETF. It consists of small, medium and large companies across all sectors.

The fund has been around for a while, having begun trading in 2001. And with Vanguard as the sponsor, you know the costs are going to be low.

Expense ratio: 0.03 percent. That means every $10,000 invested would cost $3 annually.

Who is it good for?: Investors looking for a low-cost index fund that is broadly diversified across the market-cap spectrum.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

SPDR Dow Jones Industrial Average ETF Trust (DIA)

Overview: You don’t have a lot to choose from when it comes to ETFs tracking the Dow Jones Industrial Average, but State Street Global Advisors comes through with this fund that tracks the 30-stock index of large-cap stocks.

The fund is definitely one of the earlier ETFs, having debuted in 1998, and it has tens of billions under management.

Expense ratio: 0.16 percent. That means every $10,000 invested would cost $16 annually.

Who is it good for?: Investors looking for exposure to blue-chip companies or the specific components of the Dow Jones Industrial Average at a low cost.

Where to get it: The fund can be purchased directly from the fund company or through most online brokers.

How to invest in an index fund in 3 easy steps

It’s surprisingly easy to invest in an index fund, but you’ll want to know what you’re investing in, not simply buy random funds that you know little about.

1. Research and analyze index funds

Your first step is finding what you want to invest in. While an S&P 500 index fund is the most popular index fund, they also exist for different industries, countries and even investment styles. So you need to consider what exactly you want to invest in and why it might hold opportunity:

- Location: Consider the geographic location of the investments. A broad index such as the S&P 500 or Nasdaq-100 owns American companies, while other index funds might focus on a narrower location (France) or an equally broad one (Asia-Pacific).

- Business: Which market sector is the index fund investing in? Is it invested in pharma companies making new drugs, or maybe tech companies? Some funds specialize in certain industries and avoid others.

- Market opportunity: What opportunity does the index fund present? Is the fund buying pharma companies because they’re making the next blockbuster drug or because they’re cash cows paying dividends? Some funds invest in high-yield stocks while others want high-growth stocks.

You’ll want to carefully examine what the fund is investing in, so you have some idea of what you actually own. Sometimes the labels on an index fund can be misleading. But you can check the index’s holdings to see exactly what’s in the fund.

2. Decide which index fund to buy

After you’ve found a fund you like, you can look at other factors that may make it a good fit for your portfolio. The fund’s expenses are huge factors that could make – or cost – you tens of thousands of dollars over time.

- Expenses: Compare the expenses of each fund you’re considering. Sometimes a fund based on a similar index can charge 20 times as much as another.

- Taxes: For certain legal reasons, mutual funds tend to be less tax-efficient than ETFs. At the end of the year many mutual funds pay a taxable capital gains distribution, while ETFs do not.

- Investment minimums: Many mutual funds have a minimum investment amount for your first purchase, often several thousand dollars. In contrast, many ETFs have no such rule, and your broker may even allow you to buy fractional shares with just a few dollars.

3. Purchase your index fund

After you’ve decided which fund fits in your portfolio, it’s time for the easy part – actually buying the fund. You can either buy directly from the mutual fund company or through a broker. But it’s usually easier to buy a mutual fund through a broker. And if you’re buying an ETF, you’ll need to go through your broker.

Considerations for investing in index funds

As you’re looking at index funds, you’ll want to consider the following factors:

- Long-run performance: It’s important to track the long-term performance of the index fund (ideally at least five to ten years of performance) to see what your potential future returns might be. Each fund may track a different index or do better than another fund, and some indexes do better than others over time. Long-run performance is your best gauge to what you might expect in the future, but it’s no guarantee, either.

- Expense ratio: The expense ratio shows what you’re paying for the fund’s performance on an annual basis. For funds that track the same index, such as the S&P 500, it makes little sense to pay more than you have to. Other index funds may track indexes that have better long-term performance, potentially justifying a higher expense ratio.

- Trading costs: Some brokers offer very attractive prices when you’re buying mutual funds, even more so than the same mutual fund company itself. If you’re going with an ETF, virtually all major online brokers now allow you to trade without a commission. Also, if you’re buying a mutual fund, beware of sales loads, or commissions, which can easily lop off 1 or 2 percent of your money before it’s invested. These are easy to avoid by choosing funds carefully, such as those from Vanguard and many others.

- Fund options: Not all brokers will offer all mutual funds, however. So you’ll need to see whether your broker offers a specific fund family. In contrast, ETFs are typically available at all brokers because they’re all traded on an exchange.

- Convenience: It may be a lot easier to go with a mutual fund that your broker offers on its platform rather than open a new brokerage account. But going with an ETF instead of a mutual fund may also allow you to sidestep this issue.

Index fund risks

Putting money into any market-based investment such as stocks or bonds means that investors could lose it all if the company or government issuing the security runs into severe trouble. However, the situation is a bit different for index funds because they’re often so diversified.

An index fund usually owns at least dozens of securities and may own potentially hundreds of them, meaning that it’s highly diversified. In the case of a stock index fund, for example, every stock would have to go to zero for the index fund, and thus the investor, to lose everything. So while it’s theoretically possible to lose everything, it doesn’t happen for standard funds.

That said, an index fund could underperform and lose money for years, depending on what it’s invested in. But the odds that an index fund loses everything are very low.

Are there fees associated with index funds?

Index funds may have a couple different kinds of fees associated with them, depending on which type of index fund:

- Mutual funds: Index funds sponsored by mutual fund companies may charge two kinds of fees: a sales load and an expense ratio.

- A sales load is just a commission for buying the fund, and it may happen when you buy or when you sell or over time. Investors can usually avoid these by going with an investor-friendly fund company such as Vanguard, Charles Schwab or Fidelity.

- An expense ratio is an ongoing fee paid to the fund company based on the assets you have in the fund. Typically these are charged daily and come out of the account seamlessly.

- ETFs: Index funds sponsored by ETF companies (many of which also run mutual funds) charge only one kind of fee, an expense ratio. It works the same way as it would with a mutual fund, with a tiny portion seamlessly deducted each day you hold the fund.

ETFs have become more popular recently because they help investors avoid some of the higher fees associated with mutual funds. ETFs are also becoming popular because they offer other key advantages over mutual funds.

What is considered a good expense ratio?

Mutual funds and ETFs have among the cheapest average expense ratios, and the figure also depends on whether they’re investing in bonds or stocks. In 2021, the average stock index mutual fund charged 0.06 percent (on an asset-weighted basis), or $6 for every $10,000 invested. The average stock index ETF charged 0.16 percent (asset-weighted), or $16 for every $10,000 invested.

Index funds tend to be much cheaper than average funds. Compare the numbers above with the average stock mutual fund (on an asset-weighted basis), which charged 0.47 percent, or the average stock ETF, which charged 0.16 percent. While the ETF expense ratio is the same in each case, the cost for mutual funds generally is higher. Many mutual funds are not index funds, and they charge higher fees to pay the higher expenses of their investment management teams.

So anything below the average should be considered a good expense ratio. But it’s important to keep these costs in perspective and realize that the difference between an expense ratio of 0.10 percent and 0.05 percent is just $5 per year for every $10,000 invested. Still, there’s no reason to pay more for an index fund tracking the same index.

Is now a good time to buy index funds?

If you’re buying a stock index fund or almost any broadly diversified stock fund such as the Nasdaq-100, it can be a good time to buy if you’re prepared to hold it for the long term. That’s because the market tends to rise over time, as the economy grows and corporate profits increase. In this regard, time is your best friend, because it allows you to compound your money, letting your money make money. That said, narrowly diversified index funds (such as funds focused on one industry) may do poorly for years.

That’s one reason why it’s crucial for investors to stick with a patient approach to ride out any short-term volatility. Experts recommend adding money to the market regularly to take advantage of dollar-cost averaging and lower their risk. A strong investing discipline can help you make money in the market over time. Investors should avoid timing the market, that is, jumping in and out of the market to capture gains and dodge losses.

Bottom line

These are some of the best index funds on the market, offering investors a way to own a broad collection of stocks at low cost, while still enjoying the benefits of diversification and lower risk. With those benefits, it’s no surprise that these are some of the largest funds on the market.

https://www.bankrate.com/investing/best-index-funds/#when-to-buy

"Index Options Strategies for the Rest of 2023", 7 AUGUST

The Cost of Protection

As we look out toward the end of 2023 in capital markets, I’m reminded of a floor-trading truism: “Buy protection when you can, not when you’re forced to.”

In reality, it’s easier said than done.

When there’s seemingly no reason to worry, protection becomes an afterthought. The problem is that demand for “coverage” tends to increase in a non-linear fashion.

What’s that Mean?

In short, you’re better off buying options when implied volatility levels are relatively low, and the market seems to not have a worry.

In the event you don’t have options for protection and there’s an adverse event that forces your hand, the cost of that coverage is probably far more costly.

Price is a function of supply and demand. There’s a finite number of firms able to supply the market with optionality. At present, there’s little demand for longer-dated optionality (vega), but that could change quickly.

In that scenario, the price for six-month or one-year optionality could increase with significant velocity. It calls to mind the visual of a crowded room with few exits.

Pop Culture “Lessons”

There’s been a lot of headlines around the potential existence of UFOs and non-human life forms. In fact, there was a Congressional hearing where a Pentagon employee (David Grusch) spoke about classified military programs that have existed for nearly 100 years.

I’m agnostic on the alien question, but I’m interested in the potential knock-on effects.

For example, did you know that Alien Abduction insurance policies are available? According to Geico, more than 30,000 policies have been underwritten in Europe. There are American firms that offer similar coverage. The St. Lawrence Agency (Florida) “sold over 6,000 policies.”

I’m curious about what impact the attention and hearings might have on premiums.

In Index Options

It’s much easier to track the relative cost of portfolio protection using implied volatility data that’s easily observable. Let’s focus on two specific time frames, six months and one year. In general, insurance policies are renewable on an annual basis. Like options, they are not available in perpetuity.

The visual below plots the implied volatility for at-the-money (ATM) (100% moneyness or 50 delta options) on the Nasdaq-100® Index (NDX). This data goes back five years and incorporates the pandemic selloff (spike in volatility) as well as two prior all-time highs for U.S. equity indexes.

One critical component to this “puzzle” is understanding that longer-dated option values have a greater sensitivity to changes in implied volatility estimates than similar (moneyness) shorter-dated options. Let’s put some numbers around the concept.

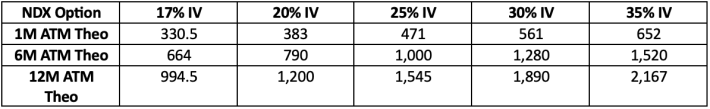

The table above shows the theoretical values for NDX ATM options with a variety of maturities. In both raw dollar (value) terms and percentage terms, longer-dated options change in value more dramatically than shorter-dated options.

Bring it Together

U.S. equity indexes have exhibited tremendous resilience while scaling the proverbial “wall of worry” in 2023. That’s great for anyone with long equity exposure. The question becomes, what if the degree of worry is “too low” and the future incline changes?

Based on the past five years, longer-dated index volatility expectations are at/near the low end of the range. Could implied vol levels move lower? Absolutely! That’s where the old floor trading truism arguably comes in.

“Buy protection when you can, not when you have to!”

While it’s not a perfect analogy, one-year index option coverage is somewhat akin to Alien Abduction insurance. Very few market participants seem to believe there’s a significant threat to the economic outlook now. As a result, the relative cost of longer-dated index protection is relatively cheap.

Similarly, not many people believe alien insurance is necessary. However, it’s possible that the recent inquiries into non-human life forms drive the cost of “alien insurance” higher.

I do not anticipate UFOs to catalyze an increase in market volatility but it’s also a non-zero possibility. The bigger point is that “we don’t know what we don’t know.” Markets are forward-looking and dynamic.

Many investors were caught offside by the recent Fitch downgrade of U.S. debt from AAA to AA+. It’s only the second time in history that U.S. sovereign debt credit quality has been reduced.

Despite sounding obvious, we don’t purchase protective policies and expect to find out how they work. We do so to avoid worrying about unlikely outcomes. We transfer a degree of risk to groups that can aggregate and manage risk more easily than we can.

Stranger Things

Over the past five years, the world and capital markets have dealt with monumental change. A global pandemic, unparalleled interest rate volatility, an ongoing European conflict, supply chain shortages, the emergence of generative artificial intelligence and much more.

The rate of change in life, and in derivative markets ebbs and flows, but change is constant. The proactive use of index options strategies can help insulate a portfolio from potential uncertainty because “every ending has a beginning.”

For the sake of simplicity, the examples included do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of a given strategy. An investor should review transaction costs, margin requirements and tax considerations with a broker and tax advisor before entering into any options strategy.

Options involve risk and are not suitable for everyone. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies may be obtained from your broker, one of the exchanges or The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, IL 60606 or call 1-888-OPTIONS or visit www.888options.com.

https://www.nasdaq.com/articles/index-options-strategies-for-the-rest-of-2023