Wednesday, July 26, 2023

Evening News with MarkZ 07/26/2023

BRUCE'S BIG CALL, 26 JULY

Bruce’s Big Call Dinar Intel Tuesday Night 7-25-23 RREPLAY LINK Intel Begins 1:17:00

Welcome, everybody to the big call tonight - it is Tuesday, July 25th and thank you for tuning in and listening to the big call.

Now our reach was 96 countries on Thursday. So hopefully we're still in that same range tonight. So wherever you're getting the call, hopefully you're getting it either in English or in a language that you understand. So thank you for that.

This is interesting because, you know, some of our sources aren't really responding back to text, the emails, the phone calls, they really, really kind of go under gone under, in some cases, a fourth NDA, a fourth NDA - so it's like okay, we're not going to be able to get information there in some cases.

A few sources had one of those phones called ?? those temporary phones, it's that you can call on - So they have burner phones that are no longer operative, or they have they took their burner phones away.

Now, primarily this would be at banks or redemption centers, that's found out or knew, they have burner phones, and they confiscated their burner phones

This is what we're dealing with. This is the level of secrecy that they want to continue to have. Fortunately, we have enough sources that we still are able to find out what we need to find out as far as the information

Alright, so as far as we can tell, and we can tell this by the fact that we know the Iraqi dinar is trading up. We know the rates that are on the redemption center screens, front screens we know that they're substantial and very high. And I'm not talking about a contract rate. That's a separate animal. We've talked about that before. This is the front screen rate that will be offered to us.

We also know that dong has been pulling up the rear and going up in value as well. And it's now at a significant point where it is and it's pushing. It's pushing a number. Just like the dinar is pushing a number. And they're right they're up against it. And those rates are actually from yesterday. So today, I would think that they still could be climbing upward when it's interesting. and we'd love to know that we’d love to see that

As far as the timing for this. Here's where we are.

The USN is coming out and should be I don't know if it's going to be announced announced or just useable and out - alright let's go back and fill in the blanks here.

The new financial system, which would include the quantum financial system, in conjunction with our new currency – the USN in conjunction with the Starlink System - the CIP system and the FinTech - all the technical aspects of it are all lined up ready to come online and be fully integrated and implemented starting at midnight tonight.

And I've had I've had a timezone of 24 hours between the start or the integration of the new financial system At midnight tonight Eastern. it's not that far away, But an hour and a half away and through midnight, Wednesday night.

So a 24 hour period of full integration into the new quantum financial system. So that's good.

Now what goes with that?

Do we get something about the new USN - our asset backed currency? We have heard they weren't gonna say we were back on the gold standard. I don't know really, why not. but I don't think you can look for that. but our new currency is asset backed.

Now let's stop and pause for a second. and say, wait a minute. what about the new money? What about us going into the redemption centers? If we want some of our new cash? The word is we're supposed to get up to $8,500 if we want, you don't take it if you're not a cash person, you don't want to take a nickel of it.

But if you like having a little bit of cash, don't go crazy. Maybe 2500 – or 5 grand whatever you're comfortable with.

But here's the interesting thing. Just yesterday, we have contacts that are at the redemption centers that literally were moving boxes that were 18 inches wide by 18 inches tall. That's a cube 18 inch each direction.

And four boxes. One box was hundreds, one box and 50s. One was 20s and one was tens.

So those four denominations that are called right denominations of those bills are USN - United States Treasury notes are full. Those boxes were slammed full and heavy.

But they were being moved into a redemption center.

I just think that's interesting timing. Most of the redemption centers I know had the USN’s already.

Most of the banks have USN in the vault - maybe in drawers in the vault.

But bottom line is they are going to be ready for us at the redemption centers with the new USN currency, our money.

Now that you know about the timing of that and you know about the new financial system, bondholders had been told that they will get access to funds I believe it's going to be Wednesday or Thursday. That's tomorrow or Thursday. My gut is it will be Thursday for the bondholders to get their 1%

So where are we left? Well, I was told by a redemption center person that we would receive our notifications either Tuesday, Wednesday or Thursday.

Today's Tuesday, okay, it’s gone now we're looking at Wednesday or Thursday Okay. And just maybe, maybe if it's tomorrow that we get notified which another source believes that is going to be the case. And Thursday looks really good fot the start of exchanges.

Alright, let's throw another piece into the puzzle here.

We have a contact that's tight with Citibank in a different state. And he was able to say that the Citibank banker who he has a relationship with says that Citibank was going to be able to start exchanges On Friday, the 28th.

So I'm looking at that going, Okay. I wonder if that's when we'll start or could we start sooner than the bank would start?

We’re also hearing We've been talking a lot about tier 4 or tier 4B for the internet group . What about the general public tier 5?

The tier 5, we're understanding what it started around the second or third of August. Okay. And they would be using obviously - they would be using regular banks - they wouldn't be setting appointments like we are. We're setting appointments using the toll free number, and we get that and putting that out and then you call it set your appointment that way.

All right. So let's see if we can make this a little bit more. not confusing, but a little simpler.

So we know we're getting notified today, write that off today's gone - could have come overnight, and wake up to it. Yeah, that's possible. It's very possible, but it looks like Wednesday. or Thursday, for notifications and it looks like the start of exchanges will be Thursday, Maybe Friday, based on the Citibank report, But remember that’s not dealing with the redemption center, that's just a regular bonafide CitiBank branch. don't read too much into that.

We have also heard from one of our bond holder paymasters that we're looking at the USN coming out Wednesday. The NESARA and GESARA on the 27th which is Thursday. And the implementation of that for the rollout of NESARA for us possibly on the 30th - three days later of this month of July. Now remember July’s got 31 days right so it's it could have could come out on the 30th or 31st.

My belief is that most of the NESARA that directly affects us is going to be in August and we didn't get the Social Security increase that we thought we might get in July. And we did not get restitution or reclamation allowance yet.

Since it didn't happen already, since it didn't happen already. In July. I'm writing it off until maybe August. Maybe that's when it comes out. It's not going to matter for us anyway, but it's nice to know for other people that don't have currency. Nice to know because it's going to be substantial.

So we've been looking for this type of political change. I've mentioned it on the big call several times. And I think that it's it has direct impact on us and our start.

So let's see if there's anything else that comes to mind.

Okay, thank you Sue - So the latest input we had on the med bed start was to be August 3, for the start of appointments for the med beds. Now. I contend that date has been pushed back and moved based on the RV and exchanges being pushed back and moved. So that is the most recent date we have.

And then that sounds like that'll hopefully that will hold up and we can get started on our exchanges this week. Okay, so that's what I wanted to bring to you for the night.

"3 SOCIAL MEDIA STOCKS TO BUY AS ELON MUSK DESTROYS TWITTER" BY SAMUEL O'BRIENT FROM INVESTOR PLACE, NASDAQ, 26 JULY

3 Social Media Stocks to Buy as Elon Musk Destroys Twitter

Twitter is falling and these three stocks stand to rise in response

- Here are the social media stocks that investors should be watching as Twitter crumbles.

- Meta Platforms (META): The industry leader had plenty going for it before it launched Threads.

- Nextdoor Holdings (KIND): This hyperlocal platform operates in a unique niche that could help it soar.

- Pinterest (PINS): Wall Street is starting to embrace this popular platform that also offers AI exposure.

A few months ago, investors were searching for social media stocks to buy if U.S. regulators issued a ban on TikTok. The China-based social media platform had raised too many red flags regarding users’ data safety, children’s health concerns and links to China’s government. This meant a blow to the social media market that would boost other stocks in the sector.

One quarter later, it is increasingly clear that the industry is being disrupted by something much wider spread implications: Elon Musk’s treatment of Twitter. Since he purchased the platform in October 2022, the Tesla (NASDAQ:TSLA) CEO has alienated advertisers and driven users away. Now his mission of rebranding Twitter as “X” threatens to harm the company even more, causing permanent damage to its brand. As Bloomberg reports:

“Brand valuation is difficult to determine, and there’s no single approach, which is why estimates vary, said Dipanjan Chatterjee, an analyst with Forrester Research Inc. But several analysts and agencies agreed that the company’s brand has already taken a significant hit since Musk’s takeover. Brand Finance for example, estimates the Twitter brand lost 32% of its value since last year.”

Musk damaging Twitter’s brand is hardly breaking news. One month after he acquired the platform, media watchdog Media Matters for America reported that he had already driven away half of Twitter’s top advertising clients. These companies had collectively spent $2 billion on Twitter advertising since 2020. Now Musk is taking it a step further in what some experts describe as a “meaningless publicity stunt.” This is bad news for Twitter, (X?), but it means further opportunity for its rivals to expand their market share.

Social Media Stocks to Buy: Meta Platforms (META)

As the undisputed industry leader, Meta Platforms (NASDAQ:META) has likely been enjoying Twitter’s gradual demise under Musk. The Facebook parent company has risen over 100% during the past two quarters, riding the waves generated by the new investor focus on metaverse and artificial intelligence (AI) technology.

Now that the world is watching its biggest competitor self-destruct, META stock is poised to rise even more. And it is quite convenient that just as Twitter’s demise has sped up, Meta subsidiary Instagram has launched Threads, a microblogging alternative for the many users who Musk has pushed away.

Threads quickly shot to popularity, reaching 100 million users faster than ChatGPT. And as analysts have noted, that quickly put a dent in Twitter’s popularity. Social media user growth tends to be a zero-sum game, and in this case, it’s clear that Twitter’s loss is Threads’ gain, thereby benefiting its parent company. As InvestorPlace contributor David Moadel notes, this new development could easily send META stock to $350 per share before the year is done. Market conditions have shifted sharply in Meta’s favor, and that isn’t likely to change.

Nextdoor Holdings (KIND)

This little-known gem of the social media sector often flies under the radar of most investors. But that doesn’t mean Nextdoor (NYSE:KIND) isn’t worth watching. This platform provides users with a hyperlocal experience, allowing them to connect with people in their neighborhoods. While it still trades at penny stock levels, KIND has risen 30% over the past six months, demonstrating that there is still a demand for the niche service it provides.

InvestorPlace contributor Faizan Farooque has named it as an under-the-radar company with a 40% upside potential. In his words:

“Notably, nearly one in three U.S. households uses Nextdoor’s services. CEO Sarah Friar is no stranger to success, with previous experience as CFO of Block (NYSE:SQ), which demonstrated consistent growth in their user base as well. Nextdoor offers a one-of-a-kind advertising opportunity for small and mid-sized local businesses (SMBs) to target customers within their area directly. That kind of expertise gives it a unique niche in the market.”

Nextdoor may not stand to benefit from the demise of Twitter as much as Meta’s other subsidiaries, such as Facebook and Threads. But as Twitter’s users continue to abandon ship, they will need somewhere to turn. This could give Nextdoor exactly the edge that it needs to rise above the $5 price point in the coming months.

Social Media Stocks to Buy: Pinterest (PINS)

While it hasn’t seen as strong a year as Meta, Pinterest (NYSE:PINS) has proven that it can hold its own in the complicated social media landscape. The platform remains a popular choice among users who like to use social media to discover new things, particularly through visual mediums. PINS stock has been rising throughout the past month and recently received a price target upgrade from Evercore ISI, whose analyst sees it benefitting from the global advertising recovery. While that is likely true, it could easily pick up users from Twitter as well, leading to an even better send half of 2023.

Investors should also note that PINS is in a good place to ride the AI wave. While often ranked among social media stocks to buy, Pinterest also uses machine learning to enhance its algorithms, analyzing user behavior and improving content recommendations for them. All this adds up to a promising economic landscape for PINS stock, which has plenty of room to run as conditions continue shifting in its favor.

On the date of publication, Samuel O’Brient did not have (either directly or

indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.comPublishing Guidelines.

Samuel O’Brient has been covering financial markets and analyzing economic

policy for three-plus years. His areas of expertise involve electric vehicle (EV)

stocks, green energy and NFTs. O’Brient loves helping everyone understand the

complexities of economics. He is ranked in the top 15% of stock pickers on TipRanks.

"STATUS OF RV" BY DINAR IRAQ & DONG VIETNAM, 26 JULY

STATUS OF THE RV

"Analysis: Iraq’s new budget may hamper more than it helps", 26 JULY

The Iraqi Council of Representatives passed the 2023, 2024 and 2025 federal budgets on June 12, nearly eight months after Prime Minister Mohammad Shia al-Sudani’s new government was formed.

This year’s budget is Iraq’s largest at 198.9 trillion Iraqi dinars, about $153bn based on the official exchange rate. The 2024 and 2025 budgets will be the same unless the cabinet requests any changes and Parliament approves them.

For the first time, the government took advantage of 2019’s financial management law, which allows for up to a three-year budget. Iraq has not only been slow at passing budgets, but three out of the past nine years also saw no budget passed at all – in 2014, 2020, 2022.

Although there is only half a year left to spend the 2023 budget, there is the reassurance that the next two years will be covered, guaranteeing the government a budget until the next federal elections in late 2025 and for provincial council elections scheduled for this year.

The federal budget also allows the government to fund local investment projects and hire hundreds of thousands of public sector employees, which reflects positively on the prime minister and his governing coalition and increases their electability in both upcoming elections.

Ambitious yet precarious

However, Iraq’s economy and budget rely heavily on oil, which puts both in a precarious position. Nearly all state revenue is from oil sales. In 2022, Iraq earned a record $115.6bn from oil, but it is a volatile commodity. Iraq is not in control of the global oil market, and it is not a relevant decision-maker in OPEC despite being the second-largest member in terms of production.

This leaves Iraq vulnerable to the precarity of oil markets and the decision-making of other OPEC members regarding output, especially since this budget is based on an ambitious oil price of $70 a barrel. If the price dips, it risks unleashing a cascade of economic woes and public anger.

The budget calls for more than half a million Iraqis to be hired this year. It is not the first budget to include massive public sector hiring. Iraq is a country that already struggles with an overburdened public sector of at least 4.5 million employees.

Government offices are overcrowded and disorganised, slowing bureaucracy down further. Big hiring this year will also burden future governments with pensions.

If the government wants to add even more jobs in 2024 and 2025, it just needs Parliament to vote on it, so it is possible that even more jobs will be added in the next two years.

Iraq’s social contract, like many states in the region, is premised on public sector hiring, with citizens expecting a public sector job the moment they graduate from university. The right to a job is enshrined in Article 22 of Iraq’s 2005 constitution, and while it does not specify the type of job, it is a common belief that it means a government position.

The public sector has grown fourfold since 2003, and now salaries constitute more than a quarter of the 2023 budget.

Iraq’s political elite, which formed after the removal of Saddam Hussein in 2003, operates as though the country can still afford this set-up, and it does so for political gain. Most of its members had been exiled or based in the Kurdish region of Iraq and used patronage networks to build ties and legitimacy with the people in the new Iraqi state.

So millions of Iraqis were hired for the public sector, something they were accustomed to but with a new political patron to be grateful to.

Whether for electability or out of a belief in the right to a public sector job, even independent candidates and members of new political parties advocate for public sector hiring. Even the reformist political movement that emerged after the 2019 October protests is disincentivised from pursuing unpopular economic reforms, no matter how important they may be.

Two reforms often discussed by experts and rejected by the public are curbing public sector hiring and implementing more stringent taxation.

The protests, which took place from October 2019 to March 2020, called for economic opportunity, an end to corruption and political reforms. They resulted in early elections and a new electoral law but no systemic change to the political system itself.

To complicate matters further, protesters continue demanding employment and, in some instances, these protests are attended by the handful of independent MPs.

To rebuild a nation

Infrastructure spending is a focus in the new budget, which allocates development and reconstruction funds in particular areas.

Like the Sinjar and Nineveh Plain reconstruction fund of 50 billion dinars ($38m) to reconstruct areas that were destroyed in the fight against ISIL (ISIS), there are also 100 billion dinars ($76m) allocated to the Baghdad municipal government for service projects in Karkh, the west bank of the Tigris, where the Darwish Bridge will be built, streets paved, and public spaces and parks rehabilitated.

Seventy-five billion dinars ($57m) are allocated for revitalizing marshes spread across two southern governorates.

In addition, there is a reconstruction fund for the poorest provinces with 500 billion dinars ($381m) aimed at improving services, such as infrastructure and access to healthcare, electricity and educational services. This is in addition to the existing reconstruction fund for areas that suffered under ISIL.

However, Iraq does not have the best record in spending its federal budget. The last budget passed in 2021 had a 79 percent execution rate and prioritised the payment of salaries and pensions.

Iraq is enjoying a record high in foreign reserves and no longer has to pay reparations to Kuwait for the 1990 invasion, but there is no vision for how to invest this wealth, and the budget still runs a deficit.

Enlarging the public sector actually contributes to further slowing Iraqi bureaucracy down, which holds back the implementation of development projects. To address this, economic reforms are necessary, but they are missing from the budget.

For example, there was no money allocated for the economic policy unit at the Prime Minister’s Office and, as a result, its director is seeking external funding in spite of Iraq just passing its largest budget ever.

The current government may simply be implementing the hiring promises of past governments, but there is no apparent justification for not embedding economic reforms into the budget law.

If a public hiring freeze or cap were to be enshrined in the law instead of having it mandated by an executive order from the Prime Minister’s Office, it would be harder to reverse.

The size of the budget makes it difficult for Iraq to seek development aid or foreign assistance for economic reforms. Improved security and growing stability in Iraq may be able to attract foreign investment, such as the $27bn TotalEnergies deal in Iraq, in which Qatar Energy has a 25 percent stake.

However, it will be difficult to prove to foreign investors that Iraq is a good bet without economic reforms and with a budget that is not significantly different from previous ones.

This is, of course, in addition to the fact that a budget this large is ripe for corruption, which further decreases foreign trust and interest in Iraq’s business environment. Iraq has long struggled with corruption, and experts estimate that $150bn to $300bn have been taken out of the country since 2003.

This budget, by virtue of covering three years, is forward-looking and emphasises infrastructure and reconstruction, which are positives. But its disregard for economic reforms will add pressure on future budgets and governments. https://www.aljazeera.com/news/2023/6/26/analysis-iraqs-new-budget-may-hamper-more-than-it-helps

IRAQ NEWS: "THE RISE IN THE EXCHANGE RATE & THE PROJECT TO DELETE ZEROS STILL EXIST", 26 JULY

Alaq: The Rise In The Exchange Rate "My Time" And The Project To Delete Zeros Still Exists

Economy News – Baghdad The governor of the Central Bank, Ali Al-Alaq, considered, on Wednesday, that the rise in the exchange rate of the dollar in the market was temporary, and while he indicated that there was no indication or indication from the American side to include new banks within the sanctions, he confirmed that the project to delete zeros from the currency still exists.

Al-Alaq said, in an interview with the official news agency, that "the central bank continues to provide the dollar at the official rate and cover all legitimate transactions for the purchase request, such as transfers and credits for various imports," adding that "what is being talked about in terms of a rise in the exchange rate does not mean that there is a rise in the official price that It is still the same, but the rise in the cash price circulating in the market is caused by the reluctance of some merchants to enter the electronic platform, which is the official channel for sale required by the new system. He added, "Merchants, in addition to other categories, cannot enter the platform because they do not practice legitimate activities and operations, and our role in the Central Bank is to push everyone who needs to buy dollars to enter the legal and correct way, and the process today is in fact a process of reorganizing the movement of trade and funds, which makes these operations Subject to local and international controls and standards, which leads to an effective implementation of the Anti-Money Laundering and Terrorist Financing Law No. 39 of 2015. Al-Alaq pointed out that “the process of implementing the new system in reorganizing the movement of trade and funds requires the cooperation of multiple parties, and we expected that the issue would receive support, implementation, and interaction from the official and popular parties to support the Central Bank in achieving the goal of this system to make the movement of funds proceed in legal contexts and correct standards to avoid any internal or external risks. He stressed, "The international financial system is integrated, coherent, and interdependent, in which some influence others, and all financial institutions in the world deal with the movement of funds with caution within an accurate assessment of risks and verification of the sources of funds and their beneficiaries. Iraq is part of this system, and we must achieve a high degree of compliance with the standards." The international financial system to ensure the integrity of our financial system, and this, as we indicated, requires great support for the Central Bank, and for each party to take its role. And the Governor of the Central Bank stated, “Regulating foreign trade falls outside the control of the Central Bank and requires the cooperation of multiple parties concerned with this file, such as the Ministry of Commerce, the Border Crossings Authority, the Customs Authority, the security services, and other parties, and what we do serves all parties, the country’s economy and its general situation, and therefore there must be solidarity.” Collaboration and interdependence between everyone with the Central Bank to achieve the goal of the system. He pointed out that "we often hear remarks about the process of selling the dollar and the movement of the currency, and today when the Central Bank assumed this great responsibility to reorganize it and put it in its correct contexts, the issue cost a great effort of human resources to monitor the process and ensure its safety with the application of electronic programs that cost the bank large sums of money." investments, and we seek the assistance of an international auditing firm to review operations and verify their validity, and here there must be support and backing to achieve the primary goal.” He pointed out that "there are parties that do not want the correct standards to be adopted, and some of them are trying to take advantage of this situation to jump on the market and withdraw the cash assets in it to achieve special benefits and speculations. Directly from Prime Minister Mohamed Shia Al-Sudani, who gave this issue great attention. Al-Alaq explained that “what the Central Bank announces of daily sales of foreign currency are not the operations actually in effect, but rather the requests that the Central Bank transfers externally to conduct import transactions, and what is implemented is less than what is announced in terms of numbers, because there are transactions that have notes, deficiencies, or lack thereof.” Conditions are met and rejected, and the daily sales rate actually executed daily reaches $155 million.” He added, "The failure to meet all requests is caused by merchants not entering the electronic platform, so they go to the market to buy dollars in cash, and the supply is what citizens circulate for the purposes of treatment, study, etc., and the current problem in Iraq is not related to a lack of cash reserves in it, as happens in a number of countries, but rather we have a large reserve." He can respond to requests and there are no restrictions." And he continued, “The problem is in the request itself, as some of those who want to buy dollars do not adopt the correct methods by going to the electronic platform, and we at the Central Bank presented two proposals to the government to meet their requests: the first includes easing tax procedures and making their percentage simple and deposited directly in accounts without entering into complications.” taxation and tax accounting, and the second proposal, which is that the entry of any goods into Iraq should be through a new mechanism that includes the presence of evidence of its official transfer, and the first proposal was accepted by the government by taking advantage of what was stated in the budget law, Article 48, and now work is underway to determine the categories covered, and the second proposal is currently being studied from The government must document the entry of goods and disclose the source of funding, which is one of the requirements of the Anti-Money Laundering Law.” He noted that "there is acceptance of the idea oftaxation and benefiting from what was stated in the budget law in Article 48, and now work is underway to organize it and define the categories and tax," noting that "the rise in the exchange rate in the market is temporary and the fate of merchants who buy dollars from the market is entering the platform and transferring in a legal manner." Then there will be no pressure on the exchange rate in the market. Al-Alaq added, however, by saying: “The penalties imposed on 14 local banks were not at the time of the current government, but rather at the time of the previous government, and the announcement of them a few days ago came after completing audits on all transfers and verifying their sources,” noting that “the phenomenon of speculators in the market who They spread radiation and create a crisis that leads to an increase in the price, and it does not change anything about the possibility of applicants for obtaining dollars from going to banks other than those that have sanctions.” Al-Alaq confirmed, “There is no indication or indication from the American side of including new banks within the sanctions,” noting that “the central bank will follow up on the issue of banks that have been subject to deprivation of the dollar and will enter into the process of reviewing and verifying them.” He revealed, "There are a number of proposals being developed to set up the trade process with the Iranian side and the payment mechanism within its framework, and work to provide means of payment through the Iraqi currency and prepare special cards for this issue." And he noted that "the Central Bank continues to put forward regulatory packages to stabilize the market, and the most important measure taken by the bank is to open the largest number of channels to conduct transfers, and now we have opened a direct channel to conduct transfers with China in its currency without going through complex operations, and these transfers are conducted quickly and easily." He stressed, "The bank started transfer operations in the Chinese currency with one bank, and now the number of banks has reached more than 10 banks." Al-Alaq announced "close dealings with European banks and in other countries in order to give transfer channels speed and help attract merchants." Al-Alaq explained, "There are certain arrangements being worked on between the Iraqi government and Iran, and between the American side regarding the payment of gas supply dues." He pointed out that "there are good efforts that are focused and escalating related to the campaign to support the Iraqi dinar," noting that "the strength of the Iraqi dinar derives not from the citizen, but from the capabilities of the country." He continued, "Prime Minister Muhammad Shia al-Sudani personally is one of the main supporters of the campaign to support the Iraqi dinar." Regarding the experience of generalizing electronic support, Al-Alaq explained that "the issue receives great interest from the Central Bank, and now a meeting has been completed with an international electronic payment company, and there is progress, but it depends on expanding the circle of culture in this aspect." And he stated, "The experience of electronic payment for citizens against government institutions has begun to succeed, and there are many departments that have joined, and we are working on a very important step, which is conducting transactions by paying via mobile phone, that is, a person can pay as soon as the other party has a (code) where any A person holding this code can pass the code on the device and enter his account, which is an advanced step even from using cards.” And on the size of Iraq's debts, Al-Alaq indicated, "The internal volume of Iraq's debts amounts to about 65 trillion, of which 46 trillion belongs to the Central Bank, and the rest belongs to government banks, and is paid in the form of payments, while the external debt is about 20 billion dollars, while the Iraqi reserve is more." Of 113 billion dollars,” noting that “the adequacy of the Iraqi reserves is high, and it guarantees foreign currencies and gold.” Regarding the Riyada initiative, Al-Alaq said, "The Prime Minister launched a Riyada initiative to qualify young people and enter them into small projects, and to embrace their capabilities and innovations," pointing out that "the Central Bank entered as a financing party by launching a project to establish the Riyada Bank, in order to absorb and finance these capabilities." And he indicated, “The Central Bank is in the process of establishing this bank, and there is great interest from us and private banks,” noting that “the bank has various initiatives, including financing small and medium projects and the ongoing housing lending initiative through the Real Estate and Housing Bank, as well as we have an initiative to support the use of solar energy, and there is An initiative for the displaced in partnership with the international institution, and we have financing previously funded industrial and agricultural projects, and the bank is working to complete its financing while it is re-studying the initiative related to the industrial sector. He pointed out, "It was dismissed from printing the category of twenty thousand dinars because of the existence of a category of 25 thousand dinars, and we do not wish to expand the current categories, because the project to delete zeros still exists." Regarding the structure of government banks, Al-Alaq said, "There is now coordination and focus on this file, and great interest from the Prime Minister personally, and periodic meetings in this field, and we have some ideas about these banks that we are working on implementing at the present time."

"3 AI-Driven Stocks That Will Be the Next Trillion-Dollar Companies" by Eric fry ( Investor Place-Nasdaq), 26 JULY

Welcome to Smart Money! My name is Eric Fry, and I’m glad you’re here.

Wall Street has sold investors on the idea that they should start with “micro” analysis – the idea that they should make investment decisions by comparing things like price/earnings ratios, income statements or other company details.

But I do the opposite; I start with “macro” analysis.

I look for big-picture trends that drive huge, multiyear moves in entire sectors of the market.

I’m talking about trends that can spin off dozens of triple- and even quadruple-digit gains in just a few years.

Catching just one of these trends – at the right time – can help anyone accumulate enough capital to finance their dreams and to provide themselves with an enviable retirement…

When investors use a global macro strategy, they identify investment opportunities from a broad, global, top-down perspective, rather than by examining stocks one by one (a micro, bottom-up perspective).

And today, I want to highlight a trend you’ve likely been hearing about nonstop for the last few months: Artificial intelligence, or “AI.”

Investors know it… and CEOs really know it. Almost no company dares to conduct a conference call without highlighting the AI technology it’s adopting or developing.

During this year’s first-quarter conference calls, for example, the CEOs of S&P 500 companies used the term “AI” twice as often as they did during the previous quarter’s conference calls, according to an analysis by Reuters.

Because of the growing buzz around AI technologies, investors are rushing into AI stocks of all sorts – hoping to give their portfolios a much-needed boost.

AI is an incredibly powerful – almost scary-powerful – megatrend, and the implications of its deployment will supercharge choice companies into previously unachievable milestones… including the coveted trillion-dollar market cap.

Yes, you read that right – trillion with a “t.” It’s an inconceivable number, so much so that only four companies (at the time this report was written) have achieved that value: Amazon.com Inc. (AMZN), Microsoft Corp. (MSFT), Saudi Aramco, and Alphabet Inc. (GOOGL).

But with the power of AI, I believe that the next trillion-dollar companies are out there… and will reward their investors handsomely along the way.

So, here are my three picks for the next trillion-dollar AI companies…

Trillion-Dollar AI Stock No. 1: Intel

As a Bible verse (and 1960s Byrds lyric) tells us, “There is a time for everything.”

Even a time to add Intel Corp. (INTC) to your watchlist.

Admittedly, the PC-centric tech world that Intel once dominated is a thing of the past. Further, a string of strategic missteps and manufacturing miscues caused Intel to lose market share in every key product category.

Since 2016, Intel has lost its share in both CPU chips (central processing units) and GPU chips (graphic processing units). Nevertheless, Intel remains the top dog and continues to grow revenue year by year.

And yet, in a stock market environment that’s dominated by sexy “story stocks,” Intel is a wallflower.

But Intel is not simply a “chip company;” it has the potential to become the next trillion-dollar AI company…

Ahead of the Game

Because of the release of ChatGPT, an AI-powered “chatbot” that can do everything from answering questions to writing essays, AI-focused investing has become the newest Wall Street sensation.

But that’s much easier said than done, as AI is difficult to invest in directly.

However, as we peel away at this onion, we find that a handful of semiconductor companies might offer an indirect play on AI.

Names like IBM Corp. (IBM), NVIDIA Corp. (NVDA), and, yes, Intel top the ranks of AI-chip producers. In fact, in 2017, Intel became the first semiconductor company in the world to generate more than $1 billion in sales from AI chips.

Importantly, Intel is the only company of these three that continues to operate fabs – and plans to invest tens of billions into building next-generation ones here in the United States. (IBM and NVIDIA design chips here at home, and then outsource the actual production to overseas companies like TSMC and Samsung.)

But that paradigm may be ending quickly…

Unpopular Opinion

The U.S. government is working to cut off the flow of advanced technology to China by incentivizing chipmakers like Intel to manufacture AI chips here in the States, rather than in East Asia.

The strategic thinking here is very basic: If the Chinese can’t manufacture or access cutting-edge chips, then they can’t build the data-center capacity they would need to train AI systems.

In such a world, Intel becomes an obvious go-to solution for U.S. chip designers like IBM and NVIDIA. Perhaps that’s why IBM has already structured a joint venture (JV) with Intel to develop AI chips – and why NVIDIA has stated publicly that it will consider contracting with Intel for the first time to produce some of its chips.

Apart from political considerations, the AI market itself is on the verge of explosive growth. IDC estimates that worldwide spending on AI systems will nearly triple to $300 billion by 2026. From that level, McKinsey predicts the AI market will soar to $1 trillion by 2030.

Intel stands at the ready with a roster of offerings that can help power the AI Revolution.

The company’s NCS2 is its latest chip that was developed specifically for deep learning. Also, the brand-new Gaudi2 AI chip, designed by Intel’s Israel-based Habana Labs, is twice as fast as its first-generation predecessor.

Chips like the Gaudi line accelerate the particular math calculations at the heart of today’s AI technology. A third-generation Gaudi3 is already in development.

These powerful, next-generation chips enable AI models to “learn” by processing complex real-world data to find patterns more quickly and economically.

And even though Intel is still widely unpopular, I recommend adding it to your AI watchlist… because I can see it becoming one of the next trillion-dollar AI companies.

Trillion-Dollar AI Stock No. 2: Meta Platforms

Facebook’s parent could soon regain its trillion-dollar crown.

Social media giant Meta Platforms Inc. (META) first became worth $1 trillion in June 2021 on an accelerating advertising business. At the time, analysts believed the firm would generate $33 billion the following year.

That didn’t go to plan. The company would instead post $19 billion in free cash flow due to a slowdown in online advertising and mounting losses from its virtual reality business. Meta’s market capitalization sank as low as $250 million last year. (It’s inched back up to around $600 billion.)

Nevertheless, Meta is still a promising bet.

The firm’s aggressive cost-cutting measures and improving ad business were already showing positive results. And soft inflation figures from last month set the stage for a summer stock surge. Facebook is historically more sensitive than its peers to market cycles.

That means a recovery could happen faster than expected. FCF is now expected to recover to $23 billion this year and hit the “magic” $30-billion level in 2024. Heavy advertising spending from the 2024 presidential election means these figures will likely play out this time around.

Trillion-Dollar AI Stock No. 3: International Business Machines

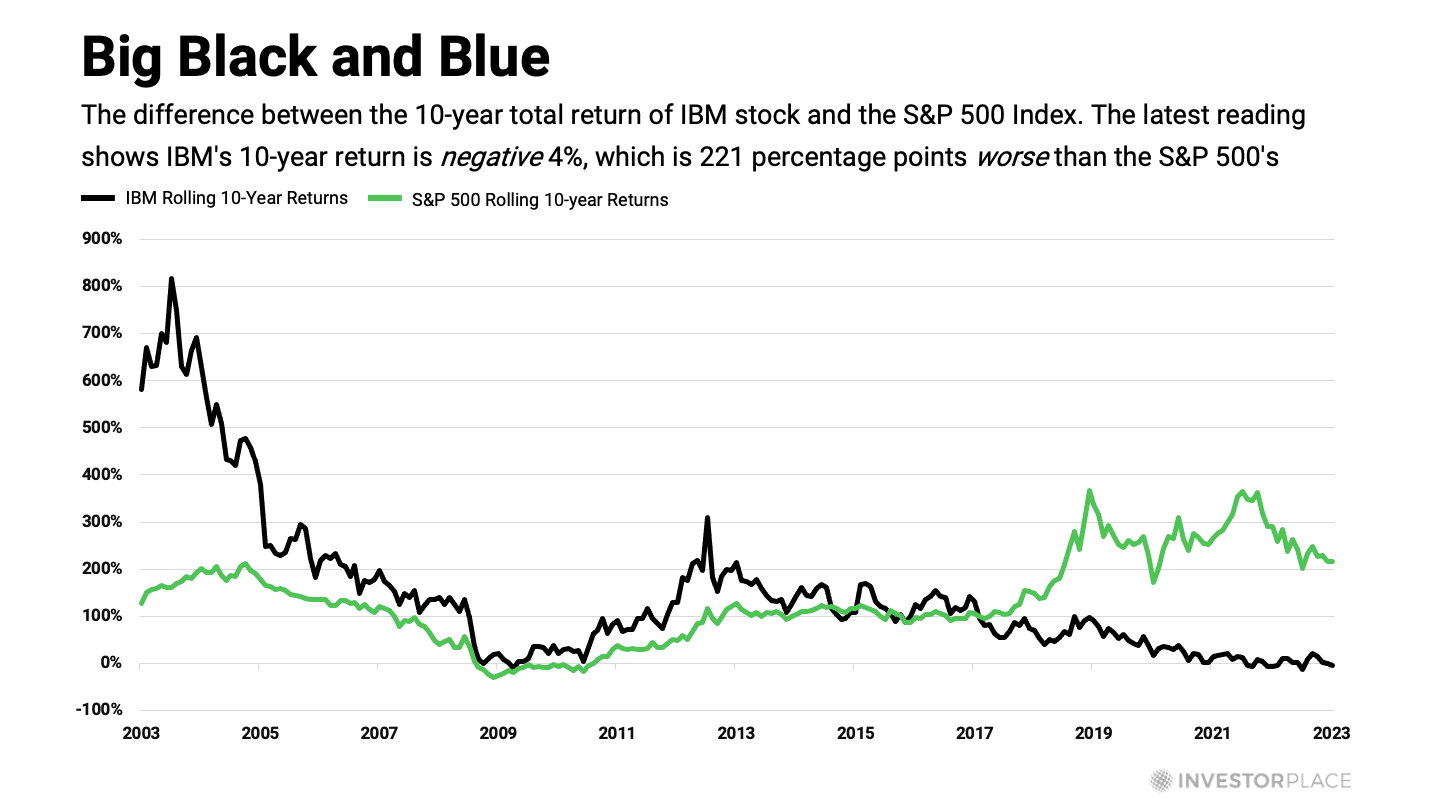

The below chart tells you almost everything you need to know about the “new” IBM…

The iconic computer company’s revenues and operating margins are no longer tumbling. They are rising once again.

After hitting a 30-year low in Sept. 2021, IBM’s revenues and margins have been making a noticeable recovery. These favorable financial trends do not prove IBM has embarked on a new growth trend, but they do support that thesis.

Underdog to Burgeoning Champion

Over the past few years, IBM has been reinventing itself as a hybrid cloud and artificial intelligence company. To accelerate this transformation, the company has been pursuing an out-with-old-in-with-the-new growth strategy.

Since 2019, IBM has divested 17 legacy businesses, while also making more than 30 acquisitions. One of the most impactful acquisitions during its shopping spree was Red Hat, which IBM acquired in 2019 for $34 billion. Although the price tag seemed a bit rich at the time, this acquisition brought a market-leading hybrid cloud platform into the IBM family.

Red Hat’s capabilities are so formidable that more than 90% of Fortune 500 companies rely on its platform.

According to Grand View Research, the global cloud-computing market will grow 150% over the next seven years – from about $600 billion this year to more than $1.5 trillion in 2030. The global artificial intelligence industry will reach a similar size by 2030, according to Fortune Business Insights.

IBM is riding the current of both of these powerful megatrends.

The AI Domination

“IBM Watson” is the company’s core AI offering. It integrates with the Red Hat hybrid cloud to enable companies to pool data from numerous sources, then process that data to achieve objectives like predicting future outcomes, automating complex processes, and optimizing employees’ time.

Out in the real world, many companies accumulate and store data in the corporate equivalent of a “junk drawer.” Valuable information exists in every imaginable form…

- Company memos…

- PDFs…

- Charts and other images…

- Databases…

- Customer records…

- Call logs…

- Handwritten documents…

- Blog posts…

- And tweets.

These data are “unstructured,” to put it politely. But Watson can use AI to synthesize and process these data so that businesses can make informed decisions.

In other words, IBM promotes Watson AI as a solution that can enhance productivity across an entire enterprise.

Increasingly, enterprises are buying the AI-empowered solutions IBM Consulting is selling. Revenues from this division have jumped 18% during the last two years.

A Positive Future

Not only are IBM’s revenues and operating margins trending higher, but profits are also following suit. Operating income has jumped 77% during the last two years.

Because IBM’s fast-growing AI and hybrid cloud businesses will power most of its future growth, I expect the company to become a dominant leader of the AI boom.

Moving Forward

I’m so glad that you decided to further your journey to wealth by joining Smart Money.

Nearly every Tuesday, Thursday, and Saturday, you’ll receive an email from me, wherein I’ll share insights on the latest market “megatrends”, how to act on them and more.

Get started by visiting your Smart Money website here.

Regards,

Eric Fry

Editor, Smart Money